ARMs are on the rise. Should you get one?

Adjustable-rate mortgages are getting more popular.

According to the Mortgage Bankers Association, the spike in ARMs is being driven by rising mortgage rates and increasing home prices.

Why is that? Well, ARMs typically have lower interest rates than fixed-rate mortgages — at least at first. So home buyers could potentially lower their monthly payments and increase their budgets.

But ARMs come with very real risks, too. So it’s important to understand the pros and the cons before signing on.

Verify your mortgage eligibilityIn this article (Skip to...)

What is an ARM?

An ARM is an adjustable-rate mortgage. In other words, its mortgage rate can float up and down in line with the larger interest rate market.

That makes an ARM very different from most mortgages, which have fixed interest rates.

With a fixed-rate mortgage (FRM), you can be sure that all your monthly payments will be the same over the life of the loan.

But with an ARM, you don’t have the same guarantee. Your rate could change down the line, and with it, your monthly payment.

Lower cost = greater risk

The attraction with ARMs is that they typically start with a lower mortgage rate — and thus a lower monthly payment — than an equivalent FRM.

A lower monthly mortgage payment means you can typically afford a bigger loan amount. So in today’s market, where real estate prices are rapidly rising and rates look set to increase, ARMs might seem more attractive to some borrowers.

For first-time home buyers an ARM might even look like a lifeline.

That’s because the lower initial monthly payments could mean they can still afford to buy a home, though perhaps a more modest one than they were dreaming of.

However, borrowers who opt for an ARM are shouldering a lot more risk if rates rise later on. That low rate is typically only locked for the first 5-10 years. After that, it’s possible for your rate and payment to rise to an unaffordable level.

So, how do you know if an ARM is a smart financial choice for you?

Is an ARM a good idea in today’s market?

Whether or not you should get an ARM depends on two factors: your appetite for risk and your future plans as a homeowner.

Your personality and risk management

ARMs are inherently riskier than FRMs, because your rate and payment can change. So your choice depends partly on how much risk you’re willing to accept as a homeowner.

Will rates be higher in 5-10 years when your fixed-rate period ends? And if so, by how much?

No one can say for certain. Economists are currently divided over what they think will happen to inflation. And if it ends up increasing in a sustained and sharp way, homebuyers with ARMs could end up exposed to a lot of risk.

Understanding ARM caps should be central to your risk management strategy. (If you’re unfamiliar with ARM caps, there’s more information below.)

Even if you have the sort of personality with which risk-taking comes naturally, you still need to be aware of just how high your monthly payments could go. And you’ll want to be sure you could cope if the worst happens.

Personal plans

Some home buyers who choose an ARM plan to avoid the risk of higher rates altogether.

An ARM can be perfectly safe if you’re planning on moving or refinancing the mortgage within your initial fixed-rate period. Because you’ll close the ARM before higher rates can kick in.

However, there’s always risk of plans changing.

A move could be delayed due to family or work plans changing, or unexpected financial troubles. And there’s no guarantee a refinance will make sense in the next few years — if rates go up, your next home loan will be more expensive in any case.

That’s not to say an ARM is always a bad idea. Many home buyers do move before their fixed-rate period ends, and save a lot of money thanks to their ARM choice. But it’s important to fully understand the risks before choosing this type of loan.

Compare mortgage options

Today’s ARM rates versus fixed rates

Rates for ARMs are traditionally lower than those for FRMs. But the gap narrows and widens over time. And it also depends on the type of mortgage you want.

For example, in April 2021, the average rate across all ARM loans was 3.10%, according to ICE Mortgage Technology. The average rate for all fixed-rate mortgages was 3.22%.

However, the gap for conventional ARM loans was more attractive: 3.25% for FRMs compared with 2.1% for ARMs. Let’s look at what that means in cold, hard dollars.

An example in dollars

Using The Mortgage Reports’ mortgage calculator, we modeled the numbers for a $250,000 home with a $50,000 down payment, making the conventional mortgage amount $200,000:

| Fixed-Rate Mortgage | Adjustable-Rate Mortgage | |

| Interest Rate | 3.25% | 2.1% |

| Monthly Principal & Interest Payment | $870 | $750 |

| Mortgage Interest Paid in 5 Years | $31,300 | $20,000 |

That $120 a month difference looks pretty good. It might make the difference between your becoming a homeowner or continuing to rent. Or it may let you buy a nicer, more costly home than otherwise.

On the other hand, if you’re buying a forever home (or one you plan to stay in at least 10 years), a fixed rate might look more attractive.

The payments are a little higher, but they’re guaranteed to stay the same over the life of the loan. And that offers a lot of peace of mind.

How ARM rates work

Adjustable rate mortgages are more complex than fixed-rate loans. If you’re considering one, you’l want to understand the ins and outs of how adjustable rates work.

Hybrid ARMs — An initial fixed rate

Nowadays, most ARMs are hybrid ones. That means they come with an initial period when the rate is fixed. Only when that period ends can the rate float up and down.

You’ll see ARMs advertised with an x/y designation, such as 7/1.

The first numeral is the number of years the initial fixed-rate period lasts. And the second number is the frequency with which your lender can adjust the rate after that initial period ends.

