Retire With A Mortgage: Smart Move Or Dumb Mistake?

These days, fewer people are throwing a mortgage-burning party before putting on their retirement bash — they are choosing to retire with a mortgage. (For Gen-Xers and Millennial readers, “mortgage-burning parties” are celebrations homeowners traditionally have when they made their final home loan payment.)

That might not be a bad thing. Sometimes it pays to retire while holding onto that

Verify your new rateAre Mortgage Burning Parties Extinct?

Traditionally, at a mortgage-burning party, you grill something, drink something, and light up the extinct loan document (and hopefully, not burn down your house) to celebrate.

Today, though, mortgage-burning parties are rarer. Probably because so many more homeowners are heading into retirement with mortgages.

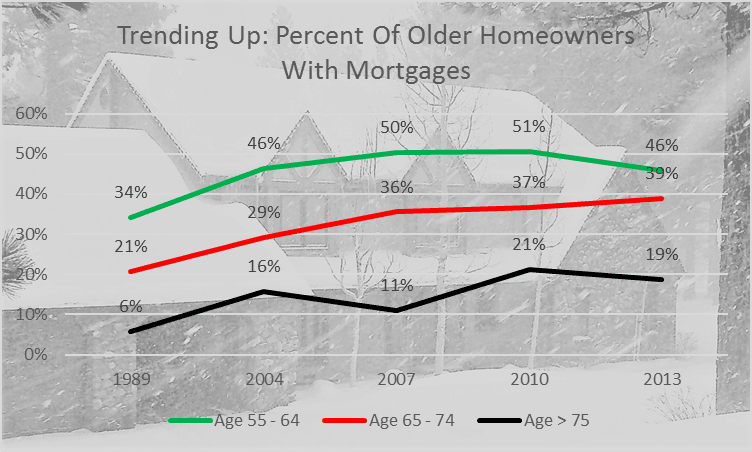

According to the Government Accountability Office, 59 percent of homeowners 55 and older have mortgage debt, while just 41 percent are positioned to retire without a mortgage.

This trend has been increasing for some time. The Federal Reserve’s Survey of Consumer Finances (SCF), which is published every three years, notes the trend. This chart shows the most recent data:

According to some financial experts, that’s not always a bad thing. What’s your plan? Throw that party? Or retire with a mortgage?

Retire With A Mortgage? Depends On Investment Income

To make this decision at all, you do have to have extra funds that could be used to pay off your home loan faster. For example, if you’re carrying higher-interest credit card debt or personal loans, they should obviously be paid off first.

Assuming that you are relatively debt-free and have income or savings that could go toward retiring your mortgage, there are several factors that must be taken into account.

A primary consideration is return on investment — the amount of interest you pay on your home loan, versus the amount you could be earning with other investments, like mutual funds or stocks.

You should use the “after-tax” numbers when you make this comparison.

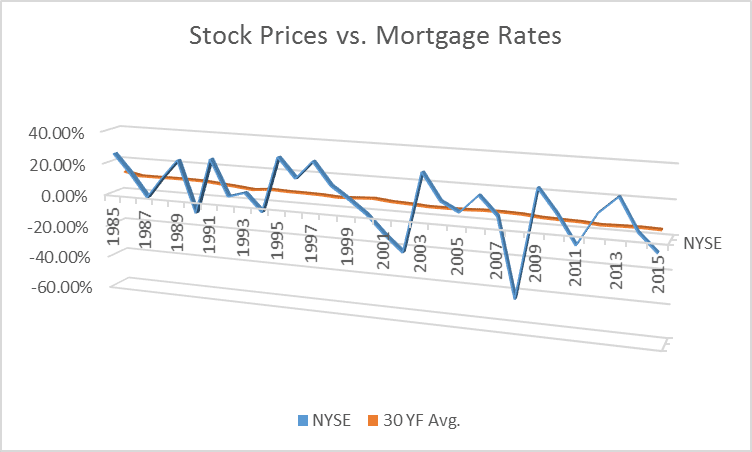

The chart below shows average returns for the US stock market, versus average 30 year fixed mortgage rates between 1985 and 2015. The average NYSE return was 9.02 percent during that period, while mortgage rates averaged 7.17 percent, according to Freddie Mac.

Compare that to today's mortgage rates, and you’ll see that a keeping a mortgage, even in retirement , can be a sensible decision. Even if you don’t feel like doing the math, a picture is worth 1,000 numbers.

What’s Your Risk Tolerance?

However, you’d be leaving out a really important factor — risk. It’s a general rule in finance and investing that higher returns (earnings) come with greater risk.

As your prime earning years near their end, how much of your portfolio are you willing to put at risk? Paying off a mortgage, on the other hand, is considered an extremely low-risk investment.

So, if you’re not the “put-it-on-red-and-let-it-ride” sort, you should pay off your mortgage if its interest rate is higher than that of a “risk-free” investment like a T-Bill or Certificate of Deposit.

For the record, on December 8, 2016, the 1-Year T-Bill rate, according to the Saint Louis Federal Reserve, was 0.82 percent. That makes a pretty strong case for paying off your home loan if you’re highly risk-averse.

Want To Accelerate Your Payoff? Get A 15-Year Loan

If you don’t have a stash of cash available to clear your mortgage balance, but you’d rather retire mortgage-free, make this part of your planning now.

A 15-year mortgage refinance (or even a ten-year plan if you can swing the payments) might be the way to go. It offers several advantages.

First, interest rates for 15-year loans are .5 to one percent lower than those of comparable 30-year mortgages. So your new payment might not increase as much as you fear.

Second, if you’re a less-disciplined person who spends whatever’s available, a 15-year home loan creates a kind of “forced savings” you’ll be glad to have when it’s time to quit working and start having fun.

Third, the GAO reports that a significant number of adults who fully expected to continue working later in life were derailed by health problems or job losses.

If you lose your expected source of income, not having a mortgage payment could provide significant relief.

What Are Today’s Mortgage Rates?

Today’s mortgage rates could be low enough to make it smarter not to pay off your mortgage before retirement — if you are positioned to take a little risk. Check with a financial planner, a mortgage lender, and your own gut.

Time to make a move? Let us find the right mortgage for you