Don’t Let Common Challenges Keep You From Buying A Home

The Millennial homebuyer, a consumer 18 to 34 years old, makes up 42 percent of the homebuyers today. This generation is making a huge impact on the housing business. It also faces unique challenges when buying a home.

As a Millennial, you grew up during the Great Recession (December 2007 – June 2009). There’s a good chance you were touched by high unemployment, student loan debt and tight credit standards.

Don’t let these challenges cause you to shy away from buying a home. Times have changed, and buying a home today is becoming easier and more affordable.

Verify your new rateThe Millennial Homebuyer Challenge

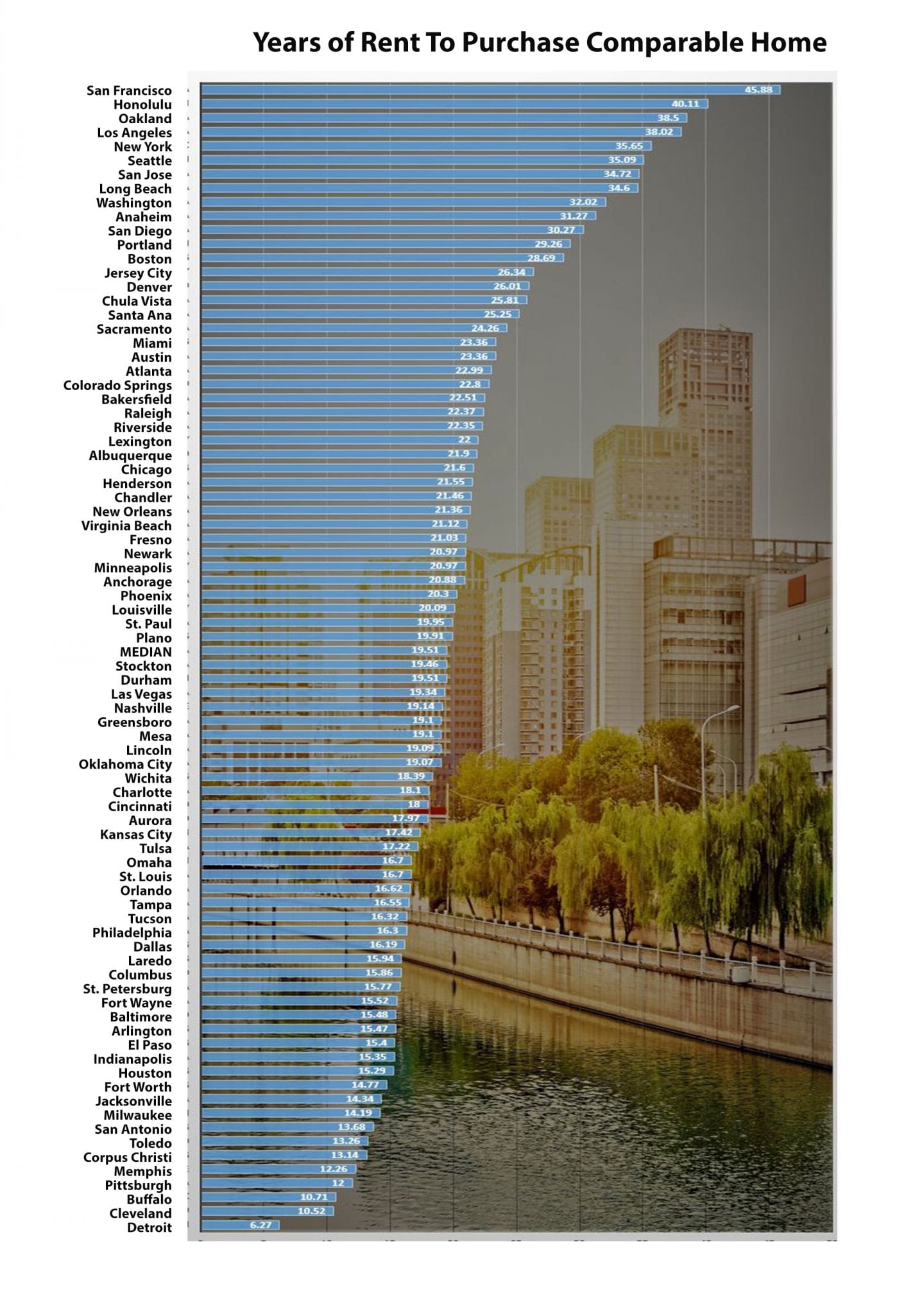

Young adults today are in excellent shape to buy a home. Rates are still extremely low by historical standards, and home values continue to appreciate. As you can see from the chart below, however, some markets make home buying easier than others.

Here are some essential tips for millennials beginning their journey towards homeownership.

Don't Wait Too Long

Unlike their parents, studies show that millennials tend to rent for longer periods of time before they take the home buying plunge.

While waiting can certainly make sense in some situations, it can also do more harm than good.

Why? Mortgage interest rates are on the move, and so are housing prices.

According to Freddie Mac, 30-year fixed interest rates have increased to an average of 4.32 percent, up a half percent over November’s 3.77 percent average rate.

On a $200,000 home, with a five percent down payment, your mortgage payment would be $54 more per month. Over five years, that means you spent over $3,200 more than those that bought just a few weeks earlier.

To protect against further rate increases, it could be wise to find a home and lock in your rate soon.

Verify your new rateFind The Right Real Estate Agent

The technology at your fingertips might (you think) lessen the value of an experienced real estate agent to a Millennial homebuyer.

Although under-30s are great at getting things done with very little help, an experienced real estate professional can make finding and buying the right home easier — especially for a first-time buyer.

After all, why not hire a person who has more education and expertise in real estate than you? As Henry Ford once said, when you hire people who are smarter than you, it proves you are smarter than they are.

The right agent offers invaluable neighborhood knowledge and is up-to-date on an area’s market conditions and potential as an investment.

Good agents guide you through the process of negotiating a price, securing other concessions (like a home warranty), and sorting out who pays which closing costs.

Don't Assume You Can't Buy A Home

A common challenge for many young college graduates is having sizable student loan debt and little savings. As such, you may assume you don’t have enough cash or income to afford to purchase a home.

Some Millennials are waiting longer than their predecessors to purchase their first home.

Recent studies, however, show that you’re likely to pay more in rent than you would for a mortgage payment.

Contrary to popular belief, you don’t need 20 percent down to buy a home – you don’t even need five percent, actually.

Some programs offer zero down options. Even if you don’t qualify for 100 percent financing, you may qualify for 95 to 97 percent loans. And many programs allow some or all of your down payment to be borrowed or gifted if it comes from an acceptable source.

Verify your new rateDon't Fall Victim To Analysis Paralysis

Your parent’s generation didn’t have access to the seemingly unlimited amount of data. You, however, can find everything you need with a quick text, email or Internet search.

It is estimated that nine of ten implement online resources for home buying education, but online information barrage can have its downside. Sometimes, too much information can cause uncertainty for homebuyers.

Do your online research, and seek advice from friends, family and real estate professionals. But don’t get overwhelmed and let a good deal pass you by.

What Are Today’s Mortgage Rates?

Millennials shouldn’t hesitate to become homeowners. With today’s technology, and the guidance of a trusted real estate agent, the Millennial homebuyer has the tools to successfully navigate the home buying process.

Find out today’s mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Time to make a move? Let us find the right mortgage for you