Homes Are Very, Very Affordable Right Now

Affordability is at one of its highest points in a generation.

It just doesn’t seem like it.

Home prices are up nearly 6% since last year, and analysts predict another 5% jump in 2017. Plus, mortgage rates are at levels not seen since 2014.

Surely this can’t be an affordable housing market.

Except that it is.

That’s the conclusion from First American, a real estate title insurance provider and creator of the First American Real House Price Index (RHPI). The index — one of the few of its kind — considers not only nominal home prices, but also income levels and mortgage rates, too.

The result: home prices are 33% more affordable today than they were at the height of the “bubble” in 2006.

There have been few better periods in history in which to buy a home.

Verify your new rateHow To Look At Real Affordability

Home prices are only one aspect of affordability.

They are not even a very important part — at least not for anyone getting a mortgage. Here’s why.

Income and interest rates matter much more. In the below chart, Home Buyer A is getting a great deal on a home. But, her interest rate is high, and income low.

Home Buyer B is paying more for a home, but he is getting a lower rate and his income covers the payment easily. Home Buyer C is the doing the best, though.

She is buying a more expensive home but getting a rock-bottom rate. Plus, she spends the lowest percentage of her income on housing.

| Home Price | Mortgage Rate | Payment* | Income | % Of Income For Housing | |

| Home Buyer A | $150,000 | 6.0% | $720 | $2,000 | 36% |

| Home Buyer B | $200,000 | 5.0% | $860 | $4,000 | 22% |

| Home Buyer C | $250,000 | 4.0% | $955 | $6,000 | 16% |

*assumes 20% down, principal and interest payment only

This is exactly how home shoppers should look at affordability on a historic scale. Previous periods of history may have had ultra-low home prices, but they also came with high mortgage rates and lower income levels.

As an example, the RHPI states that “real” home prices (considering income and interest rates) are 10% below year-2000 levels. It’s hard to believe, but mortgage rates averaged 8.05% that year, according to Freddie Mac.

If mortgage rates were that high today, a home buyer would pay $1,770 per month for a $300,000 mortgage. Today’s mortgage rates would put that payment around $1,170 - a difference of $600 per month.

Combine low rates with a healthy job market, and homeownership today is about as easy as it’s been in decades.

“Real” Home Prices Over Time

Home affordability hit an all-time low in mid-2006, meaning homes were not very affordable at all. Mortgage rates were around 6.5% and home prices were climbing faster than incomes across the nation.

It’s a different world today.

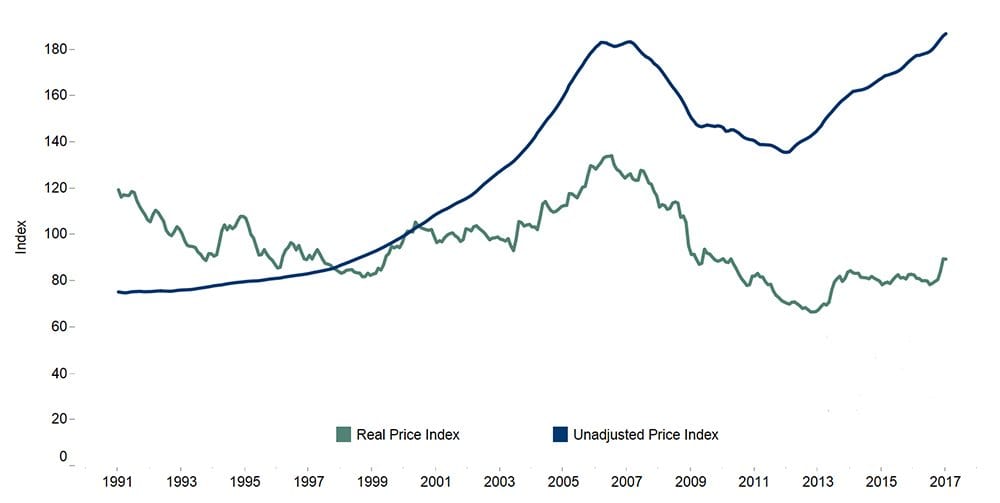

The graph below shows it best. The Real Price Index shows that home affordability has not increased substantially since 2009. But, you might not come to that conclusion looking at an Unadjusted Price Index.

