2020 housing market: New year, same old?

The new year is almost upon us. But though the page on the calendar will change, it seems that housing conditions largely won’t.

According to most experts, 2020 will see much of the same as 2019:

Low mortgage rates, tight housing inventory, and rising home prices (though not everywhere, this time).

Wondering if you should buy or sell a house in the new year? Study up on this housing market forecast for 2020.

Find and lock a low mortgage rate todayJump to:

Mortgage rates

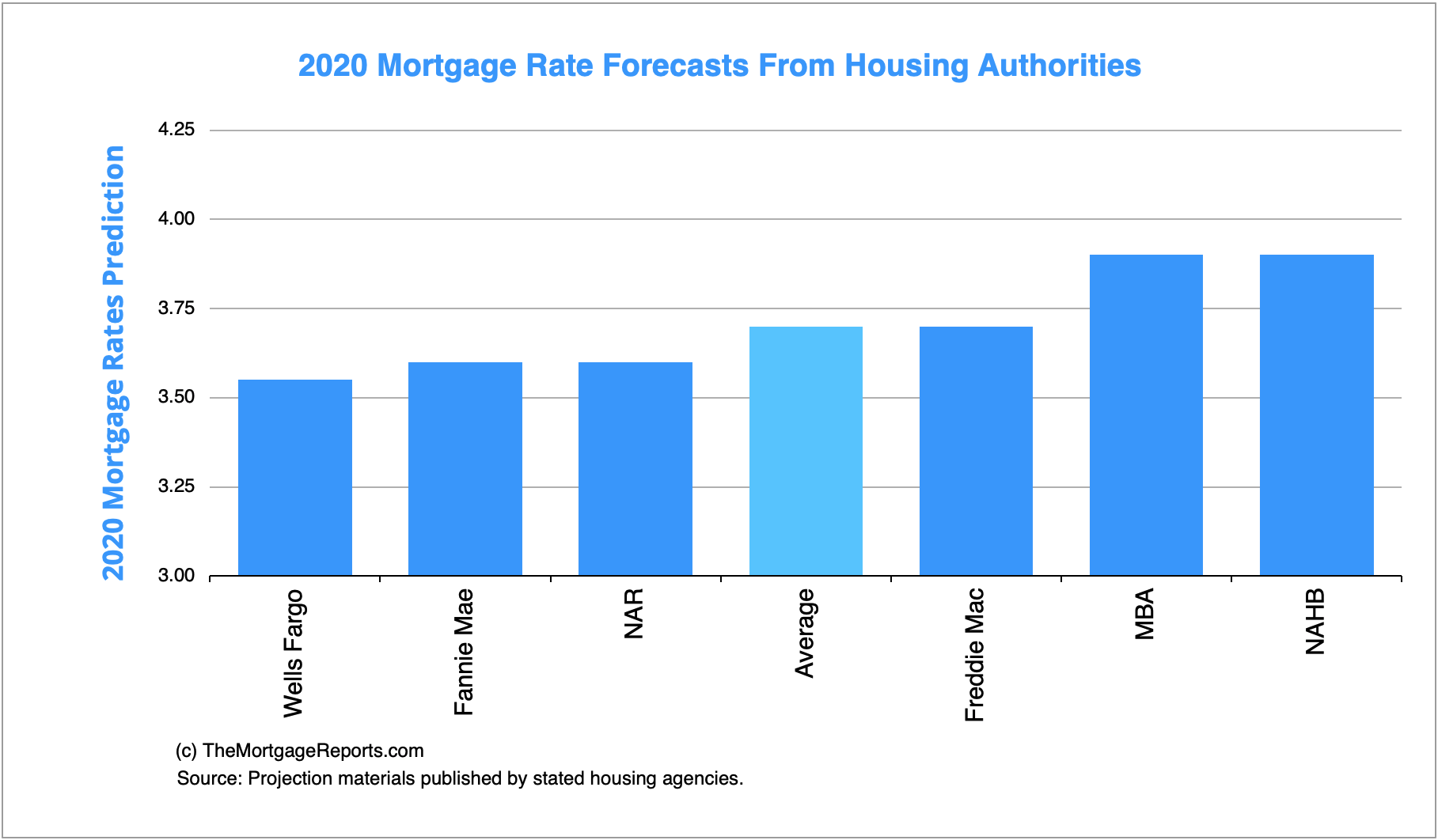

The news is all good for mortgage rates. No matter where you look, experts are predicting sub-4 percent rates across the year.

