Student loans: a reality check

It can be hard to think about buying a home when you’re still paying off student loans. The idea of taking on more debt can be daunting, especially if you are far from the student debt payoff finish line.

Verify your new rateResearch: student loans exceed annual income

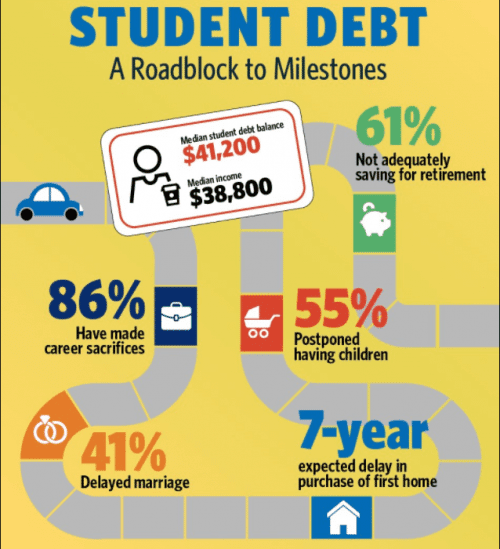

Data show that most millennials are saddled with major student loan debt, which has possibly hurt their chances of owning a home. Those surveyed say it may take years before they are ready to buy.

Image courtesy of the National Association of Realtors

A new study by the National Association of Realtors (NAR) and American Student Assistance had some interesting results. After polling millennials, they found that:

- Typically, they carry a student debt load ($41,200) that exceeds their annual income ($38,800)

- Only 20 percent currently own a home

- Among the eight in 10 who do not own a home, 83 percent feel their student loan debt has impacted their ability to purchase

- Eighty-four percent expect they will have to postpone purchasing for at least three years seven years is the median amount of time they expect have to wait before buying

- Nearly 80 percent borrowed funds their education at a four-year college

- Thirty-two percent had previously either been in default or forbearance on their loans

Student debt hits new highs

Jessica Lautz, NAR’s managing director of survey research and communications, says the report found that millennials actually have worse problems with student debt than earlier generations.

“Eighty-three percent are saying their student loan debt is delaying them from purchasing. It means they are unable to save for a down payment,” she says. “They also are not feeling financially secure enough because they’re paying so much for their student loans.”

Buying a home with student loans gets easier in 2017

Lautz cites an alarming stat: per Experian, college loan balances for Americans have risen more than $833 billion over the last 10 years, climbing to an all-time high of $1.4 trillion.

Robert Johnson, president/CEO of The American College of Financial Services, says it’s harder for these millennials to qualify for home financing, too.

“Mortgage lending standards have gotten much more stringent since the financial crisis. With high levels of student debt, millennials simply can’t meet the new higher standards for mortgage debt,” says Johnson.

DTI matters

Another thing that makes it tough to get approved for a mortgage is a high debt-to-income (DTI) ratio, which many millennials suffer from, says Lautz. This metric is more important to lenders than the total amount you owe on student loans.

6 ways to buy a home without paying off your student loans

“DTI is a borrower’s total amount of recurring monthly debt payments, including credit cards, student loans, auto loans and mortgages, versus their gross monthly income,” says J. Keith Baker, program coordinator of Mortgage Banking and faculty at North Lake College.

Lenders, which prefer a DTI lower than 43 percent, calculate this number using a special formula.

First, they add up your total monthly debt obligations; this includes all loans and credit card payments, along with expected housing debt (mortgage principal and interest payments, property taxes, homeowners insurance and, if required, mortgage insurance). Next, they divide your monthly debt amount by your monthly gross income.

What you can do

Wait too long and you could miss out on continued low mortgage interest rates. With the right strategies, you can get a better handle on your debt and get closer to your dream of buying and owning a home of your own.Try these tips:

- Pay down as much debt as you can. That means whittling down your outstanding balances on student loans, credit cards and auto loans.

- Be punctual with payments. The higher your credit score, the more you can stretch income guidelines when you apply for a mortgage.

- Work to decrease your interest rate. Consider refinancing, extending or consolidating student loans to reduce the monthly payment.

- Save as much as you can for the down payment. Many lenders require a minimum 20 percent down payment. If you can save even more, you can borrow less. That can lower your DTI.

No and low down payment loans in 2017

- Move back home for a while. “Among first-time home buyers, we found that the highest share move directly from a family member’s home into their own home,” says Lautz. “By living with mom and dad or a relative, you can pay down your debt faster and save quicker for a larger down payment.”

- Check out a HomeReady mortgage. You only need 3 percent down, mortgage insurance is discounted and guidelines are more forgiving.

- ARM yourself. Most first-timers only keep their home a few years. You can get a much lower rate and payment by choosing a loan with a rate fixed for three, five or seven years.

- Convince a partner to pitch in. “Get a co-borrower in on the deal,” says Lautz. She notes that a second borrower can decrease your DTI by bringing extra income to the application.

- Seek out a smaller home. “One of the biggest problems with first-time buyers is purchasing more home that they can really afford or need,” Johnson says. “Remember – the larger and more expensive the home, the bigger the mortgage payments, tax assessments, utilities, upkeep and repairs.”

This just in

As of this writing, Lennar Homes is kicking off a new program with its lender subsidiary, Eagle Mortgage. Buyers of new Lennar homes can choose this mortgage that pays off up to $13,000 in student loans.

New program pays off student loans when you buy a home

You don’t have to feel powerless about the fact that you have student debt. Explore your options and take steps now to fast track your dreams of owning a home.

What are today’s mortgage rates?

Current mortgage rates are still very affordable — one reason it may be smart to buy sooner rather than later, if you can. To get the best loan and rate, shop aggressively, comparing quotes from at least four lenders.

Time to make a move? Let us find the right mortgage for you