The housing ladder jam

Suppose you’re a younger first-time homebuyer, finally ready to enter the market — only to find few, if any, homes available. You might be facing a surprising culprit: the senior housing shortage.

How does that affect you? Picture your local housing market as a ladder, and you’re trying to step onto the first rung.

The problem is, that rung is crowded with people who want to move up — but can’t, because the rungs above them are also full.

At the top of the ladder are seniors, many of whom would like to downsize but have nowhere to go. Until they can move, everyone else stays stuck — including you.

Boomers often take the blame for today’s housing challenges, but in this case, they’re just as stuck as everyone else. Keep reading to see how it all connects — and what could help.

Find the best first-time home buyer loan for you. Start hereIn this article (Skip to...)

- What’s causing the senior housing shortage?

- How this bottleneck impacts first-time buyers

- Fixing the senior housing gap for a healthier market

- The bottom line

What’s causing the senior housing shortage?

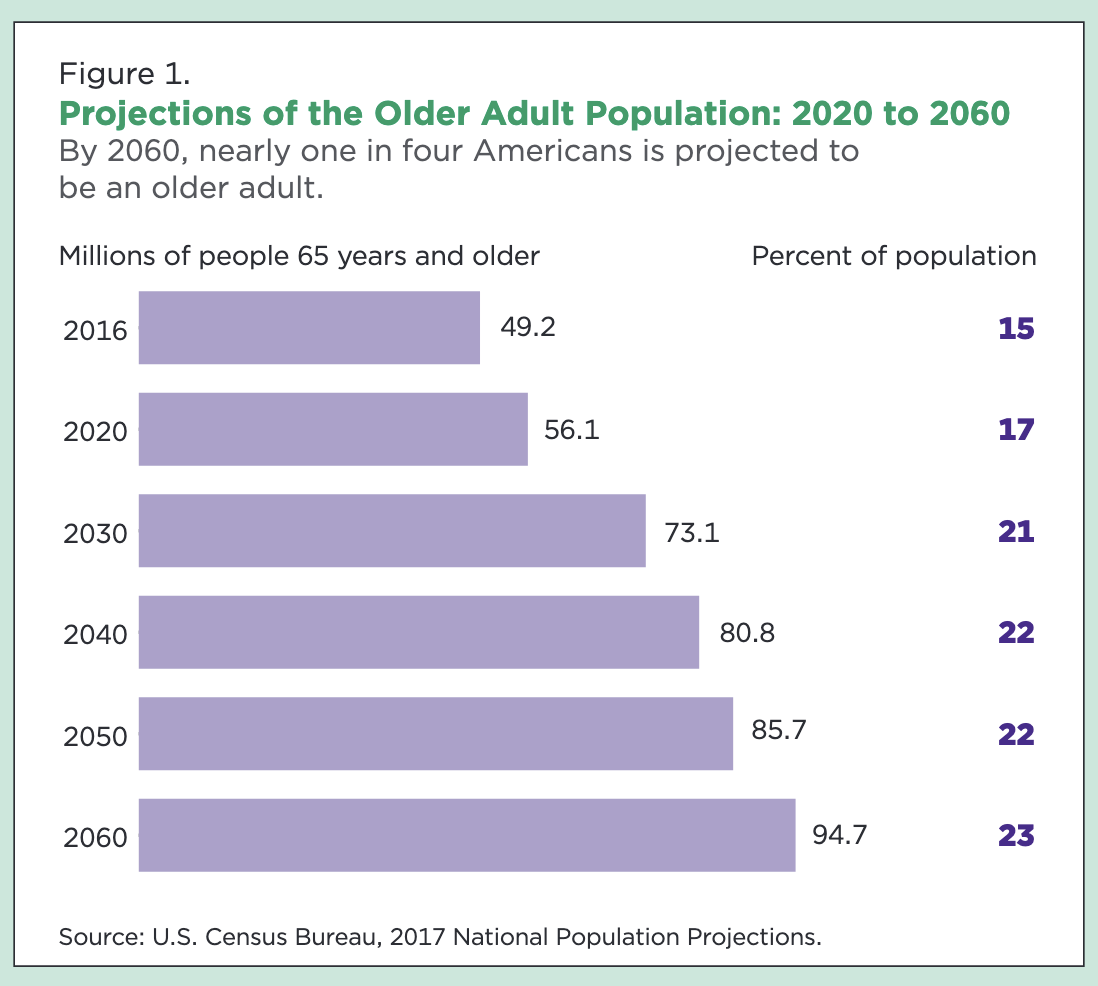

The Urban Institute neatly summarized the problem in its March 2025 report, America’s Housing Market Is Failing Older Adults. “The US population is aging,” the authors wrote. “Within the next decade, older adults will outnumber children for the first time in American history. As Americans live longer, their housing needs will change, but our current housing market is ill-prepared for this demographic shift.”

Here is the U.S. Census Bureau’s chart showing how people 65 years and over will remain a growing proportion of the American population: nearly one in four by 2060:

Find the best first-time home buyer loan for you. Start here

Downsizing seniors

For many, downsizing on or near retirement is a rite of passage, just as becoming a homeowner had been decades earlier. But it’s becoming increasingly difficult for many simply because they struggle to find somewhere to go.

In February 2025, The Wall Street Journal ran a story, Aging Boomers Are About to Rekindle the Senior-Housing Market. It found that 18.8 million Americans are set to be 80 years or older by 2030.

