USDA loan eligibility at risk after 2020 census

If you’re banking on a USDA loan to buy a house, it might be time to start getting serious about applying. Because the 2020 census could change the map of eligible areas.

Currently, 97% of the U.S. landmass is USDA-eligible. But the map is based on population size, and it hasn’t been completely revised since 2000.

There’s no guarantee the USDA program will change after the 2020 census.

But if new population data is accounted for, that 97-percent-eligible map could shrink significantly — cutting way back on the number of homes that qualify for zero-down USDA financing.

Verify your USDA loan eligibility with Neighbors Bank. Start hereIn this article (Skip to...)

- USDA loan benefits

- The current USDA loan map

- Is the home you want eligible now?

- Will the 2020 census change the USDA loan map?

- No word on changes from USDA

- What about areas that are “rural in character”?

- Areas most and least likely to be affected

- Do you qualify for a USDA loan?

USDA loan benefits

First, let’s revisit why so many buyers rely on USDA loans to become homeowners.

The USDA Rural Housing Loan is designed to serve people who have less access to financing, including rural and low- to moderate-income families.

For those who qualify, this program has huge benefits, including:

- Zero down payment required — Though you can make one if you want

- Smaller mortgage insurance payments — Annual mortgage insurance costs just 0.35% of the outstanding loan balance each year, compared to 0.85% for FHA loans

- Competitive mortgage rates — USDA loan rates are often significantly lower than conventional mortgage rates

- Moderate credit score threshold — Most lenders allow credit scores of 640 and up for a USDA loan

The only other mainstream loan to offer zero down is a VA mortgage. And to get one of those, you need to be a service member, veteran, or otherwise military-affiliated.

USDA loans, on the other hand, don’t have any occupation requirements. Anyone can apply, as long as they live in a qualified ara and make low- to moderate-income.

The current USDA loan map

This loan program is backed by the United States Department of Agriculture (USDA).

But to apply for USDA financing, you do NOT need to be engaged in an occupation in any way connected with farming. You just need buy a house somewhere “rural.”

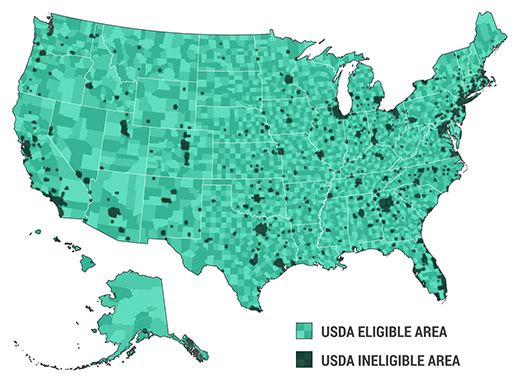

Source: USDAloans.com based on Housing Assistance Council data

Is the home you want eligible now?

USDA’s “rural” designation is stretched widely. No, you won’t be able to buy a downtown penthouse in a big city. But some suburbs of smaller towns and cities do count.

In fact, homes across 97% of the map of America are currently (though not necessarily after the census) eligible. That’s because all places that aren’t designated as urban count as rural. And only 3% of the US landmass is “urban.”

Want to know whether a property you have your eye on is currently in an eligible area? Use this lookup tool on the USDA’s website. Check the map or type in the address.

Will the 2020 census change the USDA loan map?

The last time the census triggered a wholesale revision of the USDA loan map was in 2000. After the 2010 census, the American economy was considered still too weak from the Great Recession to change the program significantly.

True, there was a limited reform in 2017. But that barely tinkered with the map. So for all intents and purposes, the USDA loan map hasn’t substantially changed in 20 years.

Now, it’s possible that a future administration could think the 2021 post-pandemic economy too weak to implement map changes, just as happened in 2010.

The USDA loan map hasn’t substantially changed in 20 years.

But that might depend on the results of the next election and who sits in the Oval Office and controls Congress.

In short, there’s a lot of uncertainty about what will happen to USDA lending after the 2020 census.

So if you’re relying on a USDA loan to buy a home in the near future, it might be time to get serious about applying.

But if you were planning to wait a few years anyway, it likely makes more sense to wait things out and see what happens — no need to jump into homeownership before you’re ready because of a possible change to the rules.

