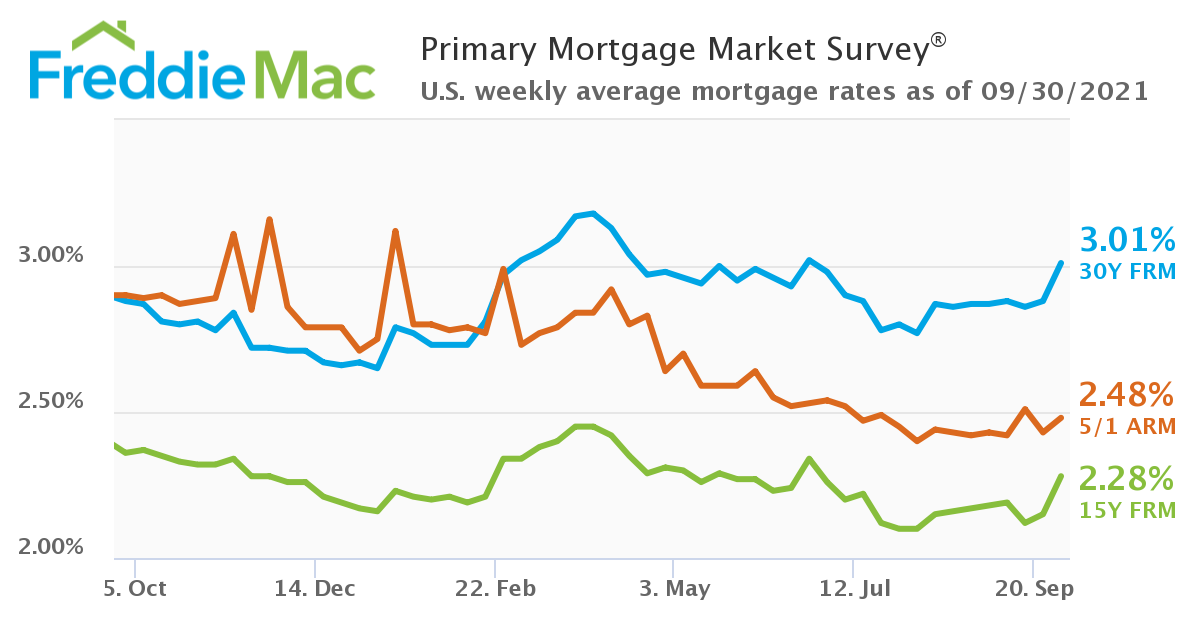

Rates pass 3% for the first time since June

30-year mortgage rates have stayed in the 2% range through nearly all of 2021, according to Freddie Mac.

But this week they spiked above 3% for the first time since June.

Other rate bumps this year were followed by big drops. But these new, higher rates could be here to stay.

With the economy improving and the Fed pulling back on stimulus soon, there are strong forces driving rates upward.

Borrowers who thought record-low rates were the new norm might want to reevaluate. Today’s rates could be the lowest we’ll see for a while.

Find your lowest rate before they rise. Start hereHigher rates are here — to stay?

Most economists and mortgage experts have been predicting higher interest rates since the beginning of the year.

With widespread vaccinations, businesses and travel reopening, and consumer confidence on the rise, our economic outlook seemed bright. And a better economy should lead to higher rates.

We even saw a false start in March and April, when rates spiked to 3.18% — their highest this year.

Source: Freddie Mac

But then the Delta variant struck, and it wasn’t clear how things would shake out for financial markets. So rates turned back down.

Now, it looks like we’re finally seeing those long-awaited ‘higher rates’ start to materialize.

Why are mortgage rates rising?

There are a couple reasons for this week’s increase in mortgage rates.

The Federal Reserve

First, the Federal Reserve has indicated it will start pulling back on pandemic-era financial policies “soon.” That probably means before the end of the year.

Since the start of the Covid pandemic, the Fed has been keeping mortgage rates artificially low by injecting billions of dollars into the mortgage market each month.

Rates were always going to rise when the Fed stopped this program.

Now the Fed has a clearer roadmap for tapering off its mortgage stimulus. And investors (who ultimately determine mortgage rates) are already pricing in those changes. So rates have started going up even though the Fed hasn’t officially made a change.

The debt ceiling debate

Second, there’s an increasingly scary debate going on in Congress over the debt ceiling.

“Much of the increase [in mortgage rates] is due to concerns the U.S. will effectively be out of cash by October 18 unless the debt ceiling is lifted, which was reiterated by both Treasury Secretary Yellen and Fed Chair Powell yesterday,” explained mortgage commentator Rob Chrisman in his September 30 commentary.

If Congress can’t agree to raise this ceiling, the U.S. could default on its debt, which it’s never done before.

This would likely lead to at least a mild recession as well as higher interest rates on mortgages and other forms of borrowing.

Find your lowest rate before they rise. Start hereWill rates keep going up?

Earlier rate spikes this year were followed by dramatic falls. But this new increase could be the start of a longer upward trend.

Ultimately, interest rates are going up because the economy is improving.

Although Covid isn’t gone — far from it — we’re all finding a ‘new normal.’ And it doesn’t look like we’ll swing back in the other direction any time soon.

As Chrisman said, “Despite the challenges that the recent upswing in COVID cases presents, it does not appear the COVID fears will create the economy-crushing headwinds they were at the onset of the pandemic.”

That said, we might see a jagged path upward — with some spikes and some falls — rather than a steady march.

If Congress does find a solution to the debt ceiling issue, as we’re all hoping they will, we could see a temporary respite from these rate hikes.

But, overall, rates will likely keep rising as the economy strengthens. So borrowers should not expect sustained drops in the near future.

A potential bright spot for home buyers

Rising rates typically aren’t good news for homeowners. But there might be a silver lining for home buyers if rates do continue upward.

Freddie Mac’s chief economist Sam Khater explained:

“We expect mortgage rates to continue to rise modestly which will likely have an impact on home prices, causing them to moderate slightly after increasing over the last year.”

Even a modest decline in home prices could be welcome news for buyers fighting an uphill battle in today’s red-hot market.

But keep in mind that your rate also impacts your home buying budget. So if you’re already maxing out the amount you can borrow, even a minor increase in rates could potentially price you out of the home you want.

Don’t miss the low-rate window

Interest rates movements can be almost impossible to predict — especially in today’s bizarre and ‘unprecedented’ economy.

However, at the moment, it looks far more likely that rates will continue upward through the end of the year, rather than fall back to the 2’s and stay there.

If you’ve been waiting on a refinance, or pinning your home buying budget on today’s low rates, it’s a good time to get serious about locking a mortgage.

Time to make a move? Let us find the right mortgage for you