Fannie Mae predicts the lowest rates, with a 2020 average of 3.6 percent, while Realtor.com clocks in with the highest at 3.85 percent.

Here’s how industry predictions shake out:

- Fannie Mae: 3.6 percent

- Mortgage Bankers Association: 3.7 percent

- Freddie Mac: 3.8 percent

- Redfin: 3.8 percent

- Realtor.com: 3.85 percent

Don’t expect rates to go too low, though — no matter what happens with the economy.

“Although the housing market is strong, weakness in other sectors, like manufacturing, is pulling down on the economy,” says Daryl Fairweather, Redfin’s chief economist.

“Because investors are already bracing for the possibility of a recession, we don’t expect mortgage rates to fall much lower than 3.5 percent in 2020 even if the economy weakens.

Find and lock a low rate now

Housing inventory remains a challenge

Inventory has been notoriously tight over the last year, and experts are saying that trend will continue — especially on the lower end of the market.

In fact, Realtor.com’s senior economist George Ratiu even predicts a possible “historic low level” of inventory in the coming year.

Here’s how Ratiu explains it:

“As mortgage rates sank in March, the low rate environment gave the housing market a second wind,” says Ratiu.

“Thousands of buyers that were priced out by sky-high prices found a way to enter the market by leaning on financing, and those that were on the edge of qualifying were suddenly and automatically back in.”

“At the start of the year, two out of three markets were seeing inventory growth. As we wrap the year, only one in 10 are seeing growth.” —George Ratiu, Senior Economist, Realtor.com

“At the start of this year, two out of three markets were seeing inventory growth,” he continues. “As we wrap the year, only one in 10 are seeing growth, placing housing into acute shortage mode.”

Though residential housing starts and building permits are actually up as of late, rising demand will likely outpace builder construction — particularly with first-time buyers.

First-time buyers increase inventory pains

According to data from TransUnion, a whopping 8.3 million first-time homebuyers will hit the market in the next three years.

| Date Range | Number of First-Time Home Buyers* |

| 2007-2009 | 6.75 million |

| 2010-2012 | 6.32 million |

| 2013-2015 | 6.67 million |

| 2016-2018 | 7.64 million |

| 2020-2022 | 8.31 to 9.2 million |

*Data from TransUnion. 2020-2022 data is a projection. 2019 is not included because the year has not completed.

“Overall buyer demand will remain very robust, particularly at the entry-level,” Ratiu said.

“The largest population cohort in the country — those born in 1990 — will turn 30 in 2020, accounting for 4.8 million Millennials hitting peak homebuying age.”

In total, Millennials are projected to make up more than half of all mortgages in the coming year. (That is, if they can find homes in their price range to purchase.)

>> Related: What to look for in a starter home

“The market is still years away from reaching an adequate supply of homes to meet today’s demand from buyers,” Ratiu said.

“A steady flow of demand and robust-yet-declining seller sentiment will combine to ensure there is no surplus adequately-priced inventory.”

Home prices could fall in select markets

Will housing prices drop in 2020? Not across the board, but in some places, you might see a slip-up.

Industry experts predict home prices to rise nationally, increasing anywhere from 0.8% (Realtor.com’s forecast) to 2.9% (Freddie Mac) across the year.

But that’s just at the national level. Locally, some markets may see home prices decline.

According to Realtor.com’s forecast, prices will decrease the most in:

- Kansas City, Missouri (-4 percent)

- Scranton, Pennsylvania (-3.2 percent)

- Greensboro, North Carolina (-2.9 percent)

- New Haven, Connecticut (-2.4 percent)

- Tulsa, Oklahoma (-2.3 percent)

- Buffalo, New York (-2.2 percent)

Conversely, home prices will rise the most in:

- Boise City, Idaho (+8.1 percent)

- Colorado Springs, Colorado (+6.3 percent)

- Bridgeport, Connecticut (+4.8 percent)

- Atlanta (+4.5 percent)

- McAllen, Texas (+4 percent)

- Chattanooga, Tennessee (+3.6 percent)

- Salt Lake City (+3.5 percent)

- Phoenix (+3.4 percent)

- Tucson, Arizona (+3.3 percent)

- Memphis, Tennessee (+3 percent)

Redfin predicts Charleston and Charlotte will see high price jumps as well. Charleston saw a 104 percent increase in listing views last quarter, while Charlotte’s were up 44 percent.

