Home Affordability is Not Cut And Dried

There’s a lot of very nice real estate in every town, but in terms of ownership, some of it may as well be on Mars. The problem is money and the eternal real estate question: how much house can I afford?

There are several ways of looking at affordability, but the most important ones are lender guidelines and your comfort zone.

Verify your new rateFront and Back Ratios

Mortgage lenders look at two numbers — the “front-end” (sometimes called “top”) ratio, and the “back-end” (also called the “bottom”) ratio. The back-end ratio is also called the debt-to-income ratio, or DTI.

How are these ratios calculated? The first number we have to look at is gross monthly income, the money you get before taxes.

You’ll need to consider your projected housing cost (lenders call this your PITI), including your principal, interest, property taxes, homeowners insurance, and things like HOA dues and flood insurance.

Example Of DTI Calculations

Your front-end ratio is your housing costs divided by your gross income.

Suppose you have a gross monthly income of $8,000. Let’s also say that your projected housing costs (PITI) are $2,000 a month. Your front-end ratio is $2,000 / $8,000, or 25 percent.

The back-end ratio includes your PITI plus payments for accounts like auto loans, student debt, and credit cards, divided by your income.

If these monthly costs amount to $1,200, then your back-end ratio is 40 percent. That’s $3,200 / $8,000.

Lenders will say your ratios are 25/40, but are these numbers good enough to get a loan?

Ratios and Mortgage Programs

Different loan programs have different ratio limits. Fannie Mae and Freddie Mac) set theirs at 36/45. FHA puts its maximum at 31/43.

VA financing is different. With the VA, they only consider the back end, and that max is simply 41 percent.

Importantly, these ratios are not set in stone. For instance, Fannie Mae will go “up to 50 percent for certain loan case files with strong compensating factors.”

Compensating factors include such things as strong reserves, homeownership education, and income from a household member who is a non-borrower, perhaps a retired family member who lives with you.

Exceptions

FHA mortgage calculations include a number of DTI exceptions. For instance:

- If you get an energy efficient FHA mortgage, the ratios can go to 33/45. That’s because you will likely spend less on monthly utility costs.

- If you have a credit score above 580 and no debts, the FHA will allow 40/40 ratios.

- You can have 40/50 ratios if your credit score is above 580 and you have several compensating factors in your favor. That includes a history of saving, conservative use of credit, and a housing payment that won’t increase much.

