“How to sell higher rates and fees”

Yes, there is a series of videos on YouTube instructing mortgage loan officers and brokers on how to limit competition and sell higher prices and mortgage rates. And if they are teaching lenders how to foil consumer attempts to get their best deal on a home loan, we thought we’d teach you how to avoid this tactic.

Don't pay more than necessary. Find rates here“Focus on the payment”

The instruction begins as the professional speaks about what a pain borrowers who ask for lower rates and fees are. And how smart lenders dodge that by distracting the consumer. They do this by steering the conversation to the monthly payment, not the interest rate.

Yep, just like car salespeople do when they want you to stop looking at the sticker price and the auto loan rate. Exactly like that.

How focusing on the payment distracts you

“When a customer tells you he wants a lower rate, what he’s really saying is that he wants a lower payment,” says the instructor. So then the salesperson steers the talk away from rates and to payments. And there are several ways to lower your payment. That’s not necessarily bad. But you should not be deterred from getting quotes from competing lenders.

- You may get a lower payment by “buying down” the rate. That means paying extra discount points to get a lower rate. If you’re refinancing, and the lender wraps those costs into the new loan, you might not write a check at closing. But those fees will be coming out of your home equity and you’ll be paying interest on them as well

- One easy way to reduce your payment is to choose an adjustable rate mortgage (ARM) with a lower starting rate. For many people, especially those who expect their incomes to rise in a few years, or who plan to sell their homes, a loan that’s fixed for three, five, seven or 10 years can make sense. The rate and payment should be lower than the 30-year fixed loan. However, if this is the route you take, compare the price of that program with offers from other lenders

- One possibly risky move that lowers your payment is the balloon mortgage. A balloon mortgage is a loan that does not pay down the balance as much as a traditional fully-amortizing home loan. And after a number of years, the entire remaining balance becomes due — you have to either pay it off or refinance it

- The “interest-only” loan also gets you a lower payment. That’s because during the first few years, you only pay the interest due. Eventually, your payments will go up substantially because you’ll have the entire balance to repay, and fewer years to repay it. It’s a loan that has its place, but it’s too risky for many

Understanding lower payment options

There is nothing wrong with any of these tactics for lowering your mortgage payment. However, if you choose one of these options, you need to know what you’re getting into. If you buy down your rate, for instance, determine how long it will take for the lower monthly payment to cover the extra costs.

ARMs with fixed rates during their introductory period can be very attractive, and can genuinely save you money. But don’t let anyone distract you from the fact that it is only fixed for a limited time period. See what the payment could do when this period ends, and determine if that would be affordable for you.

Balloon mortgages are legal, but they are not what the government calls a “qualified” mortgage. That’s because there is risk to the borrower if he or she cannot repay or refinance the loan when it becomes due. What if you lose your job, your credit rating tanks, or home values fall and you can’t sell? The same concerns apply to interest-only loans. Whatever loan you get into, you need an exit strategy in case things don’t go as planned.

Shop til the rate drops

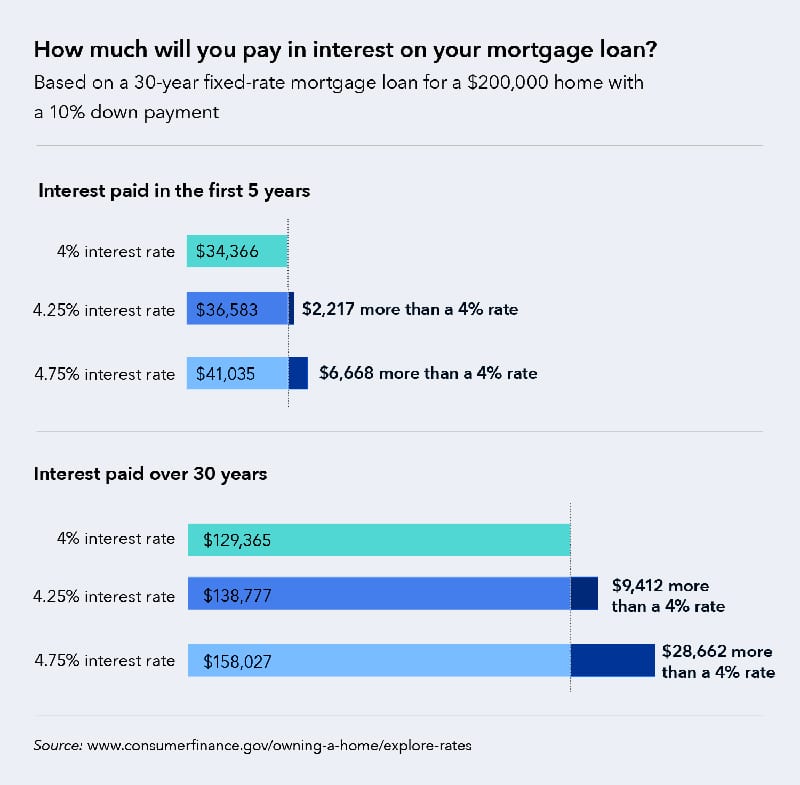

It’s good to consider the monthly payment. Your payment determines what’s left to cover the rest of your living expenses and contribute to your savings. But don’t get distracted away from comparing mortgage rates. Whatever program you decide to go with, get quotes from several other lenders to make sure that you’re getting a good deal — not a good sales job.

Time to make a move? Let us find the right mortgage for you