Worried about qualifying for a mortgage? You’re not alone

According to a recent survey, about 60% of potential home buyers think they’d have trouble qualifying for a home loan.

But with interest rates hovering near all-time lows, now could be the time to conquer those doubts and make your homeownership dreams a reality.

A good first step is to understand why mortgage lenders actually deny applications and nip any potential issues in the bud.

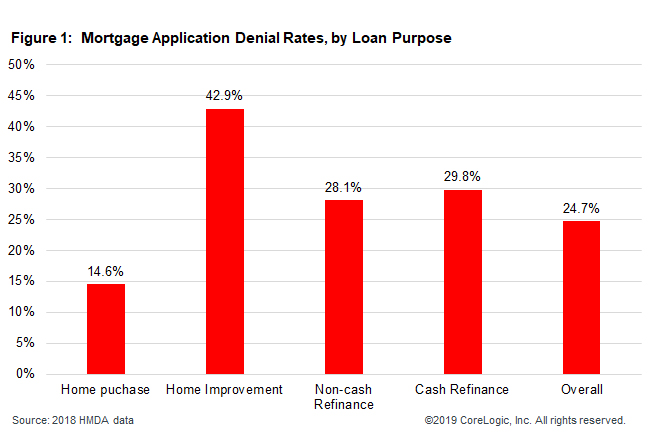

In 2018, there were two main reasons for mortgage denials: Poor credit and high debt-to-income ratios.

Here we’ll share some tips for amping up your credit score and reducing debt in preparation for applying for a mortgage. Do so, and you’re likely to see lower rates and a more affordable loan overall.

Of course, it’s still important to compare interest rates and closing costs from a few different lenders. Regardless of your credit or debt, this will help you find the best deal.

Check rates from major lenders. Get started here.The top two reasons mortgage applications were denied in 2018

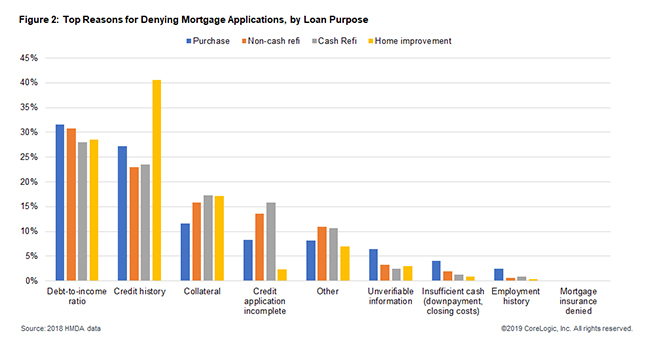

According to Home Mortgage Disclosure Act data recently released by CoreLogic, high debt-to-income (DTI) ratios and low credit scores were the top two reasons mortgage applicants were turned away in 2018.

Among purchase applications (those applying to buy a new home), DTI issues accounted for 37% of denials, and credit issues for 34%.

The report also showed that lenders denied almost one in four mortgage applications in 2018.

However, that data includes applications for home improvement loans, interest-rate reduction loans, and cash-out loans.

Across the entire mortgage lending spectrum, only 15% of applications denied were for customers hoping to buy a new home.

This should give buyers some peace of mind. With purchase applications accounting for the smallest number of denials, fears that would-be homebuyers have about not qualifying may not be justified.

Of course, even if you’re in a position to qualify, taking steps to improve your finances can still net you a lower mortgage rate and help you save thousands over the life of your loan.

Verify your new rate. Start hereLow credit: 34% of mortgage denials

Many would-be homeowners ask “What is the ideal credit score needed for mortgage qualification purposes?” Of course, the ideal score is a perfect score.

But, not every mortgage applicant has perfect credit. The best answer to the question is that it varies by loan program. For example, FHA-backed mortgages allow credit scores as low as 580. But lower scores usually come with higher interest rates.

- Flexible loan programs: 580

- Conventional loan programs: 620

- Qualifying for the best rates: 720+

You’ll most likely get the lowest rates if your score is in the “excellent tier” of 720 or higher. When your score is higher, you’ll typically pay less for a mortgage.

With this in mind, it’s worth it to work on your score — no matter what it is — before you start shopping for a home loan.

Tips to improve your credit score and qualify for a mortgage

The best way to increase your credit score is by building up a history of on-time payments. Remember, your payment history accounts for 35 percent of your FICO credit score — and in the mortgage industry, your FICO score is the only one lenders use.

However, building up a strong credit history takes a lot of time.

Fortunately, there are some strategies you can implement now to increase your FICO score fast.

- Make timely payments on all lines of credit

- Keep your credit usage of open-ended accounts like credit cards at or below 30% of your available limit

- Check your credit report and dispute any errors

The first thing you can do is pay down balances on revolving lines of credit. Your credit utilization ratio — which measures the credit you’re using against your total available limit — accounts for 30 percent of your FICO score.

For example, if you have a $5,000 combined limit on all your lines-of-credit, and you’re using $2,500, your credit utilization ratio is 50 percent ($2,500 / $5,000 = 50 percent). The general rule of thumb is to keep your credit utilization ratio at or below 30 percent.

