Will mortgage rates go up in 2021?

Throughout 2021, the consensus has been that higher mortgage rates are coming.

But two big questions remain: When will rates actually rise? And by how much?

We asked 10 industry experts for their mortgage rate predictions to find out.

Some believe average mortgage rates could go as high as 3.5% or even 4.25% before the end of 2021. Others predict a more modest rise, to around 3.2%.

The good news is, today’s rates are still near historic lows. So home buyers and homeowners can lock in a great deal for the time being.

Find and lock a low mortgage rateIn this article (Skip to...)

- Mortgage rate predictions

- Current mortgage rates

- Will rates keep dropping?

- What’s driving rates?

- Strategies for borrowers

- Your next move

Expert mortgage rate forecasts for 2021

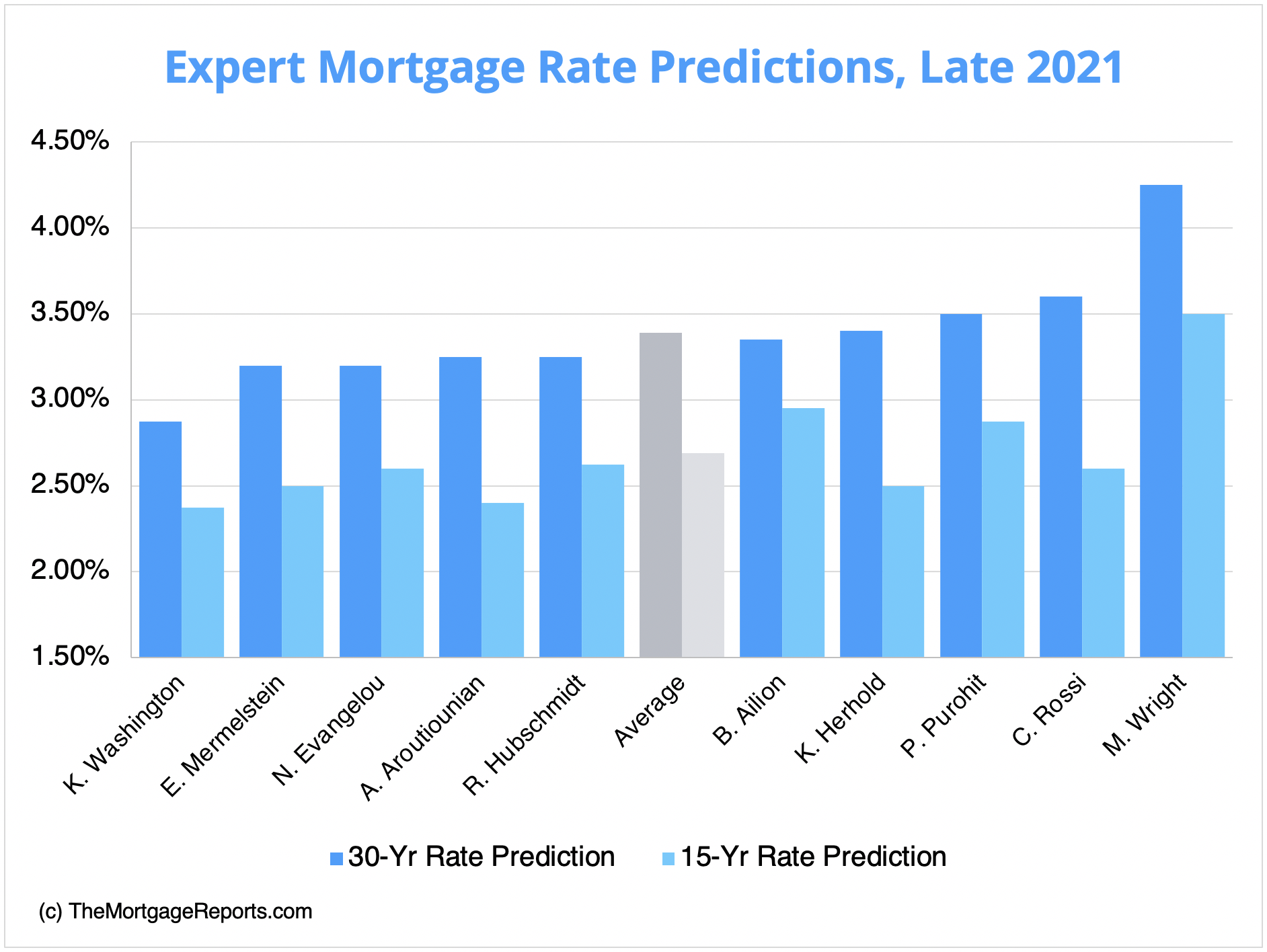

We consulted 10 trusted real estate experts on how high mortgage rates are likely to go by the end of 2021.

