What is mortgage insurance (MI)?

Everyone wants to pay less for mortgage insurance (MI), and with a little preparation and some shopping around that may be possible. But before we look at lower costs, let’s first explain what MI really is.

Most loans with less than 20 percent down (for purchases) or home equity (for refinances) require some form of mortgage insurance. For conventional (non-government) loans, it may be also be called PMI, or private mortgage insurance. FHA programs require mortgage insurance premiums (MIP) regardless of the size of down payment. VA home loans call their insurance premium a funding fee. Some lenders may not require a separate insurance policy, but charge a higher interest rate to cover their risk.

Find rates for programs with and without mortgage insuranceWhy 20 percent down?

Mortgage lenders really, really want you to buy a home with at least 20 percent down. That’s because it substantially reduces their losses if you don’t repay your loan and they have to foreclose.

However, most homebuyers, especially first-timers, don’t have 20 percent to purchase a property. The National Association of Realtors lists these figures for median down payments in 2018:

- All buyers: 13 percent

- First-time buyers: 7 percent

- Repeat buyers: 16 percent

If you don’t have 20 percent down, most lenders force you to purchase mortgage insurance. The policy covers their losses if you default and they don’t fully recover their costs in a foreclosure sale.

How much does mortgage insurance cost?

What MI costs are you likely to face? For conventional mortgages, MI costs depend on your credit rating, down payment size, and type of loan you choose. For government loans, your credit score does not affect mortgage insurance premiums.

Related: Avoiding PMI is costing you $13,000 a year

Conventional (non-government) loans

Mortgage insurance costs for conventional loans can vary widely. Unlike government mortgages, mortgage insurance costs for conventional mortgages can depend a great deal on your credit rating.

Conforming mortgages

Mortgages that meet Fannie Mae and Freddie Mac standards – known as “conforming mortgages” – are available with as little as a 3-to-5 percent down payment. Lenders can choose how much coverage they want for these loans.

