Types of homes

Different types of homes qualify for different mortgage loans and rates. The main types of homes you can buy are:

- single family residence

- manufactured home

- condominium

- cooperative (co-op)

- townhouse

- multi-unit (2-to-4 unit) properties

So how does this work in practice? Your loan availability and what you pay for it depends in part on the type of home you purchase.

Verify your new rateOwnership options

The issue here is that the actions of non-owners impact the value of your property. For example, your condo association might decide to mow common areas less often, thereby making the entire property less valuable, including your unit.

How your property type affects your mortgage approval

Lenders may or may not offer condo financing. Fannie Mae, Freddie Mac, the FHA and VA all have lists of approved communities they will finance, and it’s much harder to buy a unit that is not in an approved complex.

Fee-simple real estate

If you own fee-simple real estate, you own property with the largest bundle of rights. You own the house itself – usually a single-family home – and the land under it.

For lenders, this is an ideal situation. FHA, VA, Fannie Mae and Freddie Mac all buy loans for fee simple properties. You can also get jumbo financing and non-prime loans with fee simple real estate.

Fee simple ownership provides you the most control over the care and maintenance of your property and allows you to more easily protect your (and your lender’s) investment.

Leaseholds

If a property is not “freehold,” meaning that you own the home and the land it’s built on, it’s “leasehold” property. With a leasehold property, you only have ownership rights to that property for a certain amount of time.

Leases can be very long – 900 years plus – but most are around 90 – 120 years. Most banks and other lending institutions have policies for approving loans on leasehold property, for example, that there be at least 10 years remaining on the fixed rental portion of the lease.

Rental house or apartment: how to choose

Alternatively, the lender might require that the term of the lender’s loan be no longer than the remaining number of years on the lease. Finally, the VA will not guarantee a mortgage beyond the actual time remaining on the fixed rent period of the lease, and the FHA insures mortgages only up to five years beyond the fixed rent period of the lease.

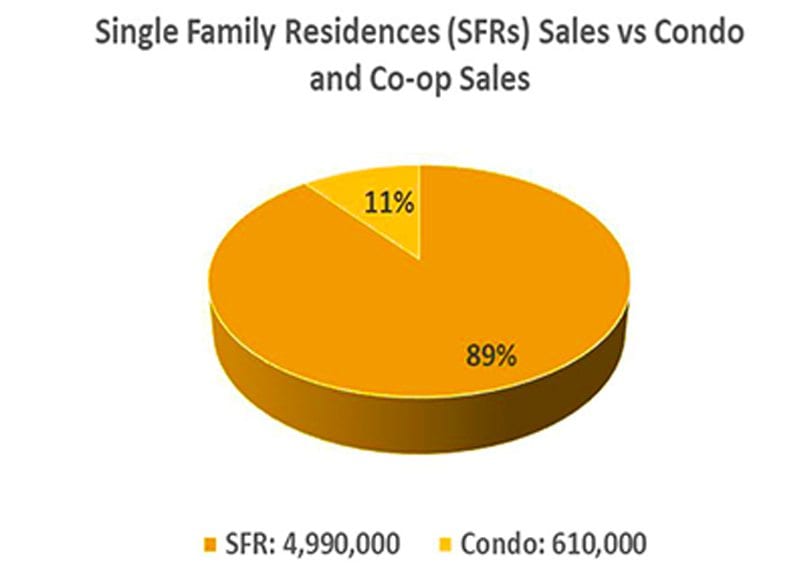

Condos, co-ops and townhomes

These communities are sort of hybrids of fee simple and leasehold ownership. They each have distinguishing features and will be defined more clearly below.

Types of homes and their financing

Some kinds of homes have mortgage default rates than others. Statistically, the more walls you share with neighbors, the more likely you are to default on your home loan. Manufactured housing also tends to come with higher default rates, according to Jack Guttentag, aka The Mortgage Professor.

Planned unit development (PUD)

Around the country, you can often find large parcels of land which are planned unit developments or PUDs. PUDs can consist of single family homes or multi-unit buildings. They can be governed in several ways but are most commonly governed as condominiums.

Condominiums

Within a condominium, you own your unit — starting at the interior walls, floors and ceilings, and a homeowner’s association (HOA) owns the land and common areas. If you buy a home within a planned unit development or condo complex, you’ll have to pay homeowner’s association (HOA) dues.

Condominiums and PUDs often have amenities like private tennis courts and parks, security gates and more. The extent of the amenities greatly affects the cost of your monthly HOA dues, however.

Condos are popular in resort areas where owners want the place maintained while they are away. They also function as starter homes in locations with high-priced housing, and low-maintenance retirement residences for people who don’t want to deal with yard work and repairs.

Multi-unit properties

In general, lenders are happy to finance fee simple multi-unit properties, properties with two to four units. They can typically be financed through the VA, FHA, and with conforming mortgages (Fannie Mae and Freddie Mac).

