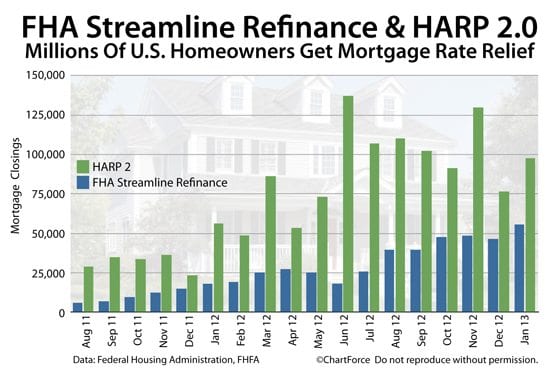

Underwater homeowners have joined the Refinance Boom en masse this year. Falling mortgage rates have drawn them in. “No appraisal” mortgages have made closings more simple. The FHA Streamline Refinance and HARP mortgage programs have been especially popular.

In 2013, U.S. homeowners will close on 2 million FHA Streamline Refinance and HARP mortgages combined.

Click here for today's live mortgage rates

.

“No Appraisal” Mortgages Extend The Refi Boom

Even as home values rise, many U.S. homeowners remain underwater, or hold less equity as compared to their original home downpayment. For these homeowners, appraisal-less mortgages can be a boon.

Currently, there are four popular home loans for which home appraisals are not required :

- The FHA Streamline Refinance

- The Home Affordable Refinance Program (HARP)

- The VA Interest Rate Reduction Refinance Loan (IRRRL)

- The USDA Streamline Refinance

Because these four programs eschew home appraisals as part of the refinance process, they can be used by homeowners whose homes have lost value since the date of purchase. Not surprisingly, with mortgage rates near lifetime-time lows, demand for “no appraisal” loans has soared this year.

Closings for both the FHA Streamline Refinance and HARP refinance are outpacing 2012 — a year in which 1.4 million loans were closed between the two programs combined. Even better is that the monthly savings realized by homeowners is huge.

The typical HARP household lowers payments by 35%, on average. Furthermore, many are making the switch via zero-closing cost mortgages, amplifying their household savings.

Click here for today's live mortgage rates

.

Comparing FHA Streamline Refinance And HARP 2.0

The FHA Streamline Refinance and HARP programs are most similar among the four appraisal-not-required refinance programs. However, differences exist. A feature comparison follows.

Loan Endorsement Entity

- The FHA Streamline Refinance is for FHA-insured mortgages only. There are no exceptions to this policy.

- The HARP program is for Fannie Mae- or Freddie Mac-backed mortgages only. There are no exceptions to this policy, although a rumored HARP 3.0 may allow .

Qualification / Eligibility Dates

- The FHA Streamline Refinance program requires that FHA-insured homeowners make at least 6 mortgage payments on their current FHA mortgage before they’re eligible to refinance into a new FHA mortgage.

- The HARP program requires that refinanced mortgages have a securitization date of no later than May 31, 2009.

Mortgage Application Verifications

- The FHA Streamline Refinance program does not require verification of income, employment, or credit score, per official FHA program guidelines. Lenders sometimes verify one or all of these items.

- The HARP program does not require verification of income, employment, or credit score, per official program guidelines. Lenders sometimes verify one or all of these items.

Mortgage Payment History

- The FHA Streamline Refinance program allows 1 mortgage late in the last 12 months, but none within the last 3 months in order to be FHA-eligible.

- The HARP program allows 1 mortgage late in the last 12 months, but none within the last 6 months in order to be HARP-eligible.

Closing Costs

- The FHA Streamline Refinance does not allow closing costs to be added to the loan balance. They must be paid as cash at closing, or paid by the mortgage lender on the homeowner’s behalf.

- The HARP program allows closing costs to be added to the loan balance, paid as cash at closing, or paid by the mortgage lender on the homeowner’s behalf.

Maximum Loan-To-Value

- The FHA Streamline Refinance allows for unlimited loan-to-value on all mortgages.

- The HARP program allows for unlimited loan-to-value for fixed-rate refinances. ARMs cap at 105% loan-to-value.

Mortgage Insurance Requirements

- The FHA Streamline Refinance has a two-tiered mortgage insurance premium (MIP) system. For 30-year fixed rate mortgages, MIP rates can be as low as 0.55% annually, and as high as 1.55% annually. Tiers are different for 15-year mortgages. Upfront MIP applies, too.

- The HARP program does not require new mortgage insurance coverage, regardless of LTV. Existing mortgage insurance, however, must be replaced using the same “coverage level”.

Maximum Loan Size

- The FHA Streamline Refinance allows for loan sizes up to $729,750

- The HARP program allows for loan sizes up to $625,500

Refinancing Options

- The FHA Streamline Refinance is for rate-and-term refinances only. Cash-out mortgages are not allowed. The FHA will not allow you to shorten your loan term unless your mortgage payment drops 5% or more.

- The HARP mortgage program is for rate-and-term refinance only. Cash-out mortgages are not allowed. The program encourages homeowners to shorten loan terms to 20- and 15-year fixed rate mortgages, offering more lenient approvals, despite higher payments.

Home Appraisals And Valuations

- The FHA Streamline Refinance assigns the home’s purchase price as the its appraised value, irrespective of the home’s fair market value. No appraisal is needed.

- The HARP program may require an appraisal, but the value is ignored. Values are assigned via an Automated Valuation Model (AVM).

Click here for today's live mortgage rates

.

Get Live Refinance Mortgage Rates

If you’ve been waiting for low mortgage rates to refinance, it may be time to get started. The U.S. economy is improving. The forces which pushed rates down in 2012 are subsiding. 2013 may be a rough year for rates; some predict rates to 4.4% or higher. We’re not close to that today.

Get a real-time look at today’s mortgage rates for HARP, FHA Streamline Refinance and the other no-appraisal mortgage types. Start your refinance before mortgage rates climb.

Time to make a move? Let us find the right mortgage for you

.