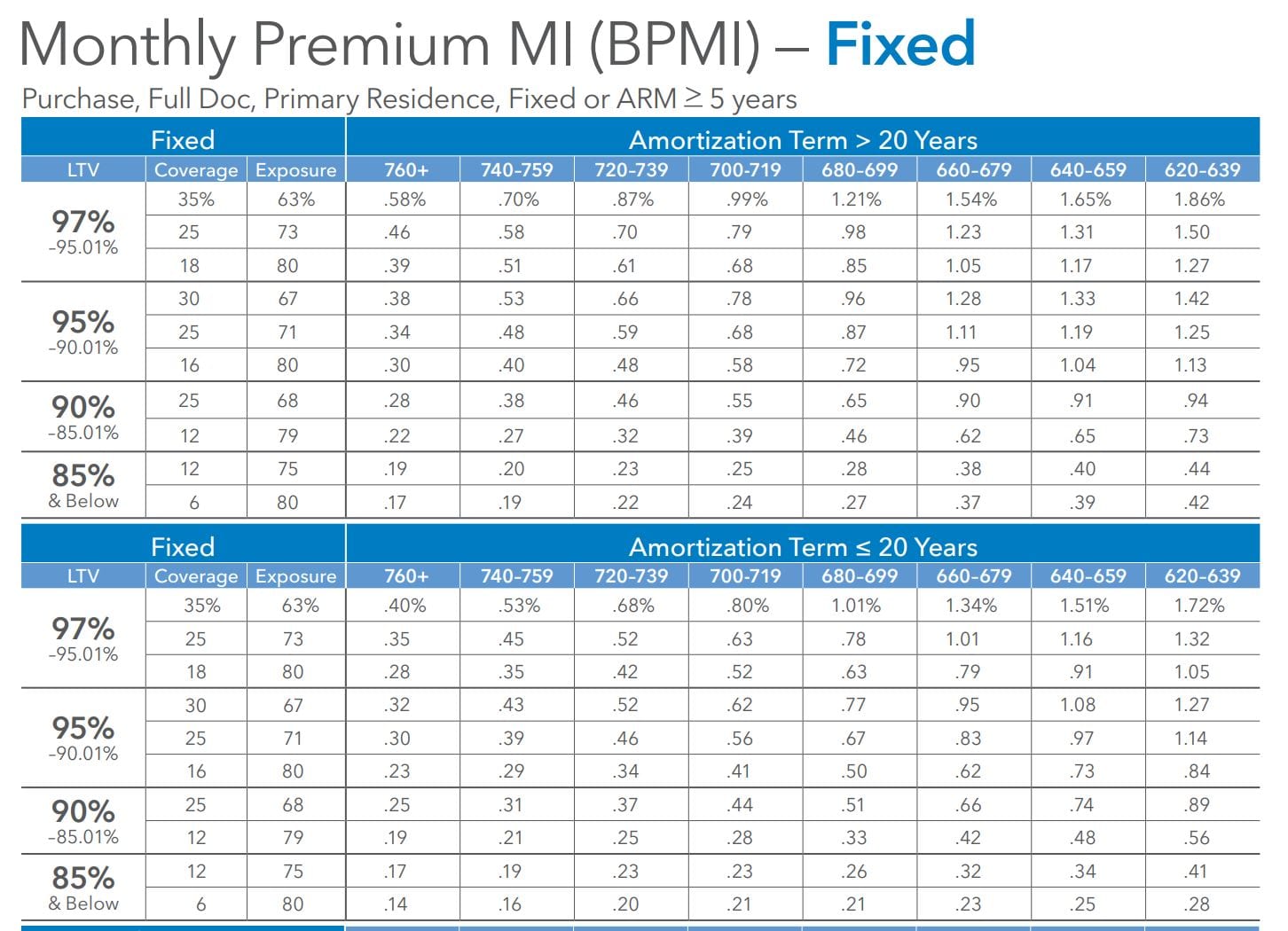

The graphic below shows rates set by one national insurer. Notice that they depend on the borrower’s credit score, loan-to-value, and loan type. Those with higher scores pay less. Borrowers who choose fixed-rate mortgages pay less. And so do those with 15-year loans instead of 30-year loans. Insurers also adjust for property type (condo, multi-unit, second home, etc.) and other factors.

You’d think that because 20 percent down is the requirement to avoid mortgage insurance that lenders would only require enough coverage to get to 20 percent — that if you put 5 percent down, they’d only need 15 percent coverage.

But you’d be wrong in most cases — lenders tend to choose more coverage and less exposure. That’s because of your chances of defaulting go up as your down payment falls. So if you put 5 percent down, you’ll probably have to pay for 25 percent coverage. And your premium for a 30-year fixed loan can range from .34 percent to 1.25 percent, depending on your credit score.

Portfolio or non-conforming loans

Non-conforming mortgages are mortgages that do not meet conforming loan guidelines. That may be because of their size (large loans may also be called jumbo loans) or other factors. Investors may buy them, but not through Fannie Mae or Freddie Mac.

Mortgage insurance can be a problem for those with non-conforming home loans.

Portfolio loans are mortgages that the lender keeps on its own books and does not sell. Portfolio lenders are more likely to self-insure. That means they may charge a higher interest rate to cover the additional default risk of a lower down payment.

Government loans

Government mortgages require insurance, too. But the factors that determine your costs are not nearly as variable as they are with conventional mortgages.

FHA mortgages

You can purchase with as little as 3.5 percent down under the FHA program. With an FHA-backed loan, you pay two types of mortgage insurance premiums (MIP). First, there’s an up-front fee MIP equal to 1.75 percent of the mortgage amount. You can choose to add this amount to the mortgage if you don’t want to pay it out-of-pocket at closing. You’ll also pay an annual premium (divided by 12 and added to your monthly payment) that depends on your loan amount and term.

Premiums for FHA loans run between .80 and 1.05 percent, depending on your loan amount and down payment. Rates for 15-year loan range from .45 percent to .95 percent. You pay these premiums for the entire life of the loan.

VA home loans

VA-qualified buyers can purchase with zero down. There is an up-front funding fee but no monthly insurance charges.

The funding fee depends on your down payment and if you have used the program before. It may be waived for disabled borrowers.

The table below shows how VA funding fees are determined.

| Type of Military Service | Down Payment | Fee for First-Time Use | Fee for Subsequent Use |

| Active Duty, Reserves, and National Guard | None | 2.3% | 3.6% |

| 5% or more | 1.65% | 1.65% | |

| 10% or more | 1.4% | 1.4% |

USDA financing

With USDA financing, there is a 1 percent up-front charge as well as .35 percent annual fee. The payments continue for the life of the loan.