This means that you can buy what is effectively an investment property under the condition that you occupy one unit. For example, FHA mortgages are generally off limits to pure investors. However, if you buy a four-plex and live in one unit, you can qualify for an FHA-backed loan.

Townhouses

Townhouses or townhomes are nearly indistinguishable from condominiums. The difference is mainly how much of the individual unit you own. In a townhouse, you own your entire unit, inside and out, roof to basement. In addition, you own the land upon which it sits.

That differs from the condominium project, in which you own the inside of the unit, but not the exterior, and not the land upon which it sits.

Coops

Co-ops, or cooperatives, are more common in the eastern part of the US. When you buy into a cooperative, you don’t actually buy the unit in which you live, nor do you purchase any land or common areas. What you do purchase is a share or multiple shares in a corporation. The corporation then owns the entire property.

You can’t just buy into any co-op you want. A board must approve you as a tenant, because the kind of neighbor you are can directly affect the property value of everyone else. The board may be a lot pickier about your finances than a mortgage lender would be. For instance, a co-op board may require you to put up as much as 50 percent down.

There is a co-op fee for co-op owners, but it not the same as the fees paid to condo or homeowners associations. The reason is that part of the co-op fee can include a payment toward the underlying mortgage owed by the co-op association. This underlying mortgage is a first-lien against the property, including all units.

Financing a co-op with a lender

Financing a co-op can be a challenge, but many lenders do finance them using similar guidelines to their condo loans. Fannie Mae says in its Selling Guide that it “purchases or securitizes co-op share loans for units in co-op projects from lenders specially approved to sell such loans to Fannie Mae.”

However, Fannie Mae does acknowledge that finding financing can be tricky because of the burden on the lender. “The lack of available co-op project data and the inconsistent reporting of co-op project information can be a barrier to obtaining affordable financing for co-op housing,” says the Selling Guide.

“Lenders are responsible for determining the most appropriate method for obtaining information about co-op projects and the accuracy of the information they obtain.”

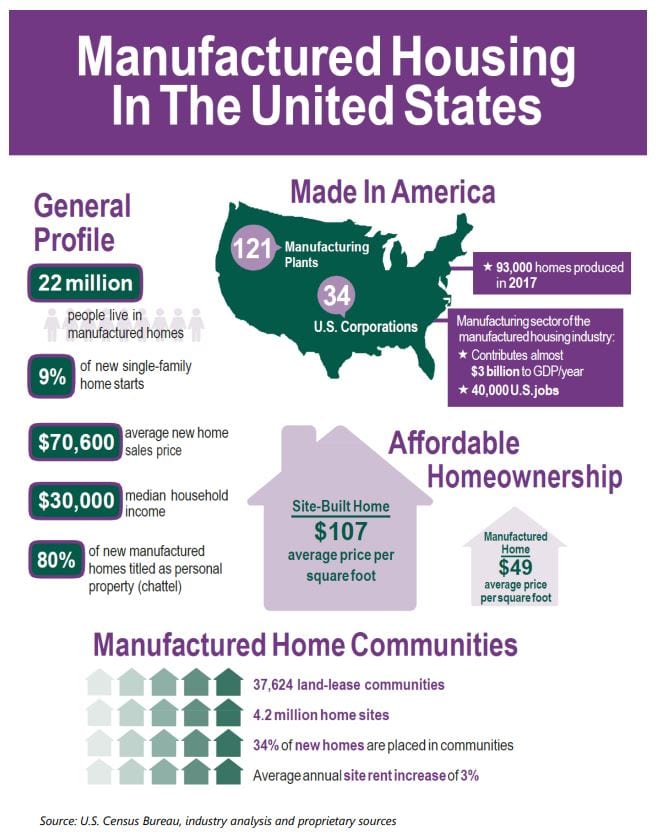

Manufactured housing

Manufactured housing, or mobile homes, can be fee-simple, leasehold, in PUDs or condo communities. The main criterion for mortgages for these properties is that it be on a permanent foundation and taxed as real estate. Sometimes the land and home are two separate purchases, and other times you buy the land and home together.

FHA, Fannie Mae, Freddie Mac, the VA and USDA all back manufactured homes. However, the terms for manufactured home loans are not always as favorable as those of other types of housing. The FHA sets the following limits:

Maximum Loan Amount

- Manufactured home only - $69,678

- Lot for manufactured home - $23,226

- Manufactured home & lot - $92,904

Maximum Loan Term

- 20 years for a loan on a manufactured home or on a single-section manufactured home and lot

- 15 years for a manufactured home lot loan

- 25 years for a loan on a multi-section manufactured home and lot

What are today’s mortgage rates?

Current mortgage rates depend in part on the type of home you finance. For instance, many lenders add risk-based surcharges for high-rise condominiums or manufactured homes.

The type of property you choose will also affect the programs available to you, and how much you’ll have to put down. It’s important when comparing mortgage quotes to tell every lender what sort of property you plan to buy, as that can change the price of the loan.

Time to make a move? Let us find the right mortgage for you