Perhaps the most common type is the 5/1 ARM. That means the initial fixed-rate period lasts five years. And the /1 means lenders can adjust the rate every one year (annually).

Importantly, most ARMs these days have a total loan term of 30 years.

That means, for a 5/1 ARM:

- Your initial interest rate is fixed for 5 years

- The rate can adjust each year after that for the remaining 25 years

- Your home is fully paid off at the end of the 30-year loan

There are other ARM flavors, too. You might choose from the most popular ones: 3/1, 5/1, 7/1, and 10/1, though you may find others.

But the longer your initial period, the higher the mortgage rate you’re likely to be offered.

Verify your new rate

ARM caps

Today, most ARMs come with caps. These limit the amount your mortgage rate can rise. ARM caps apply in three ways:

- Limit the amount your rate can rise at the first adjustment

- Limit the amount your rate can rise with each subsequent rate adjustment

- Limit the amount your rate can rise over the entire lifetime of your mortgage loan

However, such caps are not legally required. So you should check that the ARMs you’re offered have these valuable borrower protections.

You should also make sure you’re comfortable with the level of protection offered.

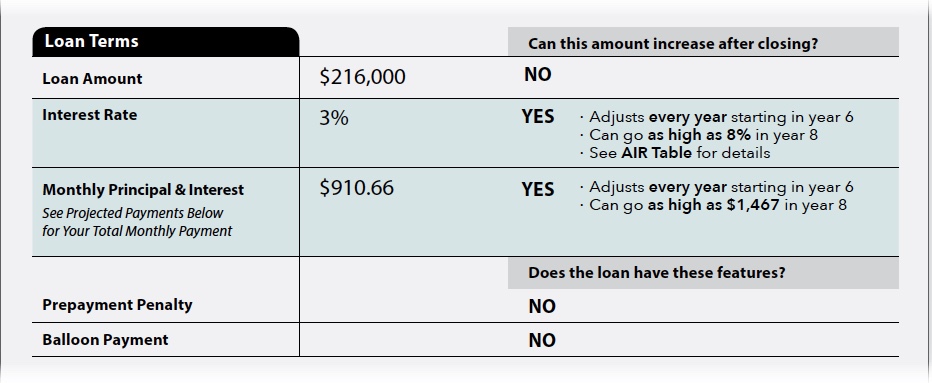

Thanks to the CFPB, your “Loan Estimate” (another name for the quote lenders must send you) must show the extent of your exposure to risk.

Look on the first page of your estimate for this section:

Image: Consumer Financial Protection Bureau

You’ll see that, in this example, your initial monthly payment of $910 could shoot up to $1,467 in year eight. That should only happen if other interest rates rise sharply. But they might.

So you need to ask yourself: How confident am I that I could comfortably afford that higher payment at that time — and possibly higher payments going forward?

If you’re not comfortable with the prospect of higher payments, an ARM likely isn’t right for you.

Planning ahead: Where will rates be in five years?

Most borrowers who choose an ARM have a fixed rate for the first five years. So the big question to consider is, where will rates be five years from now, when the fixed period ends?

No one can say for certain.

The late Harvard economist John Kenneth Galbraith once said, “The only function of economic forecasting is to make astrology look respectable.” And he was right. Because anyone who predicts with certainty where mortgage rates will be next week — let alone in five years — is more than likely to be proved wrong.

What we can do is look at what’s influencing rates and guess where they might end up. Right now, that’s not looking so good.

Rates set to go higher?

At the moment, the Federal Reserve is keeping interest rates artificially low. Most of the rates you pay (including ARMs that are beyond their initial fixed-rate period) are directly linked to the federal funds rate. And that’s currently at its all-time low.

But many economists fear that we’re about to experience a bout of higher inflation as the economic recovery from the COVID-19 pandemic gains traction.

That would force the Fed to hike its rates — causing ARM rates to rise — perhaps sharply and for years or decades to come.

Yes, we’ve grown used to uber-low interest rates over the last decade or so. But they’re not normal or guaranteed. And you certainly shouldn’t rely on them staying where they are if you go with an ARM.

How to decide between a fixed- and adjustable-rate mortgage

To sum it up, now is actually a very risky time to buy your forever home using an ARM.

Yes, you can refinance to an FRM or another ARM further down the line. But that’s not cheap. And there’s a good chance both those rates will have risen by then.

So, pay close attention to the caps we discussed above that limit your exposure to risk. And ask yourself: Will you really be able to comfortably afford those higher payments if they become necessary?

You should also question how certain you are that you’ll move home before your initial, fixed-rate period expires, if that’s your plan.

What you don’t want to do is be dazzled by the savings you can initially make with an ARM and ignore all the risks.

This is one of those decisions you want to make with due consideration. Your mortgage lender and loan officer can help you decide.

But ultimately, only you can answer the question: “Is an ARM loan a good idea?”

Resources for borrowers: If you’re considering getting an ARM, you can download a free PDF of the CHARM booklet (Consumer Handbook on Adjustable-Rate Mortgages) from the Consumer Financial Protection Bureau (CFPB). It’s 12 pages long and is packed with essential information.

Time to make a move? Let us find the right mortgage for you