Their predictions ranged from 2.875% to 4.25% for a 30-year, fixed rate mortgage, and from 2.375% to 3.50% for a 15-year fixed mortgage.

These predictions may help steer you toward better decision-making when it comes to buying a home or refinancing before the end of the year.

But keep in mind: timing the market can be a dangerous game.

If you’re ready to lock a mortgage rate now, it’s a great time to do so. Rates are as low as they might go for the remainder of 2021.

But if you’re just starting on your home purchase or refinance journey, don’t worry too much.

Even the highest mortgage rate predictions for 2021 are still “low” by historical standards. So there’s nothing wrong with waiting until you’re ready.

Start your mortgage rate lock hereKhari Washington, real estate and mortgage broker, 1st United Realty & Mortgage, Inc.

30-year mortgage rates by late 2021: 2.875%

15-year mortgage rates by late 2021: 2.375%

“My prediction is that rates will stay in the same range they have been, and they will likely flex within a 1 percent band,” says Washington.

“Rates will get closer to the upper band of where mortgage rates are currently. The Fed’s easy money policy will keep them in the same band, but the strengthened economy will put them in the upper range,” he continues.

“If the Fed changes its position on rates and thinks inflation is going up, along with bond buyers being more hawkish on the economy, rates could rise.”

Edward Mermelstein, real estate consultant, investment advisor, attorney

30-year mortgage rates by late 2021: 3.2%

15-year mortgage rates by late 2021: 2.5%

Mermelstein explains, “My rate predictions are based on historical trends as well as reported projections from Fannie Mae, Freddie Mac, and the National Association of Realtors.

“High inflation and a strong economy are the main factors likely to drive rates up by the end of the year. With growing inflation, lenders will increase rates to compensate for the loss and will take on the capital they are lending due to inflation.

“Also, many lenders will not want to give mortgages due to the long time frame of the loan. Rather, they would prefer to lend short-term debt until they have developed a better view on inflation. If this is the case, mortgage rates will be pushed up with less capital available to lend.

“If there is a strong economy, there will be increased demand not only for housing but capital and investment of any type. When there is increased demand for mortgages, rates increase.”

Nadia Evangelou, senior economist and director of forecasting, National Association of Realtors

30-year mortgage rates by late 2021: 3.2%

15-year mortgage rates by late 2021: 2.6%

“The economy is growing faster than expected as more Americans get vaccinated against COVID-19 and resume traveling and going to restaurants, bars, events, and shows. However, I don’t see mortgage rates making big moves in the near future,” says Evangelou.

“Even though inflation may end the year above 2 percent, the Fed has reassured multiple times that it will allow inflation to run above this 2 percent goal without affecting its low rate policy.

“Employment is another major factor that will also influence mortgage rates; a faster job market tends to push mortgage rates higher and can spur inflation, too, which drifts up mortgage rates.”

Arman Aroutiounian, head of Capital Markets, Reali

30-year mortgage rates by late 2021: 3.25%

15-year mortgage rates by late 2021: 2.4%

“I do not foresee any meaningful deviation — plus or minus 0.5 percent — in mortgage rates for 2021,” predicts Aroutiounian.

He continues, “I would attribute any move outside of my predicted range to a rise in inflation or a slight tightening of monetary policy.

“Several other factors could influence mortgage rates between now and the end of the year, including a reversal in the current downward trend in COVID cases, political or global unrest particularly in the Middle East, and a stock market correction.”

Randy Hubschmidt, managing partner, Fortis Family Office

30-year mortgage rates by late 2021: 3.25%

15-year mortgage rates by late 2021: 2.625%

“I think mortgage rates through the end of 2021 will largely remain where they are currently — neither increasing nor decreasing by any significant amount,” predicts Hubschmidt.

“Homeowners who are worried about missing these low interest rates can relax to a certain degree. They can focus more on not overpaying for a home and on waiting for the right house at the right price to come along.

“Of course, if new variants of the coronavirus strain continue to put pressure on the world’s populations, health care, and the economy, we could see a reduction in rates as the Federal Reserve continues to remain accommodative to the broader economy rather than risk stalling the recovery.”

Bruce Ailion, Realtor and real estate attorney

30-year mortgage rates by late 2021: 3.35%

15-year mortgage rates by late 2021: 2.95%

“The strength of the economy and inflationary concerns will move interest rates up by the end of the year,” says Bruce Ailion, Realtor and real estate attorney.

