Is there old debt lurking in your financial closet?

Before you apply for a home loan, it’s a good idea to get a copy of your credit reports. Suppose your report includes some old debt from years ago. And suppose that’s timed out as a result of your state’s statute of limitations on debts.

Don't "reactivate" an old collection when you apply for a mortgage

What you do next could have a huge impact on your ability to get your mortgage application approved. And it could affect your financial well-being for years to come. So read on to make sure you know how to protect your interests.

Verify your new rateHow to get a copy of your credit reports

Under federal law, you are entitled to a free copy of each of your credit reports annually. You can get more updates whenever you want. But you’ll likely have to pay for those.

Don’t worry: You can access your own credit reports as often as you like without affecting your credit score.

There’s only one trustworthy website

The three big credit bureaus, Equifax, Experian and TransUnion, have set up a website to allow you to get your free reports (one from each) at AnnualCreditReport.com.

Use only that site. There are plenty of credit report scammers out there. The Federal Trade Commission calls them “imposter sites.”

Statutes of limitations

Each state has a statute of limitations on debts in its jurisdiction. A debt that remains unpaid after the period specified in your state’s law times out. In other words, it is no longer enforceable.

However, things can be slightly more complicated than that. So be sure to finish this article so you get the full picture.

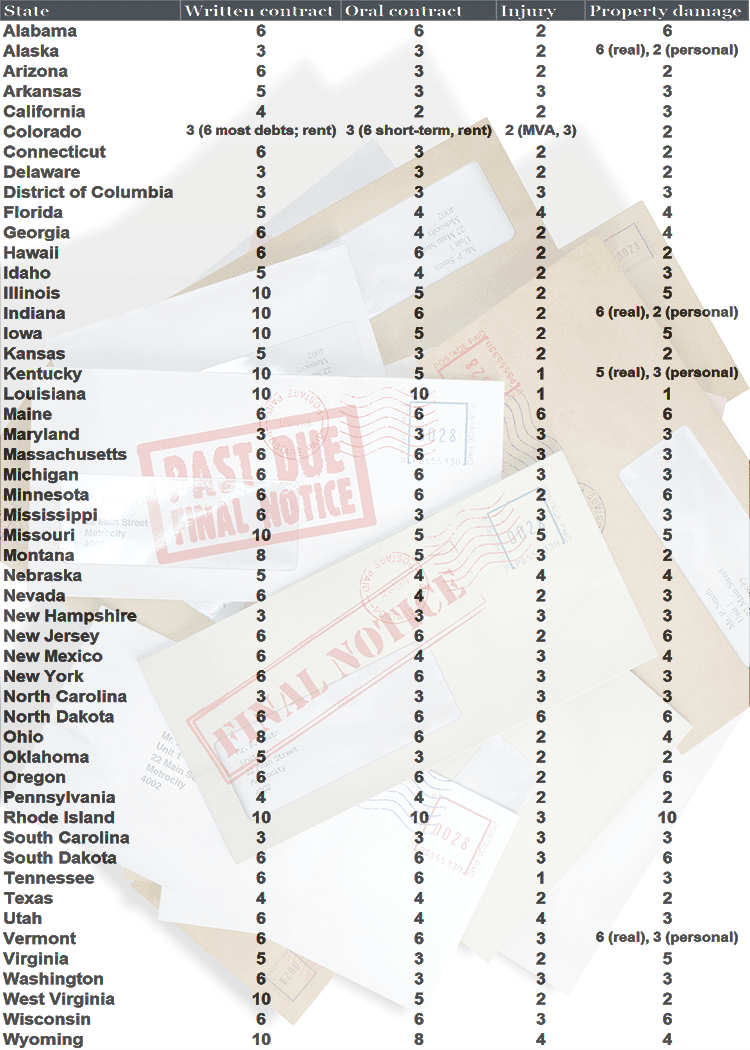

Statutes of limitations by state

The time allowed creditors to collect varies wildly from state to state. Most debts time out after three years in, for example, Alaska. But they are collectable for a decade in, say, Kentucky — and 15 years if you signed your agreement in that state before July 15, 2014.

Here is a run-down of the statutes of limitations in each state, courtesy of legal site nolo.com.

Debt scavengers

Some companies buy up (become the legal owners of) old debts that others have been unable to collect. Often, the statute of limitations has run its course on those accounts.

Too much debt to buy or refinance? Here's your plan

These companies pay a tiny fraction of the face value of the loans — maybe less than one percent. But they know they’re going to have a tough time making money from such hard-to-collect accounts.

Hardball

So they play hardball. They sneer at ethical business practices. Sometimes they act unlawfully.

