Does more education equal more house?

Most of us know intuitively that the more education you have (at least, the right kind of education), the better your job possibilities and the higher your average income will be. So, how does that translate to home affordability? How much home can you buy at your education level?

See mortgage rates for homes in all price rangesAverage income by education level

According to the US Bureau of Labor Statistics (BLS), your income and job stability increase significantly with your education level. Here are the median annual earnings for those with various degrees in 2017, the most recent year provided:

- High school diploma: $37,024

- Some college, no degree: $40,248

- Associate’s degree: $43,472

- Bachelor’s degree: $60,996

- Master’s degree: $72,852

- Doctoral degree: $90,636

- Professional degree: $95,472

How much home can you buy with your education?

If you put down the average amount for a first-time homebuyer (7 percent according to the National Association of Realtors), don’t carry a lot of debt, and finance at 4.7 percent, this income should get you housing at these approximate values:

- High school diploma: $161,231

- Some college, no degree: $175,843

- Associate’s degree: $199,449

- Bachelor’s degree: $283,354

- Master’s degree: $339,978

- Doctoral degree: $424,913

- Professional degree: $447,866

These prices are estimates and vary with your credit rating (mortgage insurance depends in part on your credit score), the state in which you buy (property taxes vary widely), and the mortgage you choose.

Related: 6 low of no down payment mortgage loans for 2019

Income stability

Another item that mortgage lenders look at is your income stability. That means your likelihood of keeping the job you have or finding new employment if you need it. And this factor also depends somewhat on your education level. The following chart illustrates unemployment rates by education level (data was also from 2017).

- High school diploma: 4.6 percent

- Some college, no degree: 4.0 percent

- Associate’s degree: 3.4 percent

- Bachelor’s degree: 2.5 percent

- Master’s degree: 2.2 percent

- Doctoral degree: 1.5 percent

- Professional degree: 1.5 percent

Mortgage approval by education level

The US government does not specifically track how much home can you buy according to education level. However, one widely-quoted study (Education Levels and Mortgage Application Outcomes: Evidence of Financial Literacy) did track mortgage completion rates by census tract, and found that there is a correlation between mortgage closings and the percentage of college graduates in the area.

Applicants in neighborhoods with 5 percent or fewer college-degreed residents closed on their mortgages 54.3 percent of the time, while those from areas with 15 percent or more college graduates closed 65.7 percent of the time. And applications in less-educated areas were denied at a 20.7 percent rate, compared to the 12.7 percent denial rate of the collegiate tracts.

While it doesn’t mean that going to college automatically gets you mortgage approval, the things that go with it — higher income and better neighborhoods — do.

You don’t need a college degree to buy a home

That said, these are statistics, which pertain to huge groups of people — but not necessarily you. (Most of us know at least one person with two advanced degrees who still works at Starbucks.) Many, many business owners and employees enjoy excellent income and the ability to purchase the security, home and lifestyle they want.

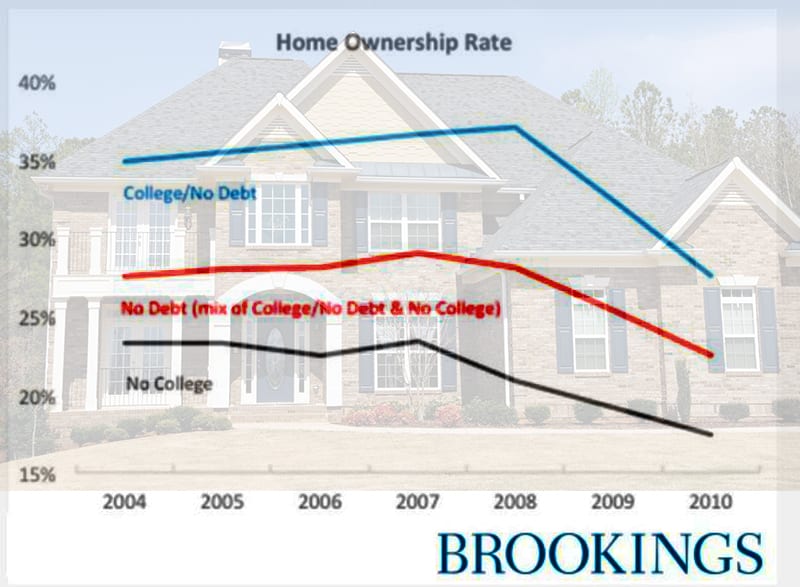

And while education definitely affects homeownership, the graph below using information from researchers at Brookings shows that debt plays a large role.

That said, there are things everyone can do at every education level to expand their chances of successful homeownership.

The B word

Studies have shown that accountability is a big predictor of success. People who track every bite of food are twice as successful at weight loss. Because writing down what they eat makes them think about it, and thinking about it makes them consider if they are hungry or not, and if something healthier might be a better choice.

Spending is the same way. Consumers with budgets show more commitment and save more effectively. So spend a month tracking every single thing you pay for. Chances are just paying attention will cause you to spend less. Don’t want to track every cent? Then create a budget with any of the many effective online tools available.

Pay yourself an allowance, and use it for all discretionary spending. Pulling cash from your wallet to pay has been proven to cause more psychological pain than whipping out the plastic or clicking “buy.” So embrace the pain now and enjoy a better future.

Live less large

Whether you can pay $500 a month or $50,000 a month for rent, spend less. Find a cheaper place. Get a roommate. Set the thermostat lower in winter and higher in the summer. Learn to cook and eat fresh food instead of paying for processed or going out. You’ll also save on medical expenses. Drop your gym membership and run in the park with friends. In fact, this whole exercise will be easier if you can enlist the help of friends who have the same goal — financial security and buying a home.

Change your habits for a month and see how much you save. Put that in the bank or toward paying off debt and make that your goal every month. Not only will you increase yours savings; you’ll also be practicing for homeownership — learning to live with less.

Boost savings

One of the by-products of living with less is that you’ll be able to save more. Don’t even think about saving for a home until you have enough emergency savings to cover at least two months of expenses (six if you’re self-employed or on commission).

Get your saving habit off to a great start with a garage sale or spend the day with an app like Letgo or work your eBay account. Get rid of everything you don’t need right now and put it into savings. Ditto for windfalls like tax refunds or gifts. Treat yourse a little, but bank most of it.

Related: Complete guide to down payment assistance in the USA

Double up

The earning and home-buying figures above are per person. So if you have more earners, you have more buying power. This does not mean you must be married to co-own a home with someone. Or even romantically involved. You just need a partner with similar habits who is also responsible and tired of making his or her landlord rich.

You’ll definitely want to put your co-ownership in writing — how you’ll buy, how you’ll divide expenses and ownership, and how you’ll dissolve the agreement at selling time.

Multiply

Another way of expanding what you can buy is to consider multifamily homes. Those are properties with two, three or four units. You live in one, rent out the others, and use the money to pay your mortgage. Pay that mortgage off, and you have a nice source of income. There’s a reason that so many very wealthy people got their start in rental property ownership.

Get down (payment)

One of the biggest obstacles to homeownership, according to many studies and surveys, is the down payment and home closing costs. But about 90 percent of homes in the US are eligible for some sort of down payment assistance (DPA) if the buyer qualifies. And loans like VA mortgages and USDA home loans don’t require any down payment.

You don’t have to be a financial genius to buy a house. You don’t have to be educated or rich. But you do have to want it enough, and channel that want into a plan, and that plan into action. Your actions, not your education, will provide the result you want.

Time to make a move? Let us find the right mortgage for you