Is it worth it to pay points?

Whenever mortgage rates go up, borrowers always wonder if it makes sense pay points and thus reduces the rate. The answer is sometimes yes, sometimes no. Here’s how to tell the difference.

Verify your new rateWhat is a point?

A “point” or “loan discount fee” is equal to 1 percent of the mortgage amount. If you buy a house for $200,000 with 10 percent down ($20,000) the mortgage amount will be $180,000. As a result, one percent of $180,000 – one point – is $1,800.

A point is paid at closing. The general idea is that if you pay a point at closing, the interest rate will be reduced. How much is a matter of negotiation with the lender?

If you have a 30-year, $180,000 mortgage at 4.25 percent, the monthly cost for principal and interest is $885.49.

But suppose that your lender offers you an alternative: In exchange for paying one point upfront, the lender will reduce the interest rate to 3.875 percent.

5 ways to shave .25 percent from your mortgage rate

You now have a $180,000 mortgage at 3.875 percent. The monthly cost for principal and interest is $846.43. You save $39.06 per month ($885.49 less $846.43). Divide $1,800 – the cost of a point in this example – by $39.06 and in basic terms, you will have to own the property for 46 months to recover your money.

Paying one point decreases your stated interest rate, the rate used to calculate your payment. But you also want to consider your annual percentage rate or APR. APR incorporates the cost of the points as well as your interest paid.

APR considers the fact that you borrowed $180,000, but since you paid $1,800 in discount points, you actually got $178,200. When you apply the $846.43 payment to an actual loan amount of $178,200, your APR is 3.9579 percent — considerably lower than 4.25 percent.

Is this a good deal? Here are some questions to consider.

Pay points and cash

In our example, the borrower paid $1,800 upfront. For marginal borrowers with little in savings $1,800 on top of the other closing costs may be an impossible burden. As a result, points may be out of the picture. Alternatively, for strong savers, paying points can be worth a look.

How to buy a home: 3 concessions that are better than a price cut

If you’re buying a home, you may be better off negotiating seller-paid points instead of a lower purchase price. So for a home listed at $200,000, instead of offering $196,000 (98 percent of the purchase price), it might be better to pay $200,000 and get seller-paid discount points costing 2 percent of the loan amount. Here’s what it looks like with a price reduction:

- Price: $196,000

- Loan amount: $176,400

- Points: 0

- Rate: 4.50 percent

- Payment: $894

And here’s what it looks like with a .375 percent rate reduction costing two points:

- Price: $200,000

- Loan amount: $180,000

- Points: 2

- Rate: 4.125 percent

- Payment: $872

Your lender can help you run the numbers as part of your loan preapproval process. That way, you know how to structure your offers.

How lenders set mortgage rates

While you might hear a mortgage quote of say “4.25 percent plus one point.” Probably though, most lenders are likely to have a range of choices if you ask. You might also see:

- 4.00 percent plus 2 points

- 4.25 percent plus 1 point

- 4.50 percent plus 0 points

- 4.25 percent minus 1 point

- 4.50 percent minus 2 points

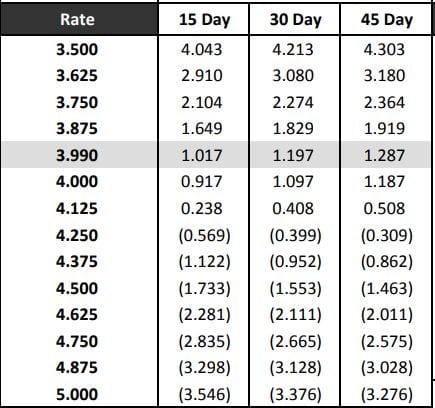

The image below is a screenshot of one lender’s wholesale mortgage rate sheet. Note that this is wholesale pricing; a retail customer would have to pay about one point more. That means the price with a rebate of at least one percent would be the “zero point” option — in this case, that’s about 4.375 for a 30-day lock.

When you see a quote with zero points that’s called the “par” price. If the quote is for a given interest rate PLUS points, it means the rate has been reduced, aka “discounted.” If you see a quote with MINUS points it means you agree to pay a higher interest rate and, in exchange, the lender will contribute cash to reduce your out-of-pocket closing costs.

4 ways to get a better mortgage rate quote

In other words, borrowers can engineer a mortgage rate to fit their circumstances. Have a good income but little in savings? Offer to pay a higher rate in exchange for the lender’s help with closing costs. Have big savings but worry about future wages? Pay points and get a smaller monthly cost for principal and interest.

Pay points versus time

Rather than think of interest rates over 30 years — the usual term for a mortgage — it might be best to consider a shorter period. In practice, tenure in homes you buy tends to be much shorter.

The typical home is sold after 10 years, according to the National Association of Realtors while Freddie Mac calculates that on loans were refinanced after just 6.1 years as of the third quarter.

Mortgage rates vs. APR: how to get your best mortgage deal

Paying off mortgages early either because a property is sold or refinanced reduces the value of points. If we have a $180,000 mortgage at 3.875 percent and pay one point, the annual percentage rate (APR) is 3.9578 percent over 30 years. The APR rises to 4.0890 percent if the same loan is paid off over 10 years.

For borrowers, the best way to see if points are worthwhile in your situation is to speak with loan officers and first ask for par pricing, the interest rate without points. Next, look at various combinations of rates and points. Lastly, consider how long you expect to hold the property and how much cash you have available.

Time to make a move? Let us find the right mortgage for you