How to increase your credit score fast

You can raise your FICO and reduce what you pay for a mortgage, automobiles, and credit cards. And it’s not that hard to do.

Here’s a step-by-step guide to get your credit score up and start paying less for everything you finance.

Verify your new rateHow much can you save?

According to MyFICO.com, improving your score by 100 points can save you thousands per year — if not enough to make you rich, certainly enough to improve your life.

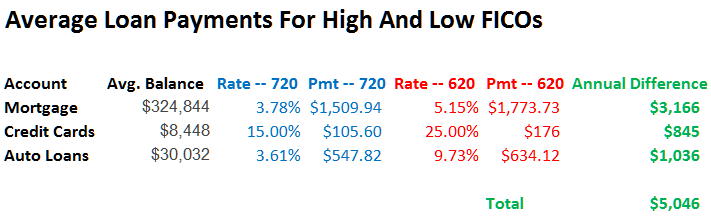

The illustration below shows how much you might save by changing your credit score from 620 to 720 for an average balance on a mortgage, auto loan and credit card balances.

What Credit Score Do You Need For A Mortgage?

The average home purchase mortgage, according to the Mortgage Bankers Association (MBA), was $324,844 in May 2017. MyFICO says that you’d pay 5.15 percent with a 620 credit score, and 3.78 percent with a 720 credit score.

The difference in payment for an average loan amount and a 30-year fixed mortgage is $264 a month. And that’s just the beginning.

You can see that improving your credit score could add some serious money to your wallet.

Step 1: Assessment

Your first task, when raising your FICO, is to see what you’re up against.

You can get a copy of your credit report from all three major bureaus for free at the government’s site, annualcreditreport.com. Pay the small charge to obtain your FICO scores as well.

Your “representative” score is the middle score of the three. So if your scores are 598, 602 and 623, your representative score is 602. Note that there are many variations on the FICO score, and not every lender uses the same one.

What Mortgages Can You Get With A 640 Credit Score?

Once you know where you’re starting, you can set goals. Shoot for the tier above your current one, and ultimately the tier 100 points higher than where you are now.

Here are the tiers MyFICO uses:

- 620 - 639

- 640 - 659

- 660 - 679

- 680 - 699

- 700 - 759

- 760 +

So if you’re currently at 620, you’ll see some savings when you get to the next highest tier, which is 640.

What’s causing your low scores?

Your plan of action depends on the reasons for your low FICO score. If the cause is inaccurate information, you can clean up your report yourself by contacting all three credit bureaus, Trans Union, Experian, and Equifax, and the company reporting inaccurately, providing proof that you paid on time.

Use A Rapid Rescore To Qualify For A Mortgage

This can take weeks to fix. If you have a mortgage in process, your lender can bring in a rapid re-scoring company to expedite the process at a reasonable cost.

There is no guarantee that correcting information will raise your score by any specific amount.

Reason codes: your plan for action

If your report is accurate, your scores have “reason codes” you can use to determine the biggest factors bringing your score down. The most common, according to Equifax, include:

- Serious delinquency.

- Public record or collection filed.

- Time since delinquency is too recent or unknown.

- Level of delinquency on accounts is too high.

- Amount owed on accounts is too high.

- Ratio of balances to credit limits on revolving accounts is too high.

- Length of time accounts have been established is too short.

- Too many accounts with balances.

What Is A Good Credit Score, And How Can You Make It Even Better?

Note that the most often-used word in those codes is “delinquency.” If your credit history looks like a rap sheet, littered with late payments, charge-offs and judgments, you’ll need to put some time between your mistakes and your next loan application.

You won’t be able to start the process until you bring your accounts current. However, your creditors may be able to help you out.

Re-Aging delinquent accounts

“Re-aging” means bringing an account current and rolling past-due amounts into the balance. Creditors might do this to help consumers who are making an effort to get back on their feet financially.

You might be able to resume making your payments on time, but not make up a missed payment. Without re-aging, your account will always be reported delinquent until you can catch up. This is called a “rolling late.”

FHA Loans: The Mortgage First-Time Home Buyers Love

Contact your creditors about re-aging the account. You have a better chance of success if you make a couple of on-time payments first, or if you have a non-profit credit counselor contact your creditor.

Re-aging can instantly improve your score.

Paying on time: Get help if you need it

Next, implement a system to ensure on-time payment. It takes about six months of on-time repayment to make a meaningful difference in your credit score, so start as soon as possible.

Set your accounts up for autopay from a checking account. Choose payment dates that follow your paydays and make sure money is there to cover your debts.

Free services like Mint can help you set up your budget and alert you when you exceed it.

Buy A Home With Just 3 Percent Down

If you can’t afford your payments, enlist the help of a non-profit credit counseling service. They can possibly lower your monthly payments, bring accounts current, get penalties waived and help you toward debt-free status.

This may be called a debt-management plan, or DMP. A DMP is not a debt settlement plan, which you should probably avoid.

Some experts recommend that you consider bankruptcy if a DMP won’t pay off your unsecured debts within five years.

When you owe too much

The other main category of reason codes concerns the amount of debt you’re carrying. FICO looks at the amount of credit you have with the amount used (utilization ratio), the balances and number of accounts with balances.

Credit bureaus look for spending patterns that are unsustainable. For instance, if every month you spend more than you earn, your payments increase each month, leaving even less disposable income.

Eventually, you have no more available credit and you can’t make your payments.

You Don't Need A 740 Credit Score To Get A Mortgage

Fortunately, fixing this changes your score almost immediately. If you have savings to pay off your accounts, consider using it. It’s a safe bet that the interest you’re getting is a lot less than what your creditors are charging.

If you don’t have savings to cover this, you may be able to improve your score by paying off your credit card balances with a personal loan or home equity loan. Lowering your revolving (credit card) account balances drops the utilization ratio.

Don’t do this unless you are 100 percent confident that you will not use your credit cards until the new loan is repaid.

What are today’s mortgage rates?

Mortgage rates today depend on your desirability as a home buyer. The better your credit score, the more aggressively you can shop for your home loan. If your credit score falls just below the cutoff for a better score, find out how much lower your rate would be with just a few more points.

You may find that it pays to wait another month or so before applying.

Time to make a move? Let us find the right mortgage for you