Mortgages for multi-generational families

What are the best mortgages for multi-generational families? Time was, that question would have troubled very few. But, by 2017, things were different. Very nearly one-in-three American adults were living in a household with other adults to whom they had no romantic attachment. That’s 78.6 million people.

Verify your new rateDoubling up

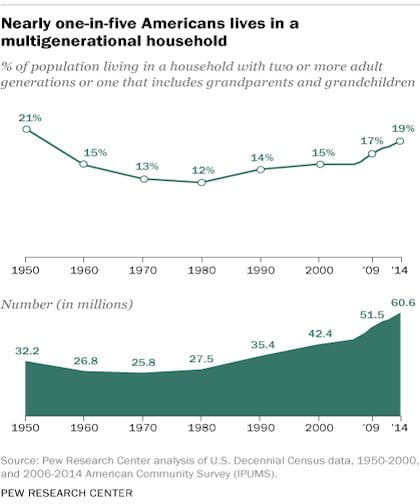

Of course, some will be “doubling up” in such shared-living arrangements with friends roughly their own ages. But the trend for living with other members of your extended family is undeniable and growing. That’s according to a 2017 study by the Pew Research Center.

As you’d expect, a lot of those are the grown-up children of the heads of the household. Even excluding students under 24 years, there were 40 million of those.

The recent big increase in multi-generational family homes involves the parents of the homeowners moving in. By 2017, such parents made up 14 percent of all those who live in a home that isn’t theirs. That’s up from 7 percent in 1995. And it’s more than all the self-described housemates, roommates, roomers, boarders and lodgers put together.

Mortgages for multi-generational families

When adult children move back to their parents’ home, they often can make only a small contribution to the household budget. However, things can be very different when it’s a homeowner’s parents moving in.

Frequently, grandpop and grandma’s motivation is not financial. They may have health issues, want to downsize or need emotional support following the death of a spouse. And they sometimes arrive with stellar credit scores and piles of cash and other liquid assets.

Some advantages

In those circumstances, it may make sense all-around for them to be added to the title and mortgage of the existing home. Perhaps their added financial weight will enable a refinancing.

One of those could provide home improvements or additions that make everyone in the household more comfortable. Or maybe their contribution will trigger a search for a different property: one that gives everyone space and the amenities they need.

As attractively, larger households enjoy economies of scale. You get to share all those pesky running costs with more people instead of shouldering them yourself. So property taxes, home insurance, homeowners’ association fees, utility bills, maintenance and repairs ... you name it ... become less of an individual burden.

Meanwhile, depending on the fitness of the older residents, you may be able to share out chores.

Some drawbacks

No matter how old their children are, parents tend never to lose their instinct to protect them. But something that’s warm and comforting at age four and 14 can be exceptionally irritating at 44 and 54.

Some people find that separating living spaces helps avoid this. Where possible, this might see the parents in a comfortable guest cottage, a beautifully finished basement or an annex addition, each with its own separate entrance.

In the right circumstances, a two-unit multifamily building might work. If that’s not possible, a frank discussion about boundaries before committing to sharing a home might help.

Socializing

There are other areas of potential conflict. When this writer’s newly widowed mother moved in with his sister Jacky, mom relocated by hundreds of miles. That meant she left behind her friends and wider family.

To start with, Jacky happily included mom in many of her social engagements. But it soon got to the point where mom expected to come along every time, which caused friction.

Money

At least as damaging as conflicts over physical and emotional space can be money. Even small things can rankle. For instance, issues may arise if you share utility bills. You could find yourself in a constant battle over light switches and thermostat settings with someone who is more or less cost-conscious than you.

At the same time, you can feel that your personal finances are being monitored. It’s one thing to phone the bank of mom and dad for an occasional bailout when it’s far away. It’s different when you’re already aware of raised eyebrows over your spending habits.

And, of course, this isn’t a one-way street: Parents are equally capable of irresponsible spending.

Bad mortgage choices for multi-generational families

Usually, such issues recede over time. Everyone pushes boundaries, draws them, redraws them and finds an accommodation. But it’s important you’re confident you can eventually establish a way of living together peacefully.

It’s easy to get into one of these mortgages, but much harder to get out of it. And that applies whether you’re adding another borrower to an existing mortgage, or refinancing, or starting from scratch with a new loan on a different home.

In for the long haul

All this means big problems if someone changes her mind and wants to withdraw from the arrangement. Unless the other borrowers can take up the financial slack caused by that withdrawal, it’s likely the home will have to be sold, the mortgage paid off and the remaining participants left to look for somewhere affordable to buy.

The same problem may arise if one of the borrowers dies before the loan is repaid. It may be fine if others named on the mortgage are also the main beneficiaries of the estate. Suppose his share in the home is the deceased’s biggest asset and other children are entitled to a share in it. This could possibly force the sale of the property.

One home, one mortgage

You almost certainly won’t be allowed more than one mortgage on the home, at least when you set up the loan. (A second mortgage in the form of home equity borrowing may be possible later.) Expect one mortgage with multiple borrowers.

Often the older parent(s) can help get a better mortgage rate, but only if they bring worthwhile assets to the party. Those may be enough to bring the down payment below the magic 20-percent level that removes the need to pay one-time and monthly mortgage insurance premiums. Bigger down payments typically bring lower mortgage rates.

However, any borrower with a poor credit score or a lot of debt can cause problems because lenders typically set rates based on the financially least attractive to multiple borrowers. So, if you’re the one seriously holding back the others, you might want to consider taking one for the team by letting them leave your name off the application.

Choosing a loan

As with any mortgage, your first task is to identify the type of loan that will suit you best. If you want to borrow a lot or don’t wish to pay for mortgage insurance, you’ll likely need a minimum 20 percent down payment.

A big range

Those who can’t scrape together that much still have access to a wide range of alternatives. For example, Fannie Mae designed its “extended income households” (EIH) products, especially for multi-generational families.

You might also be eligible for mortgages backed by the Federal Housing Administration (FHA loans), the Veterans Administration (VA loans) or the United States Department of Agriculture (USDA loans). FHA loans are particularly good if you want to buy a multi-unit home and rent out unoccupied units — you can get in with 3.5 percent down.

Comparing home loans: Which one is best for me?

Caveat about multi-generational VA loans

Those last two may be available without any down payment at all. However, there is one caveat for VA loans: all the borrowers must be eligible to get in with zero down. And that means they must either be service members or veterans or the qualifying spouses/widows/widowers of servicemembers or veterans.

VA Mortgages: The VA Loan Eligibility Reference Guide

You can do a VA loan with a non-eligible co-borrower. It’s called a “joint” VA loan, and you need to come in with a down payment for the non-eligible borrower — with 2 joint borrowers, the non-eligible borrower will generally need to come in with 25 percent of the loan amount. Which may defeat the whole purpose of getting a VA home loan.

Your starting point

You will borrow from a private-sector lender regardless of the type of mortgage you choose — even if you get one backed by the government.

And it means you can access a variety of deals. Scarily, picking the worst over the best could easily lose you tens of thousands of dollars over the lifetime of your loan.

So treat your search for a multi-generational mortgage as you would any other:

- Get plenty of competitive quotes

- Pin down the terms of the best deals

- Compare them with other contenders

It’s easy to get multiple mortgage quotes from competing lenders. The pick two of the most competitive lenders and see which one you trust most to get the job done.

Time to make a move? Let us find the right mortgage for you