You should also check your credit report for any errors or outdated information. If you see anything on your report that doesn’t belong, you need to dispute it with the credit reporting agency immediately. Removing that information will increase your score.

Increase your credit score by 100 points in a few days with a rapid rescore

When you fix errors on your credit report or remove negative information, your score increases. However, doing so through the credit reporting agencies takes time.

A rapid credit rescore through your bank or mortgage lender could help.

With a rapid rescore, your lender helps speed up the removal of negative information. Your new, better score will available faster than it would otherwise.

Depending on what’s in your report — like two or three old high-balance collection accounts — you could see your score rise by 100 points in just a few days.

Keep in mind that just a small increase in your credit score can improve your chances of getting approved for a mortgage — and save you thousands of dollars in interest costs. A mere 20 point increase in your score could take you out of a mortgage loan program with a higher interest rate into one with a lower rate.

If your credit report has “dings,” start improving earlier

It can take up to 12 months to increase your score if your report has some dings, such as a late payment or a collection account. During this time, you can improve your score by maintaining perfect credit. This means you should make all your payments on time and avoid applying for any new credit.

Too much debt: 37% of denials

Your debt-to-income ratio (DTI) is how much of your monthly gross income you spend on debts. Lenders use this ratio as a key factor when determining your ability to repay a home loan.

To calculate your ratio, you divide your monthly debt by your gross income.

For example, if your income before taxes is $8,000 per month, and your monthly debt, including future housing expenses, is $4,000 per month, your DTI would be 50 percent ($4,000 / $8,000 = 50 percent).

Here are some typical DTI limits for different loan types:

- Conforming loans: 43% DTI limit (but up to 50% for strong loan profiles)

- FHA-backed loans: 43% DTI limit (as high as 50% with compensating factors such as good credit or extra cash reserves)

- USDA Loans: 43% DTI limit (up to around 45% for strong loan files)

Before you apply for a mortgage, you should calculate your DTI. When you know what your ratio is before you start shopping, you will get a better sense of how much mortgage you can afford.

Keep in mind that mortgage lenders don’t use monthly bills like insurance payments, utility, or phone bills. Lenders calculate your DTI using the debts that appear on your credit report, like car loans and student loans, lines of credit and past mortgage payments.

Debt-to-income ratios also include any child support or alimony payments you’re required to pay.

Use our mortgage calculator’s income tab to find out how much you can afford.

Tips to improve your DTI ratio and qualify for a mortgage

If your monthly income is looking a little low compared to your monthly debts, it might be harder to qualify for an affordable mortgage. But there are steps you can take to improve those numbers.

First, you can raise your qualified income by including any overtime, commission earnings or bonuses you’ve consistently received over the past two years. These things might not be automatically included.

Tip: Taking on a $500-per-month car loan can reduce your home buying power by $100,000.

Here are five more easy steps you can take to improve your DTI:

- Pay down credit card balances as much as possible

- Do not apply for any additional credit

- Increase how much you pay toward your current debt

- If your spouse has high debts but low income, try to leave him or her off the mortgage application

- Combine all your high-interest debt into one loan with one affordable monthly payment

One of the most important things you can do is avoid buying big-ticket items with large monthly payments.

For example, if you take on a car loan with a $500/month payment before you buy a house, it can reduce your buying power by $100,000 or more.

Remember, the rules aren’t set in stone

The rules for DTI ratios aren’t universal. Although the Consumer Financial Protection Bureau established a maximum DTI of 43 percent (up to 50 percent in some cases until 2021), it’s still up to lenders to decide whether or not to give you a home loan.

Many lenders today now offer Non-QM, or “non-qualified mortgages,” which are loans that don’t quite meet the conventional loan guidelines established by Fannie Mae and Freddie Mac.

For example, if you have a DTI of 50%, traditional rules say you might be excluded from a mortgage. But if you also have a 720 credit score, strong cash reserves, and a lot of liquid assets, you might still qualify.

These considerations are known as “compensating factors.” With them, lenders may not consider your higher than average DTI much of a risk.

Flexible loan programs for high DTI and low credit

Loan programs offered by The Federal Housing Administration and Department of Veteran’s Affairs also make exceptions if you have a higher than average DTI.

Like we discussed earlier, the maximum DTI for mortgages backed by the FHA is typically 43 percent. However, the FHA allows DTIs up to 50 percent if you have good credit and make a significant down payment.

VA-backed home loans offer a range of benefits for veterans and active-duty military. These low-to-no cost mortgages have no minimum credit score requirement and flexible DTIs. The VA doesn’t set DTI benchmarks, so it’s up to lenders to determine a maximum DTI. In some cases, lenders allow DTIs of up to 50 percent if you meet the VA’s residual income requirements.

Start on your home buying goals now

Higher than average debt-to-income ratios and credit scores were the two main reasons why lenders denied mortgage applicants in 2018.

Now that you know what to look for, you can improve your chances of qualifying for a mortgage by checking your credit scores and calculating your DTI before you start applying.

And there’s one other thing you can do to get costs down. Compare rates from multiple lenders to find the most competitive deal for you. Start here.

Time to make a move? Let us find the right mortgage for you