Mortgage rates on a historic slide downward

Home refinance rates are low.

This is a statement which is both true and does not adequately describe the current mortgage situation.

Mortgage rates in the 3% range – something many believed would never be seen again – are back.

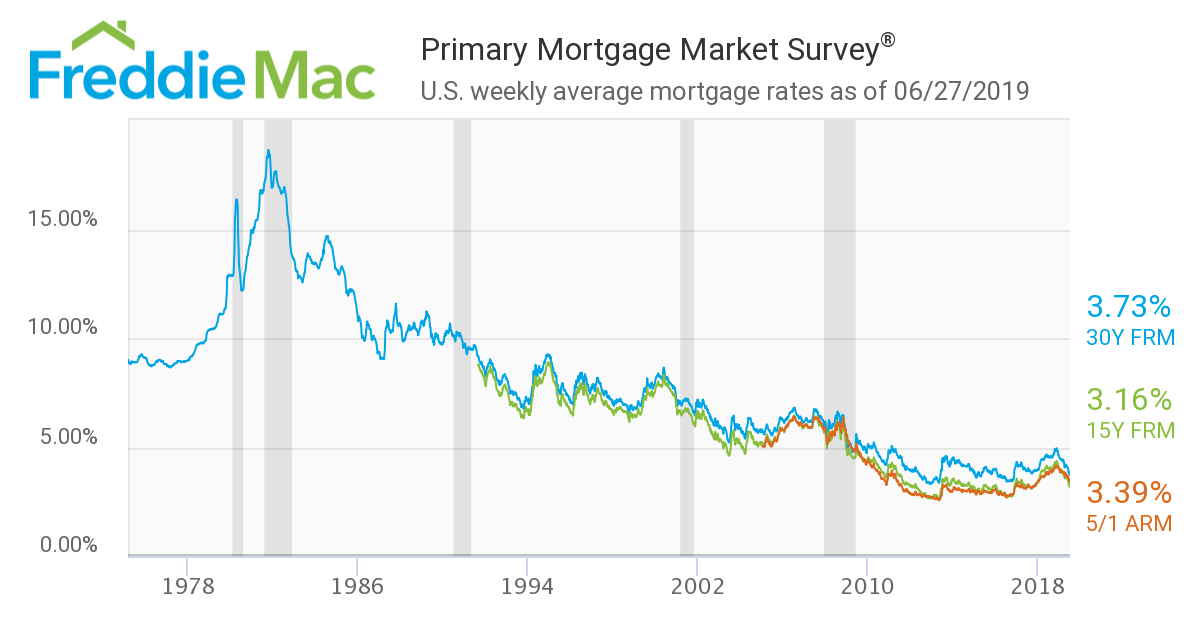

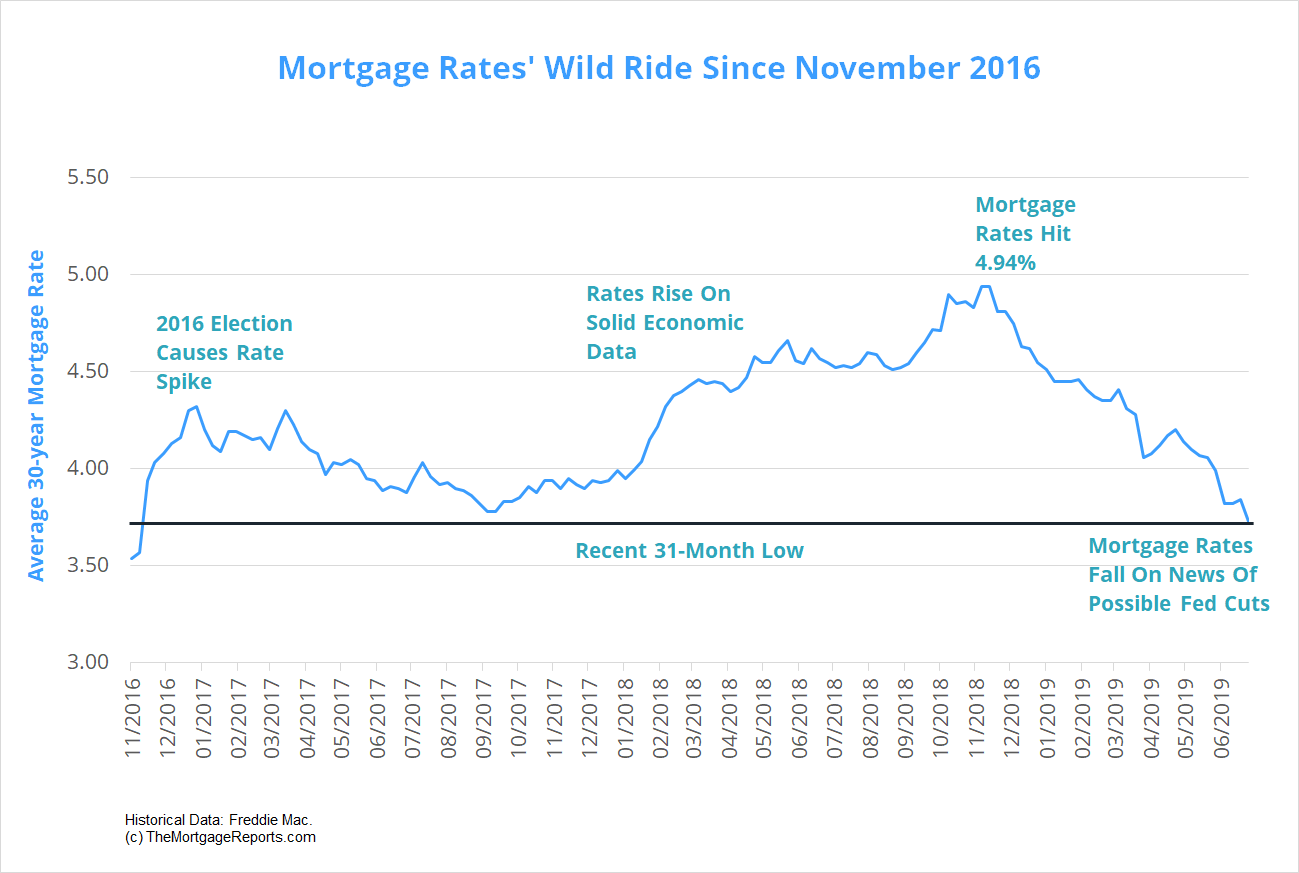

Freddie Mac – which has been publishing a weekly rate survey since 1971 – said that at the end of June the 30-year fixed-rate mortgage rate “fell for the seventh time in the last nine weeks, and to the lowest level since November 2016.”

How low? Just 3.73% for a 30-year fixed mortgage, 3.16% for a 15-year loan, and 3.39% for a 5/1 ARM.

If you’ve been thinking of financing or refinancing real estate now is a very interesting time to consider your options.

Capture low rates before they rise.Mortgage rates by the numbers

How good is the mortgage marketplace today? We’re not at the record 3.31% set in 2012 but at 3.73% home refinance rates are not far off. And – compared to other rate measures – we’re doing extremely well.

- Between April 1971 and the end of 2018 mortgage interest averaged 8.08%.

- Rates between 1971 and 2018 ranged from a high of 18.63% in 1981 to just 3.31% in November 2012.

- In the last 10 years, the period between 2008 and 2018, mortgage rates averaged 4.37%.

- In the last five years, the period between 2013 and 2018, mortgage rates averaged 4.03%

- Mortgage rates in 2019 have so far averaged 4.19%.

- June mortgage rates averaged 3.8%.

- Between the week of November 15, 2018 and June 20, 2019, mortgage rates plummeted from 4.94% to 3.73%, a drop of almost 1.2%.

Since the early 80’s, mortgage rates have been on a continuous slide. As recently as 2008, 30-year mortgage rates topped 6%. Today’s homeowner is seriously benefitting.

Surprise! Mortgage rates aren’t where they’re supposed to be

Go back to November 2018 and the major real estate organizations were largely predicting that mortgage rates this year would reach 5% – or more.

| Agency | 30-Yr Rate 2019 Prediction |

| NAR | 5.3% |

| NAHB | 5.2% |

| MBA | 5.1% |

| Freddie Mac | 5.1% |

| Fannie Mae | 4.8% |

| Realtor.com | 5.5% |

| Average of all agencies | 5.17% |

In making these predictions there was a general sense that mortgage levels would rise because the Fed would continue to hike bank rates. However, while the Fed controls the rates charged by banks it does not govern mortgage interest.

An alternative way to look at mortgage rates is to consider the worldwide supply and demand for cash. The world is sitting on an ocean of capital.

The #1 rule of investing is that higher supply leads to lower demand.

In fact, there is so much money floating around that investors are “earning” negative interest in Europe and Japan. Much of the world economy is soft, mushy and risky. Just think of Brexit as well as potential trade wars with China and Mexico.

