Will mortgage rates go up in 2022?

As the U.S. economy continues to climb out of its Covid slump, and as inflation puts upward pressure on interest rates, most experts agree mortgage rates will climb higher in 2022.

Just how high will they go? Industry sources are split on that. But they mostly agree on 30-year rates in the high-3% to low-4% range by the end of next year.

That means it’s in your best interest to buy or refinance early in 2022 if you’re banking on today’s low rates to help you save.

Get started shopping for mortgage ratesIn this article (Skip to...)

Overview of 2022 mortgage rates forecast

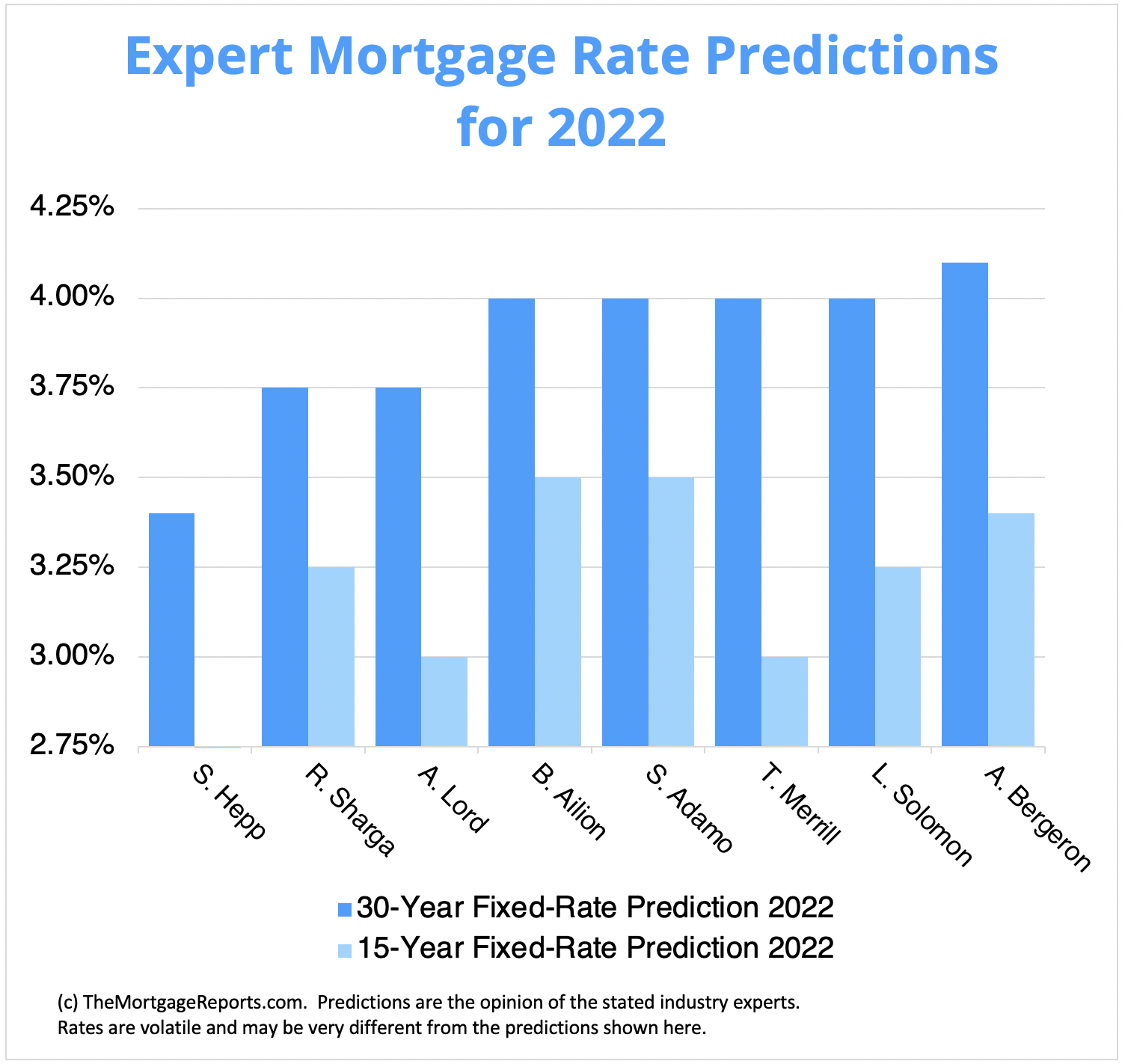

We interviewed eight mortgage, housing, and finance professionals to get their mortgage rate forecasts for 2022.

