Mortgage and refinance rates forecast for 2020: Housing authorities are optimistic

A year ago, a lot of experts predicted higher mortgage rates in 2019.

Turns out those predictions were far off base. Rates have actually dropped quite a bit in the second half of this year.

But what will mortgage interest rates do in 2020? Will they continue to drop? Or will various factors drive them higher? Those seeking to purchase a new home or refinance next year want answers.

For guidance, we checked in with several leading housing authorities. These groups issue mortgage rate forecasts and mortgage rate predictions

Overall, their 2020 outlook says rates should stay low. But as we saw in 2019, mortgage rates can take even the best guessers by surprise.

If you get a good rate quote in 2019, don’t wait for rates to go lower in 2020. Lock now to protect yourself against an unexpected rate spike.

Find and lock your low rate nowAveraging all major interest rate forecasts

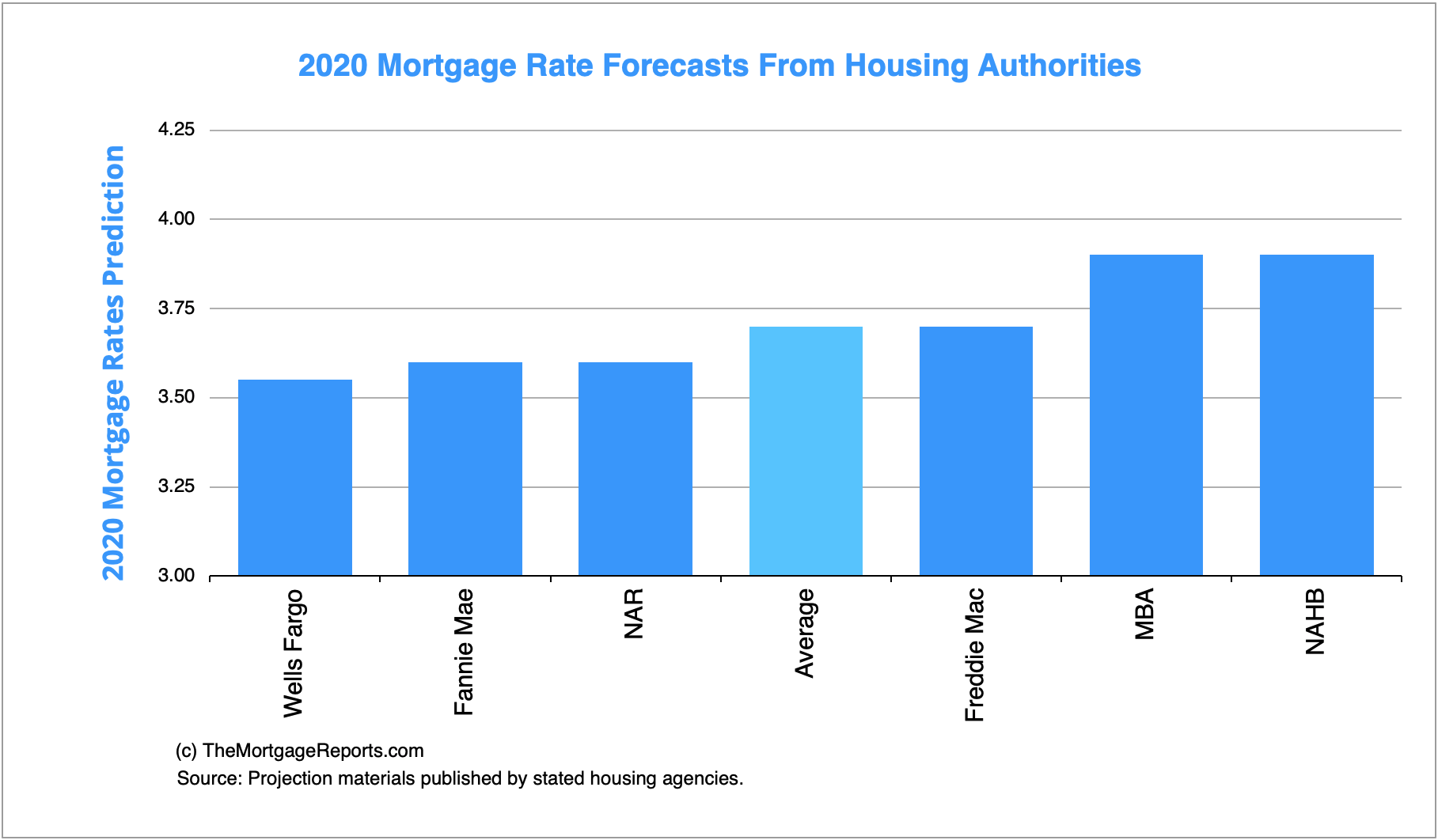

Focus on any single prediction and it’s probably going to be wrong. It’s just too hard to predict market-driven outcomes. That’s why it’s best to analyze all the estimates and look for middle ground.

To get a solid prediction, we averaged 2020 rate forecasts from six top agencies, housing authorities, and lenders.

| Agency | 30-yr rate prediction for 2020 |

| NAR | 3.6% |

| NAHB | 3.9% |

| MBA | 3.9% |

| Freddie Mac | 3.7% |

| Fannie Mae | 3.6% |

| Wells Fargo | 3.55% |

|

Average of all agencies |

3.7% |

National Association of Realtors (NAR): Rates should remain around 3.6%

Lawrence Yun is chief economist for the NAR. He told us his group believes mortgage rates will remain low next year — ending up around 3.7% for 30-year fixed-rate home loans.