If you’re a high net-worth individual or run a “sovereign fund” – an investing vehicle used by cash-rich nations to diversify their holdings – you’re probably looking at the US and thinking, “hey, those folks pay their mortgages, they have a huge internal market, and American home refinance rates are positive. Why don’t we move money there?”

And then, bingo, with electronic speed, money comes into the US mortgage market. More supply pushes down rates and that’s where we are today.

When you look at mortgage rates from an international perspective the Fed’s importance is, um, marginal. Since the world economy is highly-integrated the US cannot stop foreign investors from entering our mortgage markets with cheap capital.

Verify your new rate

Is now the right time to refinance?

It’s interesting to speculate where mortgage rates might be in six months or a year but the truth is that no one knows.

What we do know is where rates have been and where they are today. We also know that today, now, it can be attractive to look at the mortgage marketplace.

Home buyers should check with lenders because rates are low, something good for affordability. Current borrowers seeking to refinance should compare current rates and payments with what might be possible in today’s rate environment.

The significant rate drop since November 2018 opens up a lot of possibilities for borrowers. Marginal borrowers who were at the edge of affordability are now more likely to qualify more easily because of lower rates.

To have a successful refinance borrowers must get a material benefit such as a lower monthly cost or a switch from adjustable-rate financing to a fixed rate. You want to be able to recapture refinancing costs in a reasonable period, say 36 months. You also must expect to live at the property for enough time to make a refinance worthwhile.

Higher rates ahead?

A short-term rate rise seems unlikely. Many economists believe the Fed will drop bank rates once or twice this year. The world economy seems to be in a rut. But these things can change quickly, just as they did since November.

An open question concerns the US political situation. How will the election impact the national economy? How will it influence mortgage rates? Will President Trump continue to push for lower rates? What about a new president?

The view here is that every presidential candidate will push for lower rates. The reason? The national debt now amounts to $22 trillion. Higher interest rates will push up government costs and cause the debt to grow still larger, something no national politician can favor.

Get today’s low rates

This could be an opportune time to capture a mortgage rate lower than has been available for most of history.

It’s always possible that rates could rise again without warning.

Time to make a move? Let us find the right mortgage for you