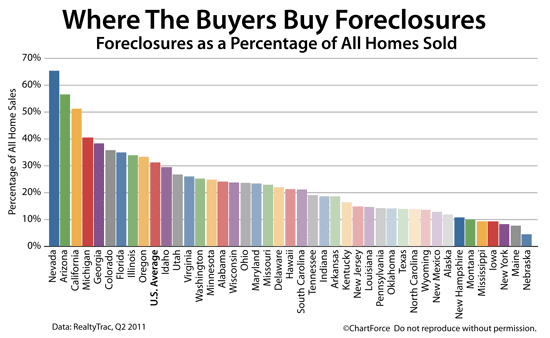

In some states, more than half of home sales are for homes in foreclosure.

National Average : 31% Of All Home Sales

Foreclosures have dwindled this year, falling 35 percent nationwide in July and reaching a 4-year low. In some states, though, foreclosures remain big business.

Within places like Nevada, for example, where the state-wide foreclosure rate is more than double the next closest state, foreclosures account for 65% of all home sales. In Arizona, the figure is 57 percent; in California, it’s 51 percent.

It’s no surprise that these 3 states lead the nation in Foreclosures as a Percentage of All Home Sales. Not coincidentally, they’re the same 3 states that top the Foreclosures Per Household list.

Time to make a move? Let us find the right mortgage for you

.

Foreclosures (Supposedly) Sell At Big Discounts

One reason why foreclosures remain popular is that they’re often sold relatively cheaply as compared to comparable non-distressed homes. According to a survey from RealtyTrac, the average foreclosed home sells for 32% less than a non-foreclosed home.

Note : This doesn’t mean you’ll get a 32% discount just for buying a distressed home.

In compiling its data, RealtyTrac averaged the sale prices of all homes sold in foreclosure; and averaged the sale prices of all homes sold not in foreclosure, and then simply divided them. The data is skewed because the foreclosed homes and non-foreclosed homes may have been in different price ranges.

The ratio, in other words, gets goofed.

The National Association of REALTORS® says distressed homes sell for 20 percent off. That’s likely closer to the actual distressed-home discount.

Get Foreclosure / Short-Sale Rate Quotes

If buying a foreclosure is on your to-do list, talk to a real estate agent first. Homes bought from banks are often sold as-is and may have material defects to make them unlendable. Do your research before you bid.

And if you’re an investor, remember that you can pay cash for a home and get your equity back immediately post-closing. It’s because of a new lending approval known as the Delayed Financing Rule. You can .