“History suggests that a growing number of people conclude at that milestone age they can no longer live comfortably or safely at home and seek a senior facility,” the Journal said. However, “Many will find themselves on a wait list. Development of senior housing nearly ground to a halt during the pandemic hasn’t picked up much. More than 560,000 new units are needed to meet all the demand by 2030, but only 191,000 will be added at current development rates, according to data service NIC MAP.”

No wonder many forward-thinking boomers are buying senior-specific housing before they actually need it. But that doesn’t solve the problem, except for them personally. The gap between supply and demand will likely remain wide for some years to come.

And the Journal warns that many seniors will probably be priced out of such housing, leaving them stranded in family-sized homes that are too big and costly for their needs and that they’d love to sell.

Not the seniors’ fault

Of course, some seniors stay put out of choice. They like the size of their homes and the convenience and reassurance of remaining in a community where they might have lived for decades or even their entire lives.

However, many others are desperate to move. As that Urban Institute report puts it, “Today, senior households—many of whom are on fixed incomes—are facing a combined crisis of housing affordability, accessibility, and availability. As the country’s population ages, policymakers must prioritize seniors in solutions to the housing crisis. Without action, the consequences will be severe.”

Indeed, the Institute reckons 11.7 million senior households now spend more than 50% of their income on housing costs, which classifies them as “severely cost–burdened senior households.” The problem is more than just rents and mortgages. Utilities, home insurance, property taxes, maintenance, and other fees all pile on the pressure, which is especially acute for those on fixed incomes, leaving some trapped and fearing real poverty.

First-time home buyers are secondary victims of this phenomenon. Fewer seniors quitting their homes means fewer family-sized homes for wannabe homeowners to buy.

How this bottleneck impacts first-time buyers

The housing ladder metaphor has been around for ages. It’s almost a cliché.

But it survives because it’s an effective way to picture the housing market. Imagining a clogged top rung lets you recognize why all the rungs below, including the bottom one, are also overcrowded.

Find the best first-time home buyer loan for you. Start hereWe need enough “inventory” (the supply of homes) to meet demand, not just for seniors but for first-time buyers, too. But the market isn’t delivering starter homes, either.

“While the exact definition of a starter home varies, they’re typically under 1,400 square feet,” says CNBC. “In 2023, just 9% of the new homes built in the United States were under that size, according to Census Bureau data. In 1982, it was more like 40% of new homes.”

Meanwhile, things aren’t getting easier. In the spring of 2025, Zillow published research showing “The number of cities where a typical starter home is worth $1 million or more has grown from 85 five years ago to 233 today.”

Of course, the story is different nationwide, and Zillow acknowledges the typical starter home nationwide is worth less than $200,000. But places where these homes are inexpensive also tend to be those where average salaries are similarly low, creating similar affordability issues.

Meanwhile, when the time comes to trade up from a starter home, the same problem remains. Clogging of all housing ladder’s rungs occurs because there are too few homes at all price levels to meet demand. So, home prices remain high and bidding wars continue.

You, as a first-time buyer, will likely find:

- Starter Homes Are Scarce: Many find themselves stuck in the very homes you’re trying to buy. And developers are building too few new ones.

- Affordability Strain: Too many buyers chasing too few homes means higher prices.

- Longer Wait Times: It’s harder to “graduate” to a new home, even after buying your first. The next rung up needs unclogging, too.

- Emotional Toll: You feel homeownership is out of reach because the system is backed up. You end up feeling hopeless, helpless and frustrated. All you can do is hang in there.

Why isn’t there enough senior housing?

You’re not the only one feeling stuck — a lot of baby boomers feel the same way.

Builders haven’t focused on making enough homes that work for older adults. As one article in The Wall Street Journalpointed out, high interest rates and rising construction costs have led many developers to stop building new housing for seniors.

Even when developers want to build, they often face pushback from local governments and neighbors who don’t want new apartments or senior housing in their area.

The result? Many homes that seniors can afford aren’t in the right places. Some older adults can’t drive anymore and need to live near stores, churches, and other things they can walk to. Others want to live close to family or near hospitals.

But the homes that check all those boxes are often too large and too expensive for seniors to afford.

Fixing the senior housing gap for a healthier market

We need to make downsizing easier for seniors, just as it used to be. Communities need to welcome senior housing construction, which would free up family-sized homes and help unclog the housing ladder.

Time to make a move? Let us find the right mortgage for youState and local governments could help by providing better aging-in-place support. And governments at all levels could provide tax breaks and other incentives to developers who build housing for seniors.

Indeed, tax incentives could also be provided for seniors who are downsizing, helping them to afford their moves. And multigenerational homes could become more common, with parents, kids and grandparents sharing a home.

Governments could make it easier to build accessory dwelling units (ADUs), which are small, self-contained residential units located in the yard of an existing single-family home. Having one of those can provide seniors with dignity, privacy and a peaceful environment while having loved ones on hand to provide support and security.

You can help by supporting local, state and national policymakers who introduce measures aimed at easing the senior housing shortage. It could help get you on the housing ladder and help you climb it.

It’s all connected — and change starts at the top

Think of today’s market as a game of musical chairs — and seniors aren’t moving. This directly affects you.

Because, until housing options open up for older generations, first-time buyers will continue to face an uphill battle.

So, become an activist. Lobby for smart housing policies that help everyone move, including you. Understand local, statewide and national housing flows (not just listings) so you can influence policymakers.

Yes, building more (and more affordable) starter homes will help. But unclogging the housing ladder is the real solution.