22 may be the new 33

Generation Z is in its teens and early twenties — not the age you’d typically think about buying a house.

In fact, the average age of first-time home buyers is around 33 years old.

But in 2019, there were already 319,000 Gen Z’ers with mortgages.

And four out of five say they’ll own homes within five years.

So will Gen Z live up to its own aspirations and outpace Millennial homeownership?

Experts say it’s entirely possible.

Verify your home buying eligibilityGen Z is more optimistic about homeownership than Millennials

Freddie Mac recently polled members of Generation Z on its feelings about homeownership. Among its key findings:

- 86% of Gen Z wants to own a home someday

- 89% believe it is at least somewhat likely they will accomplish this goal someday

- The median age Gen Z estimates it will purchase a first home is 30 years old

In fact, more than four in five Gen Zers plan on buying a home over the next five years.

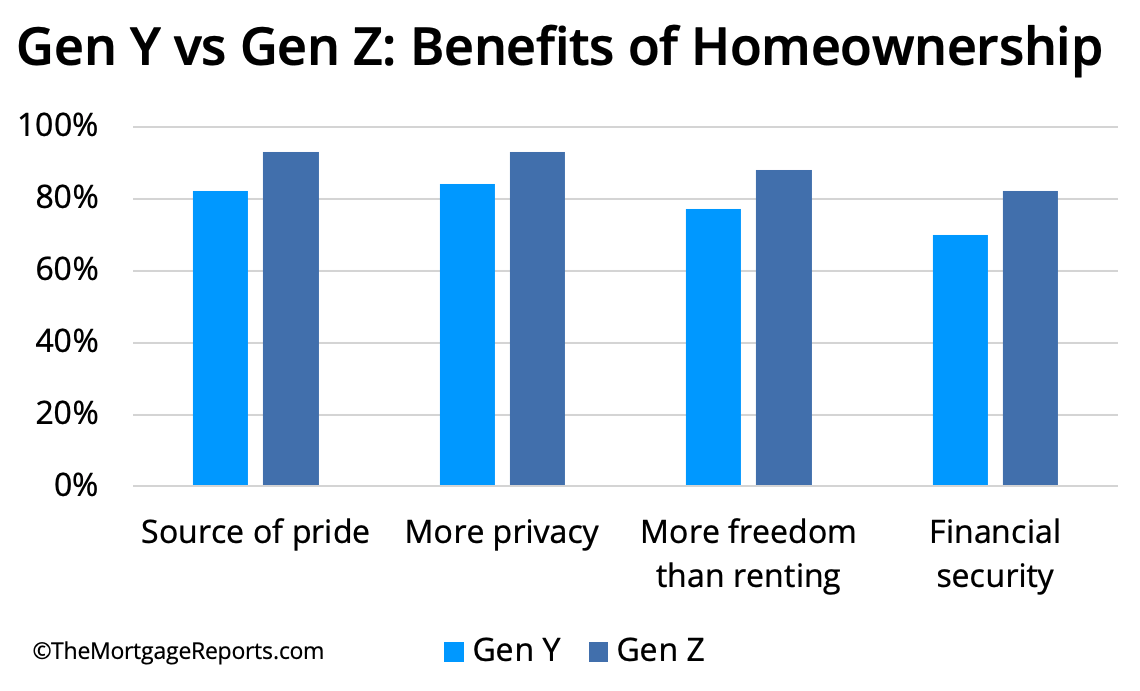

Gen Z also had an overall rosier view of homeownership than Generation Y (Millennials) did at the same age:

But those sentiments weren’t equally shared among all.

The chances of buying and owning a home were perceived to be much higher among those who are:

- 14-17 years old

- Currently live in an owned home

- Come from families earning $50,000/year or more

- Received a financial education from parents

- Experience low stress and greater confidence about finance

That’s not entirely surprising.

But it begs the question: Is Gen Z really more prepared for homeownership than the generation before it?

Verify your home buying eligibilityWill Gen Z own a home by age 30?

Guy Troxler is vice president of loan operations for VAHomeLoanCenters.org. He believes owning a home by age 30 is a realistic goal for Gen Z.

“In many cases, this demographic was too young to understand what was happening during the mortgage crisis several years ago. And most of their lives have been a period of economic growth and positive outlook,” he says.

By contrast, “Gen Y is old enough to remember the economic crisis, which happened in their teens and 20s. Many millennials also entered the workforce at a difficult time. This impacted their ability to save and purchase homes,” says Troxler.

“Gen Z members are less skeptical of real estate and more concerned about their financial futures” —Bruce Ailion, Realtor and attorney

Realtor and attorney Bruce Ailion says millennials weren’t the only generation who soured on housing over 10 years ago.

“It’s understandable that Gen Z members are less skeptical of real estate and more concerned about their financial futures,” says Ailion. “They were younger at that time during the Great Recession.”

He continues, “Gen Z represents a return to the traditional track of valuing housing.”

>> Related: 3 things to do this week if you want to buy a house this year

Does Gen Z underestimate the impact of student loans?

Troxler believes these findings are quite revealing about Gen Z.

“They show that Gen Z is planning for the future more than we may give the younger generation credit for,” says Troxler.

“Gen Z is planning for the future more than [many] give the younger generation credit for.” —Guy Troxler, VP Loan Operations, VAHomeLoanCenters.org

Jeremy Sopko, CEO of Nations Lending, agrees.

“In general, it’s notable that this age group perceives themselves as hopeful in nature,” adds Sopko.

