Experts predict low rates in 2020. Should you trust them?

The season for mortgage rate predictions has started. Economists are stirring their tea leaves — and adjusting their computer models — in an effort to tell us what lies ahead.

The predictions so far look promising. Most experts and leading agencies forecast rates below 4% throughout 2020.

- 2020 mortgage rate predictions from experts

- 2020 mortgage rate predictions from major housing authorities

But mortgage rate predictions have been wrong in the past. And there’s little chance of rates falling further. If rates don’t move as predicted, we’ll likely end up with higher rates in 2020.

The only way to guarantee a rate on par with what you see in the market today is to get a rate lock as soon as you have a good quote in hand.

Find and lock a low rate. Start hereFactors that could trump mortgage rate predictions in 2020

Experts have good reason to believe mortgage rates will stay around 3.7% in 2020. A slowing economy, continued trade wars, and global uncertainty should all force rates to stay at or near where they are now.

But any of these factors could change on short notice. Events both in the U.S. and overseas could substantially impact domestic mortgage rates.

We might see mortgage rates shucking their 2020 predictions if these — or other — events happen:

A recession in the U.S.

Many economists believe we’re overdue for a recession. The economy grew by only 1.9% last quarter. And major trading partners such as Germany, China, Japan, Italy, and France are now on the brink of recession or actually in one. Slowdowns in these countries could mean less demand for U.S. goods and services. If this leads to a recession in the U.S., we could potentially see even lower mortgage rates than predicted for 2020.

Trade wars improving or worsening

Trade wars with China and Europe seem likely to continue. But events in these trade wars are constantly fluctuating. Worsening trade wars usually mean lower rates. But if agreements are signed or tariffs are removed — as happened just last week — we could see U.S. mortgage rates spike.

Government deficits affecting investor competition

The federal government is running a massive deficit. The deficit grew by 26 percent — or $205 billion — in the past 12 months according to the Bipartisan Policy Center. The total deficit now exceeds $984 billion.

As the government borrows more, it increases the supply of new debt coming into the market. This means there’s more “supply” for investors who buy up debt. To keep those buyers interested, interest rates — including mortgage rates — could rise.

An unexpected Federal Reserve policy change

It’s unclear what — if anything — the Fed will do with bank rates in 2020. The Fed does not set mortgage rates, but it influences them. And it can directly affect home equity lines of credit (HELOCs) because such loans are widely originated by banks. After three rate cuts in 2019, it seems unlikely the Fed will lower bank rates again in 2020. But events could change that.

Find and lock a rate while they're low. Start hereMortgage rate predictions have been wrong in the past

Mortgage rate predictions have often been wrong. We can look at the past year alone as an example.

In November 2018, the consensus was that 2019 mortgage rates would be somewhere in the 5% range. Rate predictions at 5.5% and above were widespread.

There were two reasons for 2019’s high mortgage rate predictions.

