FHA home loans are popular with Gen Y

Many buyers in their twenties and thirties are now looking to buy a home. But they’re worried about higher interest rates and saving enough for the down payment. That’s why many turn to borrower-friendly options like FHA home loans. This loan requires only 3.5 percent down to those who qualify.

In fact, new data show that millennials are taking out larger FHA home loans than in past to buy a home. This especially helps them compete against other buyers in markets with limited housing stock.

Explore different loan options. Learn what you qualify for. An FHA home loan may be ideal for you.

Find FHA home loan rates and programsWhat the research found

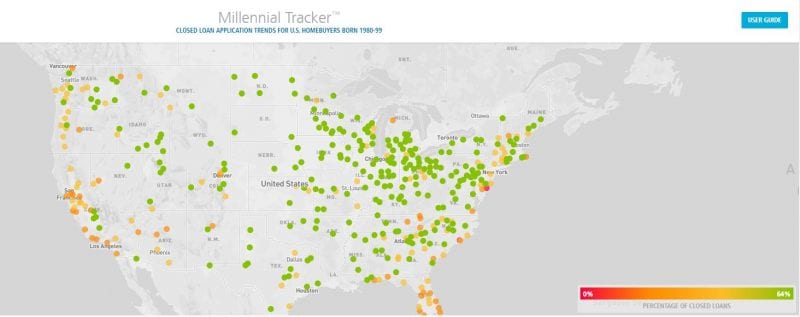

Based on the latest Ellie Mae Millennial Tracker findings:

- 26 percent of all closed loans to millennials last November were for FHA loans.

- The average FHA loan size was $186,454. That’s up from $178,862 in November 2017, and $170,167 in November 2016.

- Across the nation, borrowers are taking out much larger FHA loans vs previous years. For instance: in San Francisco, the average FHA home loan amount was $505,871 in November 2018 vs. $460,853 a year earlier; in Boston, it was $353,680 vs. $343,219. In Washington, D.C. it was $313,168 vs. $283,584. And in Chicago it was $194,630 vs. $178,335.

- For 56 percent of FHA loans, men were listed as the primary borrower. Women accounted for 35 percent. Nine percent were not specified.

How to decipher these findings

Joe Tyrrell, executive vice president of strategy and technology for Ellie Mae, Inc. isn’t that surprised by this data.

“Millennials continue to make up the largest segment of buyers,” he says. “But inventory remains relatively tight. And interest rates have risen in recent months. Hence, borrowers are not waiting to buy. Instead, they’re increasing their loan amount to purchase what is available on the market.”

He adds that “millennials have found the need to take out larger FHA-backed mortgage loans. This is so that they can buy from the limited inventory available in such a competitive market.”

Michael Mesa is a Certified Mortgage Planning Specialist with Fairway Independent Mortgage Corporation. He says many millennials have large amounts of student debt which can limit their ability to save money. That makes FHA home loans an attractive choice.

“An FHA home loan can be the ticket when carrying a lot of debt or after a negative credit event in the last 12 to 24 months,” says Mesa.

These numbers suggest something else, too: Gen Y is increasingly motivated to buy homes.

“The reasons include family formation and the opportunity to build equity. There’s a surging demand among their generation,” says Tyrrell. “This is particularly true in large metro areas such as San Francisco, Los Angeles, and Washington, D.C.”

Benefits of an FHA home loan

FHA home loans are enticing to millennials and others for many reasons. One is that they are not risky: An FHA loan is backed and issued by the U.S. government (the Federal Housing Administration).

More importantly, “they allow more flexibility when it comes to your debt-to-income ratio (DTI) and credit score,” Mesa notes.

Want to qualify for a 3.5 percent down FHA loan? All you need is a FICO credit score above 580 and a DTI ratio of less than 43 percent. You must have a steady income and proof of employment. And the home you want to buy must be used as your primary residence. You must also pay for mortgage insurance for the life of the loan if your down payment is less than 10 percent.

Verify your new rateNote that some lenders offer conventional mortgages with just a 3 percent down payments required. And Fannie Mae has a Conventional 97 loan that also requires only 3 percent down. The mortgage insurance you may have to pay for the latter is also cancelable when your home reaches 20 percent equity.

So if you qualify, a Conventional 97 loan may be a better value than the FHA’s 3.5 percent loan. But that depends on your credit score. The Conventional 97 requires at least a 620 FICO score.

Related: 3 conventional loans that meet or beat FHA

Before pursuing an FHA home loan

Prior to committing to an FHA home loan, prepare yourself for homeownership.

Pay off outstanding debt, including student debt. “Start with the loans that have the highest interest rates first,” says Tyrrell. Also, aim to use no more than 35 percent of your allowable credit limits,” Mesa says.

Improve your credit score. “This could lower your interest rate so that a monthly mortgage payment is much more affordable.” In addition, “monitor your credit report on a consistent basis,” recommends Mesa.

Create a realistic budget. “Outline all your expenses so you know exactly how much of a mortgage payment you can realistically afford every month,” adds Tyrrell.

Research the housing market in your desired area. “Look into the most affordable neighborhoods,” suggests Tyrrell. “Get a better understanding about the fluidity of the housing market, too. “

Look for alternative ways to save money. “For example, research housing options in the suburbs vs. the city. Look at more affordable options in states with higher inventory. And pinpoint day-to-day expenses that can be sacrificed,” notes Tyrrell.

Try to save at least 3.5 percent of the purchase price of a home within your desired area.

Get educated about the mortgage loan process. “Learn what materials are needed to apply for a loan as well as what it takes to get a loan approved,” Tyrrell says.

Shop around for FHA-approved lenders. “Explore multiple options to find the provider that will work best for your needs,” says Tyrrell.

Prepare to apply for an FHA loan. “Gather any documentation that a lender will need,” says Mesa. “And begin writing any letters of explanation about your financial situation that a lender or underwriter may require. A full and transparent loan application will sharply increase your chances of being approved.”

A good mortgage loan officer can answer your questions and help you with things like letters of explanation. And our own mortgage experts here at The Mortgage Reports are also available to take your questions on our Ask forum.

Time to make a move? Let us find the right mortgage for you