What factors help you get a pay raise?

Dreaming about buying a home but worried about how to afford it? Earning more would help, but how to ask for a raise? You won’t get it just because you want to buy a house. Here are the top three reasons your boss is likely to grant your request:

- You are doing excellent work

- Your responsibilities have increased

- You are underpaid compared to others in your profession

More money equals more mortgage

Due to mortgage reforms in recent years, your income is a more important factor than it previously was. You may need higher earnings to get the house you want. That means requesting a bump in salary. You have to know how to ask for a raise, say the experts.

The job market is strong. Unemployment is down and the economy is robust. Now’s the perfect time to make a case for why you deserve more pay. Prepare to back that up with facts.

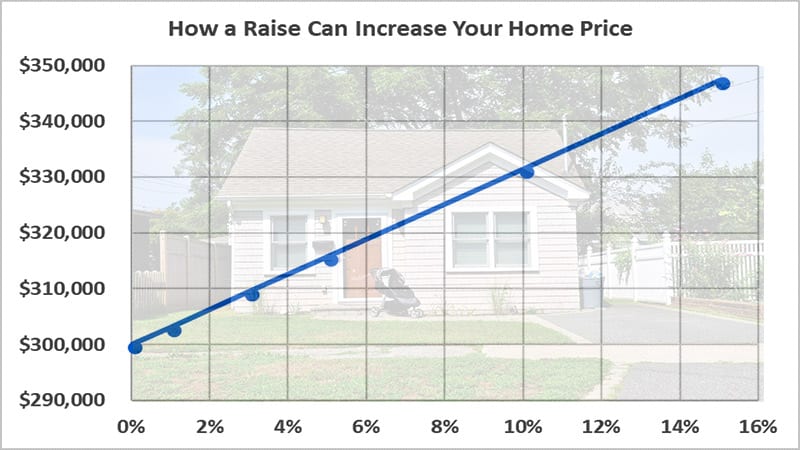

In general, mortgage lenders don’t want to see more than a third of your gross income going to housing costs. The chart below shows how a pay raise could increase your loan amount (and purchase price), assuming that you currently qualify for a $300,000 loan.

Facts about pay raises

A 2017 Paysa survey of managers reveals that the best reasons to ask for a raise include:

- Your work is excellent (chosen by 35.4 percent of respondents)

- You have taken on more difficult tasks at work (24.8 percent)

- You are underpaid compared to others in the same field (17 percent)

- Your work is good (9.2 percent)

- You are personally experiencing financial hardship (4.4 percent)

The same Paysa poll found that, among managers able to grant raises, the following is too much to ask for a raise:

- Over 1 percent of current salary (chosen by 16.3 percent of respondents)

- more than 5 percent of current salary (38.8 percent)

- Over 10 percent of current salary (15.9 percent)

- No amount is too much – ask for what you think you deserve (28.9 percent)

New research suggests that annual pay raises should be around 3 percent of base salaries in 2018.

Why asking for a raise is worth it

How to ask for a raise when you’re (understandably) nervous? The biggest hurdle to overcome is fear of speaking up. Preparing carefully before popping the question can help your chances. Provide evidence to your boss that you’re worth more and demonstrate your confidence.

Mary Pharris, director of business development and partnerships with Fairygodboss, says it’s important to ask for a raise when the time is right.

“If you are performing your job, you are inherently generating value for your company. Employees should be recognized for this. And compensation should always be part of that recognition,” she says.

If you don’t ask, you don’t get

Human resources consultant Laura MacLeod, professor at City University of New York, agrees.

“If you don’t ask for a raise, you’ll likely never get one,” says MacLeod. “Nobody is going to offer extra money without being alerted to the fact that you’ve done great work and deserve a raise.”

The reasons many don’t ask for a raise are simple: fear and anxiety.

“Workers often fear rejection. They may have a boss who is authoritarian or not welcoming. Or they may worry that they’ll appear too proud or boastful by asking,” MacLeod notes.

Yet even a minor pay bump can help if you’re trying to buy a home.

“More money, no matter how much, can aid you,” adds MacLeod. “It allows you to save more. And it can be used in documentation to help you attain better mortgage rates or other credit benefits.”

Before popping the question

Prior to meeting with your employer, do your homework. Start by putting yourself in your boss’s shoes.

“They’ll want to know what you’re doing to save the company money, increase sales or make it more efficient,” says Dave Arnold, president of Arnold Partners LLC.

Count on conducting research.

“This means documenting what you’ve done for the company. Indicate how it’s benefited the culture or bottom line,” suggests McLeod.

“Check out HR policies on raises at your company as well. Talk with trusted colleagues who can shed light on how and when raises have been handed out.”

Rehearse what you plan to say to your boss, too.

“Create a script for yourself and practice. Having talking points about why you deserve a raise will help you think through your business case. It will also help get rid of any nervousness,” Pharris says.

When you’re ready, make an appointment to speak with your employer.

How to ask for a raise

When it’s time to meet with your boss, try these tips:

- Take slow deep breaths and relax. You don’t want to appear nervous or sweaty

- Be clear, concise and direct in your language

- Demonstrate your value. “Say and show what you’ve done to increase revenue, cut costs or improve processes for your company,” says Arnold

- Highlight what you want to do as well as what you’ve done. “Share your strategy for how you’ll get to the next step,” says Pharris

- Avoid ultimatums. “Don’t threaten to quit if they say no,” Arnold cautions. Also, “don’t compare yourself to other employees,” notes Pharris

- If they say no, learn why. “Ask what you need to do to earn a raise. Get it in writing, if possible,” Arnold says. “Frame your request as, ‘I’d like to know how to improve my work and understand your expectations so I can continue to benefit the company.’ Always gear your pitch toward the company,” says McLeod

- Ask when it would be appropriate to revisit this issue in the future

What happens next

If your boss agrees to raise your wages, plan to put that extra money to work for you.

“Try to bank 100 percent of that raise in a special account to help you achieve your goal of buying a home,” recommends Arnold.

If you get turned down, don’t get discouraged. Strive to work harder and produce better results that can impress your employer. Continue gathering evidence of your worth. This can help you build a stronger case for a raise the next time you ask for one.

Time to make a move? Let us find the right mortgage for you