In its U.S. Economic Outlook report for October, the NAR officially forecasted a 3.6% average rate annually for the 30-year fixed-rate mortgage in 2020.

“The Fed will have cut the Federal Funds rate two more times by next year,” Yun says.

Yun notes that “rates will be higher if inflation picks up due to tariffs filtering up as higher prices.” If a rate increase happens, it’s “likely to be muted by a slower economy. But don’t underestimate the negatives of higher tariffs.”

Yun also expects the U.S. budget deficit to grow.

“That puts a lot of pressure on the U.S. Treasury to find buyers of U.S. bonds. If foreigners don’t step in mortgage rates will get pushed up along with other bond yields,” he adds.

National Association of Home Builders (NAHB): Rates could tick higher

Liz Thompson is the director of media relations for NAHB. She says the NAHB’s mortgage rates forecast “calls for a 3.9% average rate for the 30-year fixed-rate mortgage for 2020.”

That’s a decrease from what the group predicted for 2020 back in June. At that time, the NAHB forecast called for the 30-year fixed-rate mortgage to average 4.49% in 2020.

Mortgage Bankers Association (MBA): Look forward to rates at roughly 3.9%

In its September Mortgage Finance Forecast, the MBA issued a 2020 rate prediction of 3.9%, on average, for the 30-year fixed-rate mortgage.

Mike Fratantoni, chief economist for the MBA, recently issued the following statement:

“Since hitting a recent high of over 5 percent in November 2018, the 30-year fixed mortgage rate has fallen more than a percentage point, and homeowners have responded strongly to the drop in rates, as more borrowers are now “in the money” and have a rate incentive to refinance.

“In the second quarter alone, refinance applications increased 30 percent from the first quarter and in the first two weeks of August, refinance applications surged another 50 percent.”

“We expect the Fed will cut rates one more time in 2019 and again in 2020 as growth weakens.” —Mike Fratantoni, Chief Economist, Mortgage Bankers Association

He added: “In July, the Federal Reserve lowered short-term rates for the first time since 2008 [due to] ongoing uncertainty around trade, lower-than-expected inflation, and weakness in the global economy. They also left room for additional cuts at upcoming meetings but noted that this was likely to be a mid-cycle adjustment, rather than a sustained move to much lower rates.

“The landscape has not changed much since then, and we expect that the Fed will cut rates one more time in 2019 and again in early 2020 as growth weakens.”

See what rate you qualify for today. Start hereFreddie Mac: Rates will average 3.7% next year

Freddie Mac’s Economic & Housing Research group recently published its 2020 forecast. The following statements are among the highlights:

“The recent decline in mortgage rates stem from the on-going global trade disputes and weakening global economy, which have led to a drop in long term interest rates in most countries.

“Despite the negative impacts of trade and the deteriorating global economy, the domestic U.S. economy continues to grow and the three-year low in mortgage rates has poised housing to reaccelerate.”

"...the domestic U.S. economy continues to grow and the three-year low in mortgage rates has poised housing to reaccelerate.” —Freddie Mac

In its report, the group noted that increased global uncertainty has put downward pressure on interest rates.

“Long-term government bond yields around the world have plummeted, dropping below zero in many European countries.”

Thus, Freddie Mac has adjusted its forecast for the 30-year fixed-rate mortgage to average 3.9% annually in 2019, before sinking to 3.7% in 2020.

The group is also “anticipating more possible interest rate cuts in the second half of 2019 and again in 2020.”

Fannie Mae: Expect rates around 3.6%

Doug Duncan, Fannie Mae’s chief economist, told me his group thinks next year’s rates will be close to where they are now.

“We expect the 30-year fixed-rate mortgage to average around 3.5% to 3.6%. That’s about 30 to 40 basis points above the 5-year adjustable-rate mortgage,” he says.

In its October 2019 Housing Forecast, Fannie Mae projected a 3.6% average rate in 2020 for the 30-year fixed-rate mortgage.

The Fannie Mae forecast calls for a slowing economy through the fourth quarter of 2020.

All of these predictions could change if there is a substantive agreement on trade with China, says Fannie Mae chief economist.

“The effects of the tax act will have waned as will the additional federal spending invoked in the debt ceiling agreement,” says Duncan. Also, “the Fed will cut (rates) two more times: once in the fourth quarter of 2019 and once in the first quarter of 2020.”

Duncan notes all of these predictions could change if there is a substantive agreement on trade with China.

“It is the trade issue that has invoked market volatility and inhibited investment, which might have driven growth and productivity to higher levels.”

Wells Fargo: Rates will average 3.55%

In its October Monthly Macro Manual, Wells Fargo provided an interest rate forecast for 2020. It expects the 30-year fixed-rate mortgage to average 3.55% over the course of next year.

The report stated: “With growth slowing to sub-2% and in the absence of a major breakthrough on U.S.-China trade relations, we expect the Fed to ease policy another 25 [basis points] Q1-2020.”

Wells Fargo further stated: “The markets are priced for about one and a half more fed funds cuts than we are forecasting. This discrepancy, along with our expectation for growth and inflation to eventually firm, is behind our expectation that Treasury yields will eventually rise moderately over our forecast horizon.”

Should you lock now, or trust in low-rate 2020 predictions?

Our advice is not to put your money on a mortgage rate prediction.

Most experts forecasted that rates would spike into the 5’s in 2019, and the opposite happened. A favorable prediction for 2020 could easily become an unfavorable reality.

Use these forecasts to position yourself if you plan to buy a house later next year. But if you want to buy soon, don’t hesitate to lock now. 2019 rates are already at historic lows, and they’re not likely to drop further in 2020.

Time to make a move? Let us find the right mortgage for you