The company behind the popular FICO scoring model published a “What If?” series for common, specific credit missteps.

The company behind the popular FICO scoring model published a “What If?” series for common, specific credit missteps.

Measure Changes To Your FICO

If you’ve ever wondered how your credit score would be affected by a missed payment or a maxed-out credit card, myFICO.com makes a look-up guide available to assess the probable damage.

Verify your new rateHere’s a few common financial difficulties and how they’ll affect your credit scores, based on your “starting score”.

Max-Out A Credit Card

- Starting score of 780 : 25-45 point drop

- Starting score of 680 : 10-30 point drop

30-Day Delinquency

- Starting score of 780 : 90-110 point drop

- Starting score of 680 : 60-80 point drop

Foreclosure

- Starting score of 780 : 140-160 point drop

- Starting score of 680 : 85-105 point drop

Not surprisingly, the higher your starting score, the more each given difficulty can drop your FICO. This is because credit scores are meant to predict the likelihood of a loan default. People with lower FICOs are already reflecting the effects of risky credit behavior.

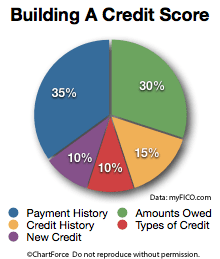

Also worth noting that the above is just a guide — your scores may fall by more — or less — depending on your individuak credit profile. The number and type of credit accounts you hold, plus their respective payments and balances make up your complete credit history.

What Rate Will You Get For Your Credit Score?

Protecting your FICO matters. When your credit scores are high, you get access to better, lower mortgage rates than the next guy. And every 1/8 percent matters to your household budget.

What rate will you get with your credit score?

Time to make a move? Let us find the right mortgage for you