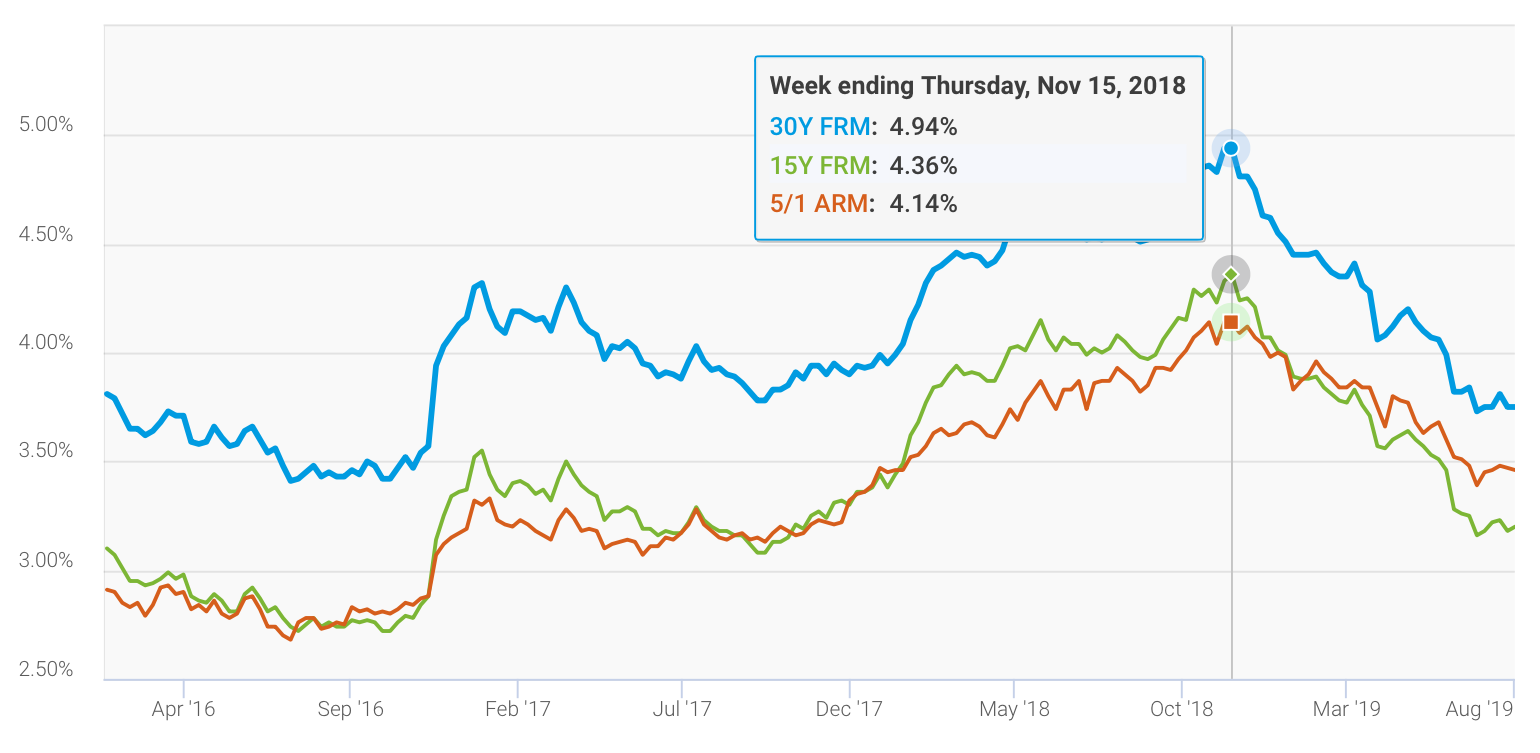

First, mortgage rates had been creeping upward for a few years. The average annual mortgage rate was 3.65% in 2016, 3.99% in 2017, and 4.54% in 2018, according to Freddie Mac’s records.

Rates rose from 2016-2018, and were expected to keep going up in 2019. Image: Freddie Mac

The historical trend was there. Rate predictions in the 5% range for 2019 were hardly bold or unreasonable.

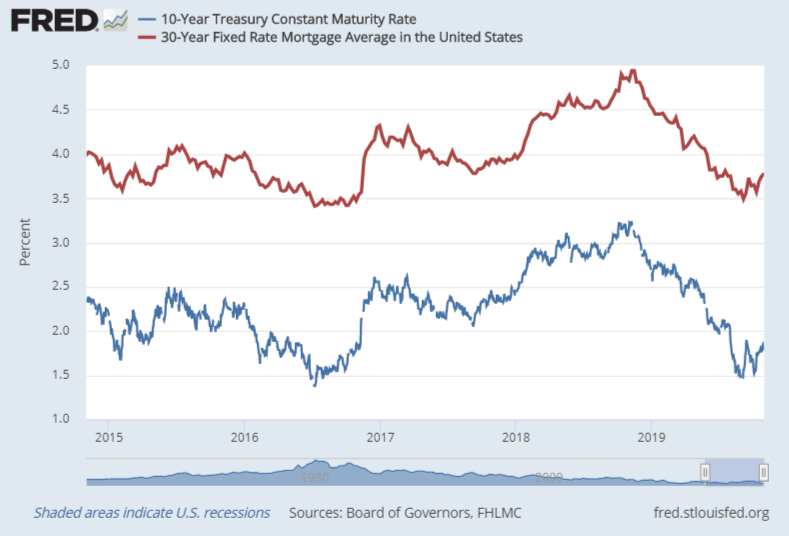

Second, mortgage rates and 10-year Treasury notes tend to move together. Not exactly, and not always, but generally.

Ten-year Treasury notes largely moved higher throughout 2018. Rising Treasury rates suggested steeper mortgage rates ahead, all things being equal. The only problem was — all things did not end up being equal.

Trade wars and economic uncertainty ended up pushing 2019 mortgage rates much lower than expected. Three Fed Funds rate cuts throughout the year helped to keep them low.

So, yes, the predictions for 2019 were way off. As they say on Wall Street, past performance does not guarantee future results. In the case of 2019 mortgage rates, the old Wall Street standard was certainly true.

Lock a low mortgage rate in 2019. Start hereReal-life consequences of mortgage rate predictions

As shown above, mortgage rates in 2019 turned the forecasts inside-out. Expected rates in the 5.5% range never happened. Actual rates were as much as 2% below those predictions.

We can use 2019 as a case study to show how mortgage rate forecasts have a real impact on the market — even though they’re technically just speculation.

Lenders can hire or fire according to predictions

In the face of higher-rate predictions, lenders expected their business to drop off dramatically in 2019. And they laid off a lot of loan officers to protect their profits.

In the first quarter of 2018, more than 107,300 mortgage loan officers were laid off. That number rose to over 167,000 in the first quarter of 2019, according to the Conference of State Bank Supervisors.

Borrowers spend or save more than expected

For borrowers, on the other hand, lower-than-expected rates were a welcome change.

Imagine: If you borrow $200,000 over 30 years at 5.5%, the monthly cost for principal and interest is $1,140. The same loan at 3.49% has a monthly P&I payment of $900.

That’s a difference of $240 a month or about $2,900 a year.

But rising rates have the opposite effect. If rates unexpectedly spike in 2020, mortgage applicants could start seeing much higher monthly payments. For some, that could make home buying unaffordable.

Processing times and costs are affected

Low rates caused the mortgage business to explode in 2019. According to the Mortgage Bankers Association (MBA), total mortgage originations for 2019 are expected to reach $2.06 trillion — the biggest boom since 2007. Refinancing was especially popular.

“Lower-than-expected mortgage rates gave the refinance market a significant boost this year, resulting in it being the strongest year of volume since 2016,” said Mike Fratantoni, MBA’s Chief Economist.

“Given the capacity constraints in the industry, some of this refinance activity will spill into the first half of next year.”

Combined with the layoffs earlier this year, the result has been fewer loan officers to help borrowers get through the lending process. That means it could take longer than expected to close on your home purchase or refinance.

In addition, a longer processing time might mean you have to lock your rate for a longer period — which is always more expensive.

What does it mean for you?

Weekly mortgage rates are below 3.8% at the time of writing this article. That’s less than half the historic average, and housing costs are low as a result.

Experts stay interest rates could stick to these historic lows in 2020. But if rates do change — and the market is full of uncertainties — they’re more likely to go up than down.

If you need to finance or refinance now’s a good time to lock in a current rate. You can get started in just a few minutes using the link below.

Time to make a move? Let us find the right mortgage for you