But there was a smaller finding buried in the report that could be concerning.

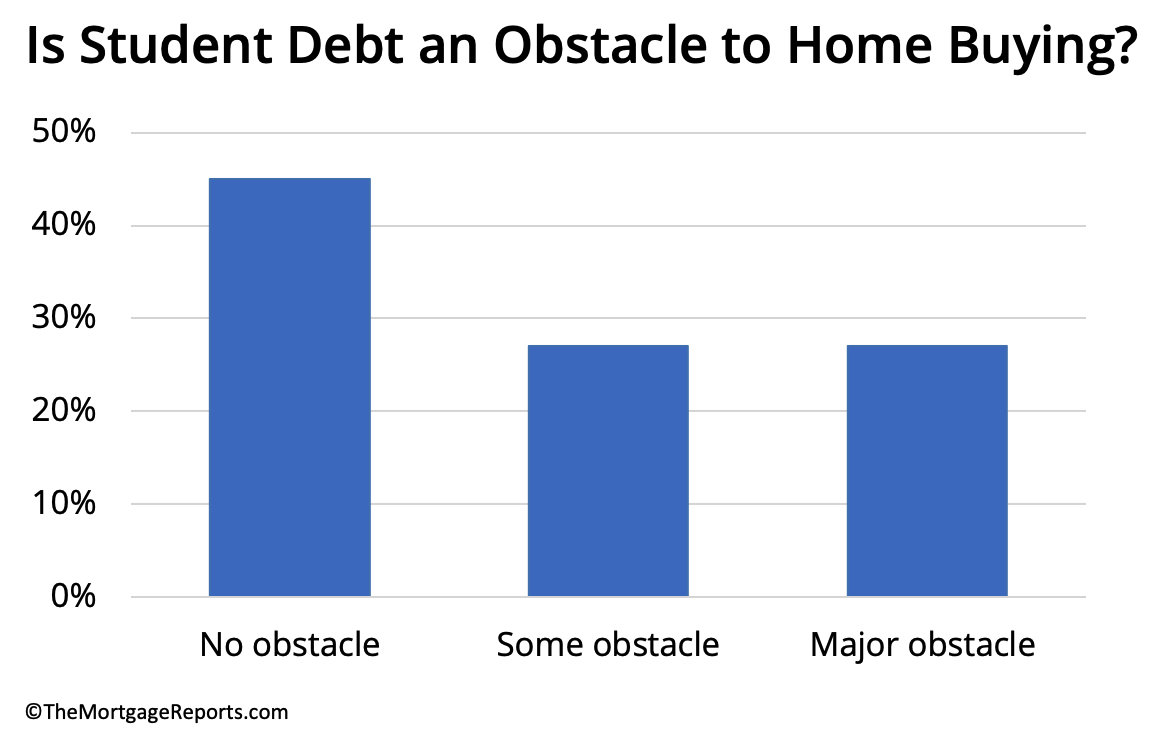

That is: 45% of Gen Z’ers view student loan debt as no obstacle at all to buying a home. By comparison, 27% see it as a minor obstacle, and another 27% as a major obstacle.

“Many have not actually reached the age where student loans are something they have to consider or that become an obstacle,” explains Sopko.

“Once they get out in the real world, it tends to change young people’s outlooks and perceptions.”

But that’s not to say student debt and other responsibilities will block the younger generation from homeownership.

Verify your home buying eligibilityA couple of caveats

Sopko says it’s important to look closer at the Freddie Mac study results.

“Those in Gen Z who are most self-assured about the possibility of homeownership appear to be the younger half of the generation. They are farther away from being put to the actual ‘rent-versus-buy’ situation in real life,” says Sopko.

>> Related: What costs more, homeownership or renting?

Sopko notes another key study finding: A greater portion of Gen Z vs. Gen Y believes homeownership is slightly less accessible today than it was three years ago: 38% vs. 31%, respectively.

“This points to an assumption on the part of some young people that everything will tend to work out for them at roughly the same clip it did for their parents.”

“Yet here’s why I think in a few years a lot of that Gen Z sentiment will change: Nine million homes occupied by owners of older generations are set to hit the market by 2027. So inventory availability might not be a problem for much longer,” says Sopko.

Home purchase predictions

The experts are optimistic that Gen Z can reach its aim of owning by age 30.

“Unless there’s another economic crisis, I believe they can achieve their goal and that they’ll be in a better position to do so than Gen Y,” Troxler says.

“Both Gen Z and Gen Y are better educated than previous generations. That leads to greater opportunities and more financial responsibility.”

“Unless there’s another economic crisis, I believe they can achieve their goal and that they’ll be in a better position to do so than Gen Y” —Guy Troxler, VP Loan Operations, VAHomeLoanCenters.org

Even if a recession hits in the coming years, “the overall economy and job market should remain healthier than during the mortgage crisis of the mid/late 2000s,” adds Troxler.

“This means that Gen Z will enter the workforce with more opportunities. And they’ll be able to save and afford a home at an earlier age.”

Sopko concurs.

“But I don’t think age 30 should be used as a yardstick. Each individual’s journey toward homeownership is different,” says Sopko.

>> Related: Are you financially ready to buy a house?

What is the right age to buy a house?

There is no “right or wrong” age to buy a house. The timing all depends on your own financials and long-term goals.

For many Gen Z’ers, buying a house within 5 years might be reasonable and doable.

Wondering if you could afford a house sometime soon? Try using a mortgage calculator, or check rates and loan options using the link below.

Time to make a move? Let us find the right mortgage for you