By the end of next year, these industry experts predict 30-year fixed mortgage rates could rise to between 3.4% and 4.1%. When it comes to 15-year mortgage rates, they predict an average between 3.0% and 3.5%.

Average interest rate predictions put 30-year fixed rates at 3.88% and 15-year fixed rates at 3.27% in 2022.

| Industry Expert | 30-Year Fixed-Rate Prediction 2022 | 15-Year Fixed-Rate Prediction 2022 |

| Selma Hepp (CoreLogic) | 3.40% | N/A |

| Rick Sharga (RealtyTrac) | 3.75% | 3.25% |

| Al Lord (Lexerd Capital Management) | 3.75% | 3% |

| Bruce Ailion (Realtor) | 4% | 3.50% |

| Stephen Adamo (Embrace Home Loans) | 4% | 3.50% |

| Than Merrill (FortuneBuilders) | 4% | 3% |

| Lyle Solomon (Oak View Law Group) | 4% | 3.25% |

| Andreis Bergeron (Awning.com) | 4.10% | 3.40% |

| Average Prediction | 3.88% | 3.27% |

Put in perspective, it’s important to remember that mortgage interest rates have remained relatively affordable. And for the foreseeable future, they shouldn’t stray too far from all-time lows.

Ponder that, 40 years ago, mortgage interest rates were close to 17%. With that in mind, an increase to even 4% by the end of 2022 doesn’t seem too scary.

Find your lowest mortgage rate. Start here

Expert mortgage rate predictions for 2022

Industry experts generally agree that mortgage rates will rise in 2022. But they’re split on just how high rates will go. Here are 30- and 15-year mortgage rates forecasts from the eight professionals we interviewed, along with the reasoning behind their predictions.

Selma Hepp, deputy chief economist, CoreLogic

30–year mortgage rates forecast: 3.4%

15–year mortgage rates forecast: N/A

Selma Hepp, deputy chief economist for CoreLogic, says it’s easy to see the factors that will probably drive mortgage rates higher in 2022.

“Inflation, government intervention in the housing market, the supply of homes for sale, and consumer debt will all play a part,” she says. “Further gradual increases in mortgage rates will be driven by the broadening of inflation and inflationary expectations as well as the continued supply shortages of labor, materials, and energy.”

With a little less demand and a little more supply next year, Hepp expects homes for sale will remain on the market a bit longer with fewer competing bidders, which should moderate home price growth.

“CoreLogic’s Home Price Index Forecast has the annual average rise in our national price index slowing from about 15% in 2021 to 5% in 2022,” she says.

Rick Sharga, executive vice president, RealtyTrac

30–year mortgage rates forecast: 3.75%

15–year mortgage rates forecast: 3.25%

“I think it’s likely we’ll see mortgage rates increase in 2022,” says Rick Sharga, executive vice president at RealtyTrac.

He explains, “The biggest question is whether today’s high inflation is transitory, as the Biden Administration claims, or will be more pervasive. Higher inflation almost always results in higher mortgage interest rates. If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.”

“If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.”

Consider that the spread between the yields on 10-year Treasuries and 30-year fixed-rate mortgages is below its historic level of about 2 points, so mortgage rates could move up a few basis points if that relationship were to simply revert to historically normal levels next year, he adds.

“A few factors could drive mortgage rates down in 2022. First, returns on many investment products are still historically low. Central banks in a number of countries deployed negative interest rates in 2021. Second, many international economies are still fairly volatile, and that often drives investments toward US Treasuries in a flight to safety, driving down yields, which could have a similar impact on mortgage rates,” Sharga says.

