A new world order for mortgage refinance rates

Refinancing at today’s new and lower mortgage rates can save millions of borrowers an average of $267 a month according to new research.

But wait. Does it pay to refinance the low-rate mortgage you already have?

It’s a good question because low-rate mortgages are generally untouchable, loans borrowers normally hang onto because they represent great deals. But we’re not living in normal times, at least as far as mortgage financing goes. What used to be a low-rate mortgage is being displaced by a new financial reality, the even lower-rate mortgage.

Can you save in this era of ridiculously low mortgage rates? You might consider finding out after hearing about how many homeowners could cut their monthly housing bill.

Check today's low rates. Start here.Rates running 1.34% lower than just 9 months ago

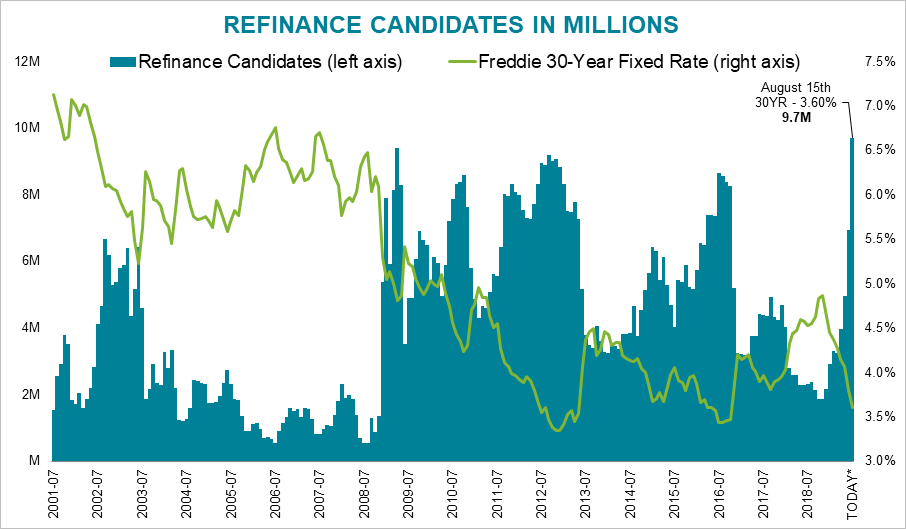

Freddie Mac reported in November that weekly mortgage rates for fixed-rate, 30-year mortgages hit 4.94 %. In mid-August, the same loan was priced at 3.6%. That’s a fall of 1.34% in less than a year.

Think about it this way: If you have a $300,000 mortgage at 4.94% the monthly cost for principal and interest is about $1,600. Drop the rate to 3.6% and the monthly cost falls to $1,360. That’s a savings of $240 a month or $2,900 a year. And remember, a “savings” is not “income.” There’s no tax on savings.

Today’s lower-rate mortgages change the game. They mean it can pay to check and re-check potential monthly and lifetime savings from a mortgage refinance.

Check your refinance eligibility.Millions may qualify for refinancing

Black Knight, a mortgage technology and data company, says as of mid-August 9.7 million mortgage borrowers were ripe for refinancing with rates at 3.6%. They can save, on average, $267 a month by refinancing.

This is a conservative estimate. The number is probably much higher. It assumes borrowers with credit scores of 720 or higher, who want 80% loan-to-value (LTV) financing, and can get at least a .75% rate reduction.

But what about other borrowers? Not everyone has a 720 credit score or 20% equity. Black Knight estimates there are an additional 10.3 million potential borrowers. Some might want a loan-to-value ratio above 80%. Some might have lower credit scores but are still eligible to refinance.

In total, there could be as many as 20 million homeowners who could see good savings by refinancing.

Source: Black Knight

Black Knight cautions that not every borrower who might benefit from a new mortgage will qualify. Also, not every borrower who qualifies should get new financing. Think of an owner who expects to move at year-end. There won’t be enough time for the borrower to re-capture refinancing costs.

Refinance calculator

One quick-and-easy way to check refinance opportunities is to run your numbers through an online refinance calculator. In just moments you can get a good sense of potential monthly and lifetime savings.

While numbers are important you want to see if refinancing gives you a “material benefit.” You want to get at least one of four advantages from refinancing.

- A lower monthly payment.

- A lower interest rate.

- More security, such as a conversion from ARM financing to a fixed-rate loan.

- A shorter loan term.

Another refinancing test involves “fee recoupment.” This is a fancy term which asks whether the cost of refinancing outweighs the benefits. The VA, for example, wants vets to get back refinancing fees and charges within 36 months as a result of lower monthly payments. It’s a useful measure for everyone.

How to avoid closing costs

One way to avoid closing expenses is to have the lender pay them. This is done with a “no-closing cost” loan. The lender increases your mortgage rate in exchange for paying some or all of your up-front costs.

If the monthly payment for the no-closing cost loan is lower than your current expense for principal and interest then refinancing might be worthwhile.

How to avoid refinancing paperwork

Mortgage refinancing has traditionally involved a lot of paperwork. Here’s good news. Mortgage lending has changed.

First, a number of loan programs have simply dumped most paperwork. FHA streamline, VA streamline, and FMERR loans waive many traditional refinance requirements. Fannie Mae and Freddie Mac often waive appraisal requirements.

Second, a lot of paperwork has been automated. With your permission lenders can get account statements directly from banks. Tax information can be obtained electronically. Instead of appraisals, in some cases, you can use an Automated Valuation Model (AVM).

Avoid the lender whipsaw

Lenders have been hit with see-sawing demand and the increased use of technology. The result has been a lot of industry lay-offs and some closings as rates rose last year. Now rates are down and refinance applications are soaring. According to the Mortgage Bankers Association’s Refinance Index, activity in mid-August was up 196% when compared with a year ago.

If you have a refinancing interest the time to start the process is now. Work with a lender who has the time and staff – and the rates – to make refinancing worthwhile.

Check your refinance savings

Mortgage rates are low but they may not stay that way for long. Get in contact with a lender to see your eligible refinance savings.