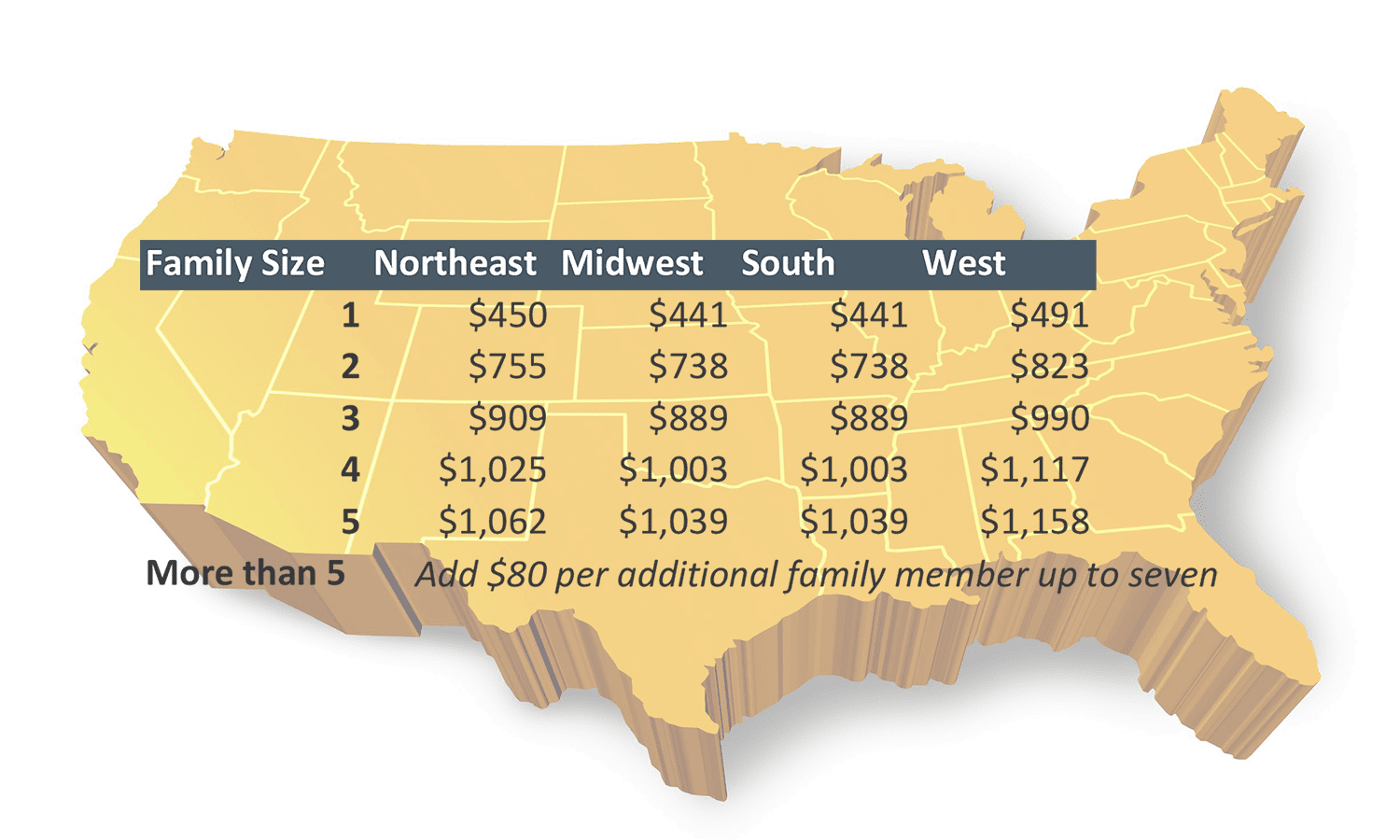

The VA program has a different approach to mortgage underwriting. Applicants whose DTI exceeds 41 percent may still get loans if they have enough cash to live on.

Toward this end, the VA uses a “residual income” requirement, meaning you can be approved if you have enough free dollars to spend after expenses. The required residual income depends on household size and where you live.

One interesting feature with many loan programs is the ability to “gross up” income. Grossing up, means giving you extra credit for income that is not taxable. So a $1,000 a month tax-free Social Security payment might be counted as a $1,250 payment by mortgage underwriters.

Calculating: How Much House Can I Afford?

If you look at the qualification standards above, you can get a good idea of your ability to qualify for financing. Take your income, look at monthly debts, and check your ratios.

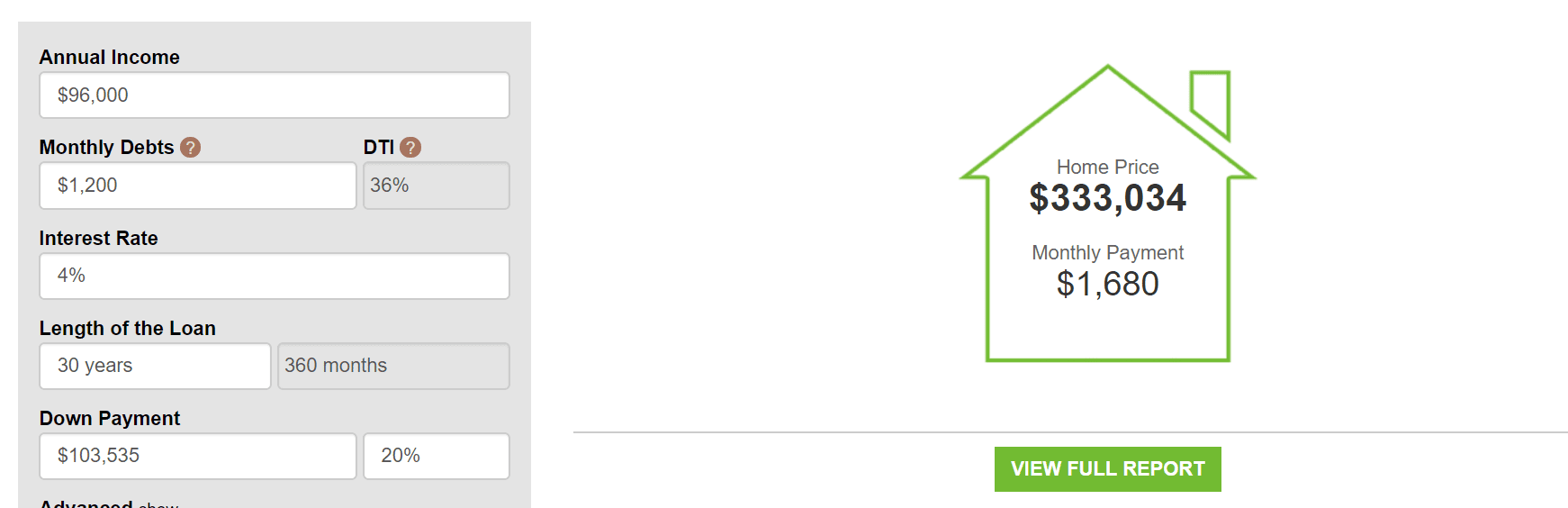

That’s easy to do with The Mortgage Report’s mortgage calculator.

In the example above, the borrowers earn $8,000 per month and have other debts of $1,200. Assuming a 20 percent down payment, a 4.0 percent mortgage rate, and that they want to keep their DTI at a conservative 36 percent, they can spend up to $333,034 on a home.

Don’t Ignore Your Comfort Zone

Looking at the DTI and interest rates can give a good idea of how much house you can afford, but the final decision will depend on lender standards.

Lenders, of course, will want to look at your income and DTI, but they also consider other factors such as the amount down, your credit, and the property’s appraised value.

Even if a lender says you can afford a certain amount, however, you shouldn’t borrow more than you are comfortable repaying. If your current rent is $1,o00, you might feel a little queasy about a $2,000 PITI.

Your lender doesn’t know that you like spending $1,000 a month on flying lessons, wine clubs, or whatever. You have to decide what’s worth giving up if your mortgage payment is much higher than your current housing costs.

What Are Today Mortgage Rates?

If you don’t like playing with numbers, or worry that you may over-estimate what’s affordable, the easy alternative is to speak with lenders and get pre-approved for financing.

This will not only give you a very solid affordability picture; it will also allow you to get a letter from a lender attesting to your ability to qualify for a loan. Pre-approval provides peace of mind and may give you a negotiating advantage when making an offer to buy a home.

Time to make a move? Let us find the right mortgage for you