Image: First American RHPI via Tableau

The RHPI considers income and mortgage rates, combined with raw home prices. But one element the RHPI doesn’t take into account is how hard or easy it is to get a mortgage.

For instance, if you can’t buy a home because mortgage rules are tight, affordability doesn’t matter.

The good news for home buyers is that data shows mortgage approvals are getting easier.

Two Reports That Show Easing Credit Standards

Mortgages are no longer “hard to get”.

A study run by the U.S. Federal Reserve (i.e. “The Fed”) showed that lenders are loosening requirements to get a mortgage.

The Fed asks more than 60 banks about their lending practices each quarter.

About 5% of banks eased credit standards “somewhat” or “considerably” for conventional loans during the fourth quarter of 2016. The other 95% held guidelines steady.

More banks have loosened requirements than tightened for 30 straight quarters going back to 2009.

But those results are from a survey. Are these guideline changes showing up in the real world? Another study suggests “yes”.

Ellie Mae is a software company whose mortgage platform handles 3.7 million loans per year. The company mines data from about 3-in-4 loans that come through its system.

The company reports that 75.9% of home purchase loans are being approved — and not only approved but successfully completed. That’s up from just sixty percent five years ago.

Credit score requirements are dropping. And, lenders are reducing the number of extra rules (a.k.a. “overlays”) they add to guidebooks published by agencies like Fannie Mae, Freddie Mac, and FHA. These loan agencies and other are making it easier to get approved and close on the right home.

Verify your new rateWhich Loan Is Right For Me?

New home buyers are often overwhelmed with the number of choices available in the mortgage market. While it’s clear that homes remain affordable, how to finance a home is still a mystery to many shoppers.

The good news is that there is probably one solid choice for each home buyer. They might qualify for only one type — conventional, FHA, USDA, or VA — or they might qualify for all four.

Even so, one clear choice typically emerges based on mortgage rates and monthly cost.

Here’s a quick rundown of which loan type might work the best for various situations.

Conventional loan

The conventional loan is often called a conforming loan because much of the time it “conforms” to standards set by Fannie Mae and Freddie Mac.

Typically these are best for home buyers with the following traits:

- Have good credit (680+)

- Can pay 5% or more down (although there are 3% down conventional loans)

- Are putting less than 20% down, but want cancelable mortgage insurance (FHA mortgage insurance is non-cancelable)

FHA loan

The FHA loan requires just 3.5% down and is very lenient about credit scores. A FICO down to 580 is acceptable to some lenders. These loans are best for home buyers:

- With a small down payment

- That can get a down payment gift

- Have a lower credit score (580-680), although many high-credit borrowers use FHA

USDA loan

The Rural Development (RD) loan is a popular choice for rural and suburban buyers. Regulated by the United States Department of Agriculture, its mission is to offer easier homeownership in less dense areas of the U.S. Many solidly suburban areas are eligible, and there is no down payment requirement.

These loans can be had by buyers with the following characteristics:

- No down payment saved

- Less-than-perfect credit

- Are buying in a suburban or rural area

- Make less than 115% of their area’s median income (check USDA income limits here)

- Do not own other adequate housing

VA home loans

This is usually the best option for those with a military background. In as little as 90 days, an active service person can be eligible. If separated from service, requirements range from 90 days to six years, depending on type of service.

VA loans are the go-to choice for active military personnel and veterans because they:

- Require no down payment

- Accept dinged credit

- Do not quire monthly mortgage insurance

- Come with lower mortgage rates compared to other major loan types

The type of loan you get is not something to be concerned about. One option will emerge as “the best” — and that’s not something you have to decide before requesting a pre-approval to buy a home.

How Do I Check My Home Buying Eligibility?

Getting a pre-approval to buy a home is easier now than in most periods of history. Affordability is at sky-high levels and mortgage rates are low.

Request a pre-approval and home buying eligibility check now, which automatically comes with a rate quote.

Time to make a move? Let us find the right mortgage for you