Verify your USDA loan eligibility

No word on changes from USDA

We asked USDA to contribute to this article, hoping to get a feel for what the post-census changes might mean — or whether there would be any changes at all.

In an email, a USDA spokesperson replied:

"Several of your questions seek information on events that have not occurred or may not occur. It is USDA policy not to comment on hypotheticals. USDA will determine what, if any, eligibility adjustments need to be made after the 2020 Census results are tabulated."

This makes sense, although it’s not a huge help to would-be homeowners wondering whether they need to apply in the next year or so.

Absent new legislation, the existing law says that an area currently designated as rural will remain so until 2030, providing it:

- Has a population under 35,000

- Is “rural in character” (aka “special circumstances”)

- Has a serious lack of mortgage credit for lower and moderate-income families

So, unless your area’s population has risen above 35,000, you should be safe on that score.

What about areas that are “rural in character”?

There’s another factor home buyers need to consider: that many USDA-eligible areas might no longer qualify as “rural in character” after the 2020 census.

USDA explained to us how the department defines areas that are “rural in character.” The department is developing regulations to establish a rural-in-character definition. But existing law says it is an area that:

"... has 2 points on its boundary that are at least 40 miles apart; and is not contiguous or adjacent to a city or town that has a population of greater than 150,000 inhabitants or an urbanized area of such city or town."

That’s a bit of a word salad. But, according to our reading, it seems to mean that the area:

- Must be 40 miles or more across at its widest point

- Cannot have a town or city with more than 150,000 residents within, on or near its boundary

- Mustn’t have a community with fewer than 150,000 residents within, on or near its boundary if that community is part of a larger town or city that busts the 150,000 limit

Here’s the issue: Many areas that are currently rural in character could find that a town or city on or near their boundaries has grown significantly since the 2000 census — potentially breaking that 150,000 population limit.

It would only take a city with a population of 145,000 to have added 5,000 souls over the last 20 years.

And, currently, that should see those areas erased from the loan map. But how likely is that where you want to buy?

Areas most and least likely to be affected

Whether or not your area could be at risk of de-qualification from USDA lending depends on population trends where you live.

States such as Wyoming, West Virginia, and Illinois, which have had shrinking populations, may be relatively safe. Indeed, it’s possible that some hard-hit places could actually regain eligibility on the USDA loan map.

But Idaho, Nevada, and Utah, for example, are among those states that have seen their populations increase significantly.

It would be no surprise if some towns and cities in those and other growing states had seen places shoot through the 150,000-population barrier.

If your local population is rapidly growing, there’s a chance your area could lose access to USDA loans.

And if one of those communities were within 40 miles of where you want to buy, you might lose access to USDA loans.

Of course, these things aren’t determined by what’s happening in whole states. It’s much more local. And there may be areas where populations are declining in some growing states. Conversely, hot spots in others may have expanding populations in spite of wider migration trends.

You can, of course, research population trends since 2000 in larger towns and cities near your target area. Or you could play it safe by applying for your USDA loan before any of these risk factors come into play.

Do you qualify for a USDA loan?

A rural location isn’t the only requirement to qualify for a USDA loan. You also need to meet the “ability to repay” standards as a borrower. That means having good credit and steady income.

Unlike many home loans, there’s an income cap to qualify for USDA financing.

The program is intended to promote rural development, not subsidize wealthy homebuyers. So, to be eligible, your household income can’t be higher than 115% of the median household income in the area where you’re buying.

No idea how your income compares with others where you want to buy? No problem. You can check that on our USDA income lookup tool.

Aside from that, USDA has similar requirements to any other mortgage.

You’ll have to have to show consistent employment and income histories, and “a willingness and ability to handle and manage debt.”

The only other significant requirements are:

- You must get a 30-year, fixed-rate mortgage — You can’t have an adjustable-rate mortgage (ARM)

- You must personally occupy the dwelling — Meaning it’s your primary residence, no investment properties or vacation homes allowed

- You must be "a U.S. Citizen, U.S. non-citizen national or Qualified Alien," according to the USDA website

If you meet all these requirements, there’s a good chance you may qualify for a USDA home loan. Speak to a lender to find out for certain whether you’re eligible, and how large of a loan you qualify for.

Time to make a move? Let us find the right mortgage for you