How to pay less for mortgage insurance

Mortgage insurance can be a big cost. For example, if you buy a home for $250,000 with 3.5 percent down, and get FHA financing, the up-front MIP will be $4,222. You’ll also pay annual MIP of $171 per month. After five years, you will have spent $14,482 ($171 x 60 plus $4,222).

Here are several strategies to reduce or eliminate mortgage insurance costs.

Go piggyback

Instead of getting one mortgage, get two. Try a first mortgage equal to 80 percent of the purchase price and a second mortgage for 5, 10 or 15 percent of the balance. You can then buy with no mortgage insurance. Here’s how that might work, assuming that you have a 700 FICO score, 5 percent down, and buy a traditional single-family home for $250,000:

- First mortgage principal and interest, assuming a 4.5 percent interest rate: $1,013.

- Second mortgage principal and interest, assuming a 7 percent interest rate: $249

- Total payment: $1,263

A comparable 95 percent loan with 25 percent coverage looks like this:

- First mortgage principal and interest at 4.5 percent: $1,203

- Mortgage insurance: $108

- Total payment: $1,311

In this case, the difference is about $50 a month.

Refinance

If the value of your property has grown, you may be able to refinance to a loan without MI, instead of without waiting until your balance is less than 80 percent. When refinancing, you want to try for a double MI whammy — a new loan with both a lower rate and no MI requirement. Speak with a loan officer for details; the monthly savings might be significant.

Look for refundable premiums

If you expect to be a short-term owner, look for mortgage insurance programs with refundable premiums. With the FHA, for example, you can get a partial refund if you pay off the loan within three years. And private mortgage insurers also offer refundable premiums. However, their upfront costs may be higher.

Reduce your risk profile

With conventional financing, you can significantly reduce what you pay for mortgage insurance by being a less-risky borrower.

- Improve your credit score. Even a one-point increase can save you money if it puts you into a better tier

- Make a larger down payment. Going from 3 percent to 5 percent can save you money, depending on the program

- Choose a fixed loan over an ARM

- Choose a loan with a term of 20 years or fewer

Pick the right program

For those with small down payments, VA home loans are almost always the least expensive. The interest rates are generally lower than conventional rates because the government backs the loan. You can wrap the funding fee into the loan, or ask the seller to pay it when you buy a home. And there is no monthly premium. However, you have to be VA-eligible.

Borrowers with good-to-excellent credit will almost always pay less for private mortgage insurance than they will for FHA coverage. And FHA mortgage insurance never goes away, no matter how low your loan balance becomes. However, homebuyers with low credit scores and small down payments may find FHA or USDA loans their best or only option. In that case, plan to refinance your way to cheaper financing when your credit score and equity positions have improved.

Split or single premiums

Single premiums let you avoid the monthly mortgage insurance by paying the whole thing up front. Split premiums allow you to make smaller monthly payments by paying a partial premium upfront. And if your seller is motivated, you may be able to get him or her to pay it for you.

Related: Getting sellers to pay your closing costs

Cancellation

Conventional loan guidelines allow borrowers to request cancellation of their MI once their loan falls to 80 percent of the value of the home when you took out your mortgage. You must normally be in good standing with your lender to drop MI this way.

With FHA and USDA mortgage insurance, coverage continues for the life of the loan. For VA-backed financing, there is no monthly charge.

Automatic termination

Alternatively, mortgage insurance for conforming loans “must automatically terminate PMI on the date when your principal balance is scheduled to reach 78 percent of the original value of your home. For your PMI to be canceled on that date, you need to be current on your payments on the anticipated termination date. Otherwise, PMI will not be terminated until shortly after your payments are brought up to date.”

It takes years

It can take a long time for a home to reach the 78 percent benchmark. For instance, if you buy a $300,000 home with 5 percent down the mortgage amount will be $285,000. At 4.625 percent interest, the loan balance will not dip below $234,000 – 78 percent of the property’s $300,000 original value – until month #112 on the amortization schedule. That’s 9.3 years from now, for many borrowers that’s long after the property has been sold or refinanced.

Time to make a move? Let us find the right mortgage for you