Al Lord, founder, Lexerd Capital Management

30–year mortgage rates forecast: 3.75%

15–year mortgage rates forecast: 3%

Al Lord, founder of Lexerd Capital Management, say two widely talked about factors will influence the direction of mortgage rates in 2022.

“The first is the Fed’s tapering of the asset repurchases program. Reducing asset repurchases creates less money supply in the market and increases interest and mortgage rates,” he says.

“Second is the shortage of homes for sale and limited new construction activity. The high home prices and the limited supply of homes, either from resale or new construction, will keep the demand for mortgages lower compared to 2021. As a result, mortgage rates will tend to remain near the same or marginally decline, I believe. The result of these two counteracting factors will lead to higher mortgage rates by the middle of 2022, if not earlier.”

Expect inflation to accelerate in 2022 while home prices continue to escalate.

“That’s why my advice to homeowners is to purchase a property sooner than later and lock in still moderate mortgage rates,” adds Lord.

Bruce Ailion, real estate attorney and Realtor

30–year mortgage rates forecast: 4%

15–year mortgage rates forecast: 3.5%

Bruce Ailion, a Realtor and real estate attorney, isn’t very optimistic that 2022 rates will remain as enticingly low as they have been this year.

“When inflation first appeared, it was hoped that it would be transitory. Today, it is considered baked into the future,” he cautions. “The 2022 inflation rate is expected to settle at 4.5%, hopefully receding to 3.5% in 2023. Expected higher interest rates will place pressure on the Fed to slow the economy through interest rate increases.”

He reminds readers that the Fed has signaled the intent to increase rates by slowing their purchase of government bonds, which will cause rates overall to increase next year.

“But rates could go lower-than-expected next year if we see a consumer backlash and unwillingness to pay higher prices. The labor pool that has been sitting on the sidelines of this recovery may reenter the workforce, as well, slowing down wage inflation. These and other actions are unlikely to occur, however,” he explains.

Stephen Adamo, president of National Retail Production, Embrace Home Loans

30–year mortgage rates forecast: 4%

15–year mortgage rates forecast: 3.5%

Stephen Adamo of Embrace Home Loans also believes rates are likely to increase in 2022, especially with the Fed already beginning its tapering of monthly bond purchases.

“That said, a macroeconomic problem could slow the increase in rates and possibly even bring rates slightly lower. The data around the pandemic has improved, even though the country is now seeing an increase in COVID cases. If the pandemic creates more challenges next year, we could see rates decrease from where there are today,” notes Adamo.

It’s more likely that, by late next year, we’ll see a moderate rate increase of at least 50 basis points higher than today, he says.

Than Merrill, CEO, FortuneBuilders

30–year mortgage rates forecast: 4.0%

15–year mortgage rates forecast: 3.0%

The good news? Borrowing costs are just about as attractive as they’ve ever been, according to Than Merrill of FortuneBuilders. The bad news? “Inflation brought about by government stimuli in the wake of a global pandemic has forced the Fed’s hand to increase borrowing costs,” he says.

For these and other reasons, he predicts that rates are more likely to head north than go south by this time next year.

“If inflation proves to be transitory, it’s safe to assume that interest rates will increase at a faster pace than they did in 2021. It should be noted, however, that the Fed can’t increase interest rates faster than the economy can strengthen. So while interest rates are expected to rise, they most likely won’t increase dramatically,” Merrill explains.

Lyle Solomon, principal attorney, Oak View Law Group

30–year mortgage rates forecast: 4%

15–year mortgage rates forecast: 3.25%

For Lyle Solomon, attorney at Oak View Law Group, the equation is simple: “When consumers can spend more, which is true today, they can afford to buy homes. That increases the demand for mortgages, which is likely to happen in 2022,” he says.

Expected stronger economic growth, which may lead to higher treasury yields, is the biggest reason why Solomon anticipates a 4% average rate for a 30-year mortgage next year.