And one of their favorite techniques is to “park” or “re-age” old debts on consumers’ credit reports, pretending they’re new accounts. This happens often enough for those terms to be industry jargon for the practice.

$10,000 medical collection: Can I qualify for a mortgage?

Now, that may be illegal, especially if the creditor doesn’t give you written notice it’s doing so. So why do they do it? To provoke you into getting in touch. To tempt you to settle for the sake of an easy life. And to lure you into doing the one thing you shouldn’t...

The really, really important bit

Once they get you on the phone or in correspondence, their goal will be to get you to waive your rights under the statute of limitations, or to extend or revive the debt owner’s rights under that law. And it’s possible for you to do that in just a few casual words in a phone call.

Getting a mortgage after identity theft

Say or write those words, and you could reset the clock on the statute of limitations. And that could mean the collector has years to enforce your once-dead zombie debt. Here’s what you must NOT do:

- Acknowledge that you owe the debt. The statute of limitations does not erase the debt. It simply makes it unenforceable by the courts. If you use the statute as a reason for not paying, that could amount to your waiving your rights under the law.

- Make (or just promise to make) even the smallest payment on it. If the collection agency says it will back off in exchange for a token goodwill payment, it very likely won’t!

The easiest way to avoid acknowledging the debt is to not engage with the “debt scavenger” (NOLO’s term). Only get the company’s name and address. Then hang up.

Next steps

Now the fight back begins, all of which should happen by certified mail (keep copies of everything):

- Research the company online. If it claims to be a law firm, is it really? Know with whom you’re dealing.

- Write to the company within 35 days of initial contact, requesting verification of the debt. By law, it must provide proof that you owe the money, proof of the sum claimed and proof that it is entitled to collect.

- If the company is harassing you, write to tell it to cease all communications. It must comply under the Fair Debt Collection Practices Act (FDCPA), though it can still inform you by mail if it ceases collection efforts or plans to sue you.

- If the debt owner has parked or re-aged a debt on your credit report, dispute it directly with that company. Remember, you must not acknowledge in any way that you owe the money.

- If the company won’t remove the credit report entry, write to each of the big-three credit bureaus (Equifax, Experian and TransUnion), disputing the entry. Include copies of all correspondence and any other supporting evidence.

- As a last resort, find a specialist debt lawyer to take your case. You may have grounds for damages under both the Fair Credit Reporting Act and the FDCPA. And some lawyers may take such cases on contingency (no win, no fee).

If you’re sued

A cheeky debt scavenger could still try to sue you, even for a debt that’s timed out under a statute of limitations. You MUST mount a defense. Unless you do, a judge is pretty much bound to find against you.

A really cheeky debt scavenger might even mock up legit-looking court papers to frighten you. Call the courthouse to verify that those papers are real.

Turned down for a mortgage? Here's your next step

But don’t use the number on the documents. Find the real number online or through a directory. The one on the papers might be a line into the collection agency that will be answered as if it were a courthouse.

If you feel guilty

Maybe you feel guilty about skipping out on the old debt. And you now have enough money to settle it. By all means, do so. But take care.

Still don’t acknowledge the debt, but offer to make an ex gratia payment just to make the whole business go away. However, say you won’t pay a cent until you receive a written undertaking from the creditor that it will remove all relevant entries from your credit report.

If you have no reason to feel guilty

Debt scavengers are not fussy about accuracy or fairness. And the debt on your credit report may well not be yours.

Someone else with a name similar to yours may owe it. Or you may have been a victim of identity theft. Or perhaps it’s one you paid in full years ago. Make sure you actually owe a debt before you cut a check to make it go away.

What do mortgage lenders say?

If there are really old debts on your credit report, do mortgage lenders make you pay them before closing? Not always. For instance, here are Fannie Mae’s guidelines:

- Borrowers do not have to pay off any outstanding collection accounts or charge-offs when purchasing a one-unit primary residence regardless of the outstanding amount.

- Those buying a two- to four-unit owner-occupied property must pay off any outstanding collection accounts and/or charge off accounts if the outstanding balance is $5,000 or more.

- Buyers of investment properties must pay off individual collection accounts and/or charge off accounts of $250 or more and collection accounts if total balance exceeds $1,000.

6 in 10 consumers now believe getting a mortgage is easy

FHA guidelines are less restrictive — HUD does not require that collections be paid off. However, individual lenders can feel differently. If you know collections will be an issue, ask lenders when you get mortgage quotes from them.

What are today’s mortgage rates?

Current mortgage rates are as inviting as ever. Don’t let your old debt, especially old debt that isn’t even yours, keep you from buying a home if you’re ready to do so.

Time to make a move? Let us find the right mortgage for you