“Consider that the second quarter saw a spike in inflation above the Fed’s long-term target of 2.0 percent. Inflation expectations took a sharp rise in April and May, causing concern. Some of this is related to very strong demand and short supply in products with supply chain issues — everything from computer chips and new cars to washing machines, lumber, and building materials.

“Plus, the labor participation rate has shrunk, and businesses are being forced to pay higher wages to attract workers. Higher wages, expanded government unemployment benefits, and the fact that consumers are now spending those dollars will lead to a strong economy for the second half of 2021, which can push rates higher.”

Kristen Herhold, spokesperson, Clever Real Estate

30-year mortgage rates by late 2021: 3.4%

15-year mortgage rates by late 2021: 2.5%

“As the economy improves as we near the hopeful end of the COVID-19 pandemic, mortgage rates are likely to increase with it,” says Herhold.

“If the supply of homes for sale increases as well, mortgage rates may increase, too. Our survey found that 77 percent of people who still plan to sell their home plan to sell in 2021, which means there will probably be an inventory bump — therefore leading to more people applying for mortgages.”

Preetam Purohit, head of hedging and analytics, Embrace Home Loans

30-year mortgage rates by late 2021: 3.5%

15-year mortgage rates by late 2021: 2.875%

“We are expecting the economy to heat up in the coming months,” notes Purohit.

“We expect 5- to 10-year Treasuries to go up another 25 basis points from current levels. We also expect the Treasury mortgage spread to increase by 25 basis points as the Fed announces tapering of its fourth round of quantitative easing by December 2021.”

He adds, “The primary-secondary spread should continue at current levels for a net increase in mortgage rates of about 50 basis points.”

Clifford Rossi, finance professor, University of Maryland

30-year mortgage rates by late 2021: 3.6%

15-year mortgage rates by late 2021: 2.6%

“These projections are based largely on what happens to the yield curve between now and the end of the year,” explains Rossi, “which is likely to steepen a bit more as fixed-income markets build inflationary expectations into their views.

“The Fed has signaled a commitment, at least for the time being, to keep short-term rates very low, so we could see a steeper yield curve ahead — which will affect the direction and level of mortgage rates.”

Matt Wright, chief financial officer, First Community Mortgage

30-year mortgage rates by late 2021: 4.25%

15-year mortgage rates by late 2021: 3.5%

“If the jobs report begins to outperform expectations, we can expect a rapid and marked increase in mortgage rates coinciding with an increase in the 10-year Treasury yield, as the Fed will be more likely to begin tapering their purchases of Treasuries and mortgage-backed securities,” says Wright.

“If so, we could easily see rates increase from their current levels. The potential for an increase in rates is far greater than a reduction in rates at this time.”

Check your mortgage rates. Start here

What are today’s mortgage rates?

Despite the pandemic, the past several months have bolstered the housing market in the form of lower interest rates.

As of this writing, rates for 30-year and 15-year fixed-rate mortgages were averaging around 2.93% and 2.24%, respectively.

Those are highly attractive numbers — close to all-time lows.

This has allowed first-time home buyers to take advantage of record-low mortgage interest rates.

And, it’s enabled more homeowners to refinance into lower rates and cheaper mortgage payments. Cash-out refinancing has become popular, too, as rising home vales and ultra-low rates create opportunities for homeowners to cash out their home equity.

Will mortgage rates keep dropping?

2021 saw an initial drop in mortgage rates. In fact, January recorded the lowest average rate ever: 2.65% for a 30-year fixed loan, according to Freddie Mac.

Unfortunately, there’s little chance mortgage rates will keep dropping in 2021.

The 10 experts we interviewed were unanimous: rates will either stay the same or creep toward the high-3% range over the next 6 months.

“It’s very unlikely interest rates will drop substantially below 3 percent by year-end” —Bruce Ailion, Relator, real estate attorney

“It’s very unlikely interest rates will drop substantially below 3 percent by year-end,” cautions Ailion.

“Housing prices are expected to continue to rise due to demographic factors, low interest rates, and a strong economy creating demand pressure. Homebuyers who wait face the double challenge of higher home prices along with higher inflation. Waiting will likely cost buyers more.”

For this reason and others, it may make sense to lock in a low rate sooner versus later if you are financially ready.

Find and lock a low mortgage rate

What’s driving mortgage rates right now?

To better understand what may happen with mortgage rates, pay attention to the broader economic situation.