“On the other hand, if inflation gets under control, mortgage rates will go down,” he adds.

Andreis Bergeron, founding member/head of brokerage, Awning.com

30–year mortgage rates forecast: 4.1%

15–year mortgage rates forecast: 3.4%

Andreis Bergeron of Awning.com sees 30-year interest rates moving slightly above 4% in 2022. In addition to Federal Reserve policy, the Fed Funds rate, and inflation, Bergeron points the finger at the bond market, gross domestic product, and housing trends among the elements that will impact mortgage interest rates in 2022.

“Rates are expected to rise in the coming years driven by the largest year-over-year inflation growth in 30 years and the fact that the Fed Funds are expected to hike rates,” he says.

Considering that inflation growth is basically double where current mortgage rates sit, lenders will be forced to increase rates to make a profit margin on their products next year, he continues.

Find your lowest mortgage rate. Start here

Should you wait to buy a home until 2022?

Are you on the fence about purchasing a property? Keep in mind that low mortgage rates are helpful, but they shouldn’t be your deciding factor. Think carefully before committing to a mortgage loan and locking in a rate until you are financially ready.

“Don’t make a bad decision and rush into a home purchase strictly to take advantage of an interest rate that’s, say, 0.5% better than recently,” recommends Sharga.

“However,” he adds, “it’s important to keep in mind that home prices are also likely to continue to rise in 2022, so waiting to see if prices are interest rates drop could cost you in terms of a higher home price and a higher-priced loan.”

“Prospective buyers should strongly consider buying at today’s prices and rates because they’re only expected to go higher for the foreseeable future.”

Merrill seconds those sentiments.

“The current market environment suggests borrowing costs and home values will increase. Prospective buyers should strongly consider buying at today’s prices and rates because they’re only expected to go higher for the foreseeable future,” he says.

Consider one example.

Say you’re buying a $300,000 home at today’s average 30-year rate of 3.10% (per Freddie Mac). With a 20% down payment, your monthly principal and interest payment would come out to $1,025.

Now imagine you’re buying in late 2022 with a 3.75% interest rate. The same loan would cost you $1,100 per month, adding $75 to your payment. And you’d pay an additional $31,190 in interest over 30 years.

To get the best interest rate possible, be sure to get your financial house in order first, suggests Hepp.

“Paying down your outstanding debt on credit cards, auto loans, and student debt will help you obtain approval for a mortgage loan,” says Hepp.

Additionally, check your credit score and work to improve a low number.

“If your score is high, you are likely to qualify for lower interest rates. So work to boost your credit score by lowering your credit utilization ratio, removing negative items from your credit report, and paying off your debts,” advises Solomon.

Should you wait to refinance?

The experts agree: The best move is to refinance sooner rather than later if you want to reset your mortgage and capitalize on today’s low interest rates. With rates likely on the rise in 2022, potential savings for homeowners looking to refinance could be diminished.

“Try to refinance by the early months of 2022, not later,” says Lord.

Solomon says that rising interest rates are expected to decrease the number of refinancing applications in 2022. It stands to reason, then, that there’s no time like the present to lock in a low refi rate.

“It’s probably time to stop considering and start moving on that loan refinance application,” agrees Sharga.

Get started on your home loan refinance

The bottom line

With many experts all forecasting rate hikes, you may come to the conclusion that it’s better to lock in a mortgage rate sooner than later.

But never forget that even the most knowledgeable experts can’t forecast the future with 100% accuracy. Mortgage interest rates next year may go higher, could drop lower, or may mirror what we see today.

It is important to remember that next year could produce different outcomes in rates — even downward movement.

If you buy or refinance today, you can always take advantage of lower rates again in the future.

The moral of the story? Don’t put all of your eggs in one basket or take unnecessary risks based on hunches. Weigh your rate lock decision carefully and don’t try to perfectly time the market.

Crunch your financials, consult closely with an experienced mortgage lending professional, and strategize your short-and long-term homeownership plans before pulling the trigger.

Time to make a move? Let us find the right mortgage for you