Pay Off Your Mortgage Early? Wait A Minute

While recent news about interest rate hikes might concern new homebuyers, it should probably not prompt most homeowners to accelerate their mortgage repayment. Even if it’s tempting to pay off your mortgage early while your checking account earns about zero.

Verify your new rateRates Are Up, But So Is Everything Else

The biggest reason that mortgage interest rates have increased so sharply is the post-election rush of economic activity, and the release of market participants from the anxiety over who would win.

Consumers sprang into buying. And when consumer enthusiasm increases, people plan large purchases. Manufacturers increase orders and hire.

More money floods into the economy.

And that triggers concern over inflation. Investors brace for the possibility of future rising interest rates by refusing to buy things like bonds and mortgages unless the yields (rates) are higher.

Eventually, prices and wages settle into new levels. People spend more, but in general, they also earn more.

First: Pay Off Higher Interest Debt

Your mortgage is probably the cheapest debt you have. It may be tax-deductible. And if it’s only a year or two old, your rate is as good as it gets. And here are average rates for other types of debt:

- Credit card rate, national average for all types: 15.71 percent.

- New car loans are still cheap at 4.36 percent for well-qualified buyers.

- Personal loan interest rates average 15 to 16 percent for most borrowers.

That’s what you should target before tackling early mortgage payoff.

Emergency Funds Next

You also need some back-up savings in case you experience an income hitch. Mortgage underwriters call these funds “reserves,” and they like them.

Reserves allow you to continue paying your bills even if your paycheck doesn’t arrive one morning. If you have a free-and-clear house, but nothing in the bank, you’re in a less-secure position. You can’t just tide yourself over with a withdrawal.

How much should you keep in reserves? The amount you’ll target depends on a number of factors unique to you.

Experts (and many mortgage program guidelines) often recommend two-to-three months of liquid funds for salaried workers in average occupations. If you’re self-employed, paid on commission or get bonuses, though, six months is more appropriate.

Retirement Funds

Next, turn your attention to fully funding your retirement savings. This goes double for you if your employer matches employee contributions.

What happens to people with paid-off houses and no money? They can become reverse mortgage borrowers.

A well-funded retirement account provides a measure of security that a tangible asset like a house does not, because it may be tough to sell fast.

Other Investments

If you’re a paragon of debt mastery, you don’t have high-interest accounts. What you do have, though, is opportunity. The opportunity to earn considerably more in investments than you’re paying on your mortgage.

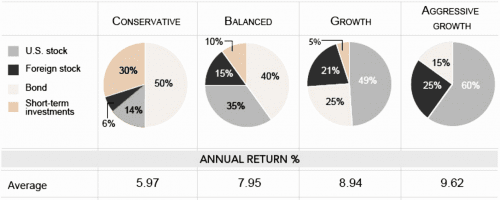

Here are some examples of the performance of average portfolios, courtesy of Morningstar. Even the most conservative portfolios generate average returns that exceeds what you’re paying for your mortgage.

Keep in mind, though, that these returns come with higher risk. As you approach retirement age, you’ll probably transition into more conservative investments with an eye to retaining what you already have.

Who Should Pay Their Mortgages Off Early?

There is a group of people who can benefit from accelerating their mortgage payoff. This cohort includes those who are retiring and want to be mortgage-free before doing so — as long as higher-interest debt is repaid first.

People in this group are more likely to invest conservatively, so they would earn less with other vehicles anyway. Prepaying their mortgage carries less opportunity cost.

For them, paying off their home loan early could be the right low-risk strategy.

By paying off their mortgages and freeing up what they were previously spending each month, these homeowners may be able to take advantage of rising interest rates down the road— investing in low-risk vehicles like CDs, Money Market TIPS, or muni bonds, but earning more at higher rates.

Finally, if you currently have an ARM mortgage and are worried about interest rate resets, you might want to pay down as much as possible or even refinance with cash in to freeze your rate and payment again.

Refinancing For Early Payoff

If you can swing a higher monthly payment, and you have your loose ends (see above) wrapped up, your ultimate mortgage prepayment strategy probably involves a mortgage with a shorter term. Like 15 years.

Not only is it easy (make payment, done), but it gets you a lower interest rate as well. Because loans fixed for 15 years run about .5 to 1.0 percent lower than comparable 30-year fixed loans.

Another Way To Pay Off Your Mortgage Early

You can accelerate your mortgage repayment by paying a little extra each month. Or, you can do it with an extra payment every year, or make a half payment every two weeks.

There is one way to prepare for early mortgage payoff that gives you access to your money in a pinch, and it lets you adjust your investments as your needs and finances change. This method does require discipline.

Instead of adding extra principal to your home loan payment each month, deposit the funds into an investment you like, at your risk-return comfort level. When you have enough to pay off your mortgage, cash out the investment and pull the trigger.

What Are Today’s Mortgage Rates?

Current mortgage rates don’t really affect what it would cost (or not cost) to prepay your home mortgage. What should drive the decision is your overall financial position and tolerance for risk.

Time to make a move? Let us find the right mortgage for you