Mortgage rates and inflation

High inflation numbers have the biggest potential to drive mortgage rates up in 2021.

“Expectations for higher inflation drifted up mortgage rates in March nearly 3.2 percent,” says Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors (NAR).

“Nevertheless,” she says, “the Federal Reserve has repeatedly reported that it considers any inflation to be temporary without affecting the Fed’s policy. As a result, rates recently dropped again to below 3 percent.”

Evangelou says investors — who ultimately determine mortgage rates — “will closely monitor inflation over the next several months.”

COVID cases and vaccinations

Another influence on mortgage rates this year? Easing of coronavirus lockdowns and an uptick in vaccination numbers throughout the country.

“That’s leading to a revival of economic growth, and it may be associated with an increase in interest rates to come,” explains Preetam Purohit, head of hedging and analytics for Embrace Home Loans.

“However,” he continues, “the Federal Reserve’s quantitative easing, the increase in bank demand for mortgage-backed securities, and a compression in the primary-secondary spread has provided some cushion that can soften mortgage rate increases.”

In other words, mortgage interest rates could rise at any time. But we’re not likely to see sharp spikes.

Federal Reserve policy

Arman Aroutiounian, head of Capital Markets for Reali, agrees.

“The biggest determinant of mortgage rates today are the actions the Fed is taking to curb the economic impact of the pandemic and keep interest rates low, including keeping the Fed Funds Rate near zero and purchasing Treasury bonds and notes,” he says.

The Fed’s benchmark rate doesn’t determine mortgage rates. But its bond buying program has been keeping them artificially low since last year.

If the Fed pulls back on that program any time soon, it could have a substantial impact on the rates mortgage borrowers pay.

The real estate market

Edward Mermelstein, founder and CEO of One & Only Holdings, insists that a stronger economy will bring greater demand for mortgages, which pushes rates up.

“Currently, the economy is on an upswing with home sales continuing to rise — which is why mortgage rates have been increasing recently,” notes Mermelstein.

“But if the economy starts to weaken, mortgage rates will drop to incentivize people to get mortgages. And if the housing market slows, we will see reduced demand for mortgages, putting additional downward pressure on rates.”

Find and lock a low mortgage rate

Strategy for home buyers and refinancers

Make no mistake: Waiting things out in the hope that interest rates will fall further could be a losing proposition.

Consider that home prices are expected to rise 9 percent in 2021 due to limited inventory, according to the NAR.

“It makes sense to wait only if mortgage rates are home prices are going to fall. But neither of these things are likely to happen in the following months,” says Evangelou. She recommends locking in a rate now if you enjoy job security and good financial health.

Others suggest borrowers should take their time and only pull the trigger when fully ready.

“Interest rates will remain relatively low for the foreseeable future, so the need to rush out and purchase a home should not be the primary driver for prospective owners,” advises Clifford Rossi, finance professor at the University of Maryland’s Robert H. Smith School of Business.

“My advice is to look at your budget and determine your need for housing over the next several years. If you are renting and see an opportunity to get into the housing market without overly stretching your finances, that seems like a reasonable thing to do.”

The same recommendation applies to existing homeowners considering a refinance, he says.

Your rate versus market rates

Remember that the rates cited here are projected averages. Even if the average mortgage rate increases to 3.5% or higher in 2021, rates in the low-3s could still be available to top-tier borrowers.

Your own interest rate could look very different from the overall market. It depends on your:

- Credit score

- Loan type

- Loan term

- Home price

- Down payment (home buying) or home equity (refinancing)

The mortgage lender you choose makes a big difference, too.

For example, mortgage refinance rates could vary as much as half a percentage point (0.50%) from one lender to the next. That spells serious savings on your monthly payments and long-term interest cost.

But you can’t just look at advertised rates. Those are based on ‘sample’ profiles and might not apply to you personally.

To find the lowest rate for your own situation, get personalized quotes from at least 3-5 lenders. Then choose the one with the best rate and lowest closing costs.

Your next move

There are various factors that will influence the real estate market between now and late December. These could drive rates higher or lower — from decisions by the Fed, to coronavirus news, to regulatory changes by Freddie Mac or Fannie Mae.

But it’s best to brace yourself for rising rates. Because, at least for now, that’s far more likely than lower rates.

Now is a great time to lock in if you’re ready. But if you’re not — as our experts said — it’s better to wait than to stretch your finances thin in this overheated market.

Do what’s right for you. And if you’re not sure, your real estate agent or loan officer can help you make the right decision.

Time to make a move? Let us find the right mortgage for you