Both cities are seeing growth as buyers migrate out of more expensive metros and as major corporations move in, bringing jobs and an economic boost with them (Volvo in Charleston and Microsoft in Charlotte).

A note for West Coasters: You’ll likely notice there aren’t any high-cost Western markets mentioned above — and that’s because these areas will continue to see a cooling off as we head into 2020.

“Low rates won’t be enough to reignite high growth rates in the nations highest-priced markets, notably on the West coast and in the Northeast.” —Skylar Olsen, Director of Economic Research, Zillow

As Skylar Olsen, Zillow’s director of economist research, explains, “Low rates won’t be enough to reignite high growth rates in the nation’s highest-priced markets, notably on the West Coast and in the Northeast.”

“In these markets, buyers seem to have hit an affordability ceiling where even low rates can’t bring many homes into the typical first-time buyer’s budget range,” continues Olsen.

“Especially because low rates don’t help overcome the upfront hurdle of high down payment requirements. In those high-priced markets, buyers will continue to fan out in search of more affordable areas.”

>> Related: Find low- and no-down-payment mortgages for 2026

Buyer & seller competition

Bidding wars actually hit a 10-year low recently, and buyers have been seeing the smallest levels of competition in a while.

Unfortunately, with more inventory struggles on the horizon and increasing demand from younger homebuyers, that trend is likely to reverse sooner than later.

According to Fairweather, bidding wars will start to rebound by the first quarter of 2020.

“Low mortgage rates will continue to strengthen homebuying demand, but due to a lack of new homes for sale and homeowners staying put longer, there will be fewer homes on the market in 2020 than in the past five years,” she said.

“We expect about one in four offers to face bidding wars in 2020 compared to only one in 10 in 2019.”

“We expect about one in four offers to face bidding wars in 2020 compared to only one in 10 in 2019.” —Daryl Fairweather, Chief Economist, Redfin

For sellers, competition levels will depend on the price point, with more luxury-end properties requiring “more patience and a thoughtful approach to pricing,” according to Ratiu.

“Properties will take longer to sell, and incentives will be needed to close deals. As the market moves toward a more balanced scenario, sellers who adjust to local market conditions can expect to benefit from continuing demand,” he said.

Sellers with entry-level homes, on the other hand, can continue to expect a good number of buyers and potential multiple-offer situations.

Other housing trends

Those are the biggest pieces of the housing puzzle for 2020.

But there are other predictions you may want on your radar if you’re thinking of buying or selling a house next year.

Here are a few:

Existing home sales will drop

Realtor.com predicts 2020 will see a 1.8 percent dip in existing home sales, due to declining inventory in this class of properties.

The decline will stem from two trends: First, Boomers are continually opting to age in place rather than move on to adult communities, nursing homes, and other facilities.

According to data from Freddie Mac, if today’s seniors behaved the same as those in generations past, we’d have an additional 1.6 million homes on the market.

Homeowners are also staying put longer. Data from Redfin shows they’re staying an average of 13 years (up from just eight years in 2010). In some cities, tenures are as long as 23-plus years.

Buyers will migrate out of larger cities

Downtown urban cores may have been all the rage a few years ago, but as Millennials age and start families of their own, their popularity is waning.

Large swaths of the population are opting out of higher-cost markets like New York and Los Angeles, instead moving toward more mid-priced cities on the outskirts and in the suburbs.

>> Related: The most affordable places to buy a home when you’re starting a family

“The move to affordability trend will continue in 2020, fueled by the twin forces of Baby Boomers retiring and seeking sunnier weather, lower taxes, and lower cost of living, and Millennials searching for family-friendly lifestyles and affordable housing,” Ratiu said.

“Homebuyers are increasingly looking not only at suburban environments near large metropolitan areas, but also considering options across state lines.”

He predicts states in the southwest like Arizona, Nevada, and Texas will see a serious influx from California emigrants, while Northeasters will head for the Carolinas, Florida, and Georgia.

Find the lowest mortgage rates in your area. Start hereRefinancing will continue its heyday (at least at the start of the year)

Refinancing surged in 2019, with refi activity at one point clocking in 344 percent higher than a year prior.

According to Freddie Mac, this movement will likely continue for at least the first half of the year.

Both Freddie Mac and the Mortgage Bankers Association’s recent real estate forecasts show refinancing will make up about a third of all mortgage activity in 2020.

You can check your own refinance eligibility right here.

Whatever you do, shop around

Whether you buy your first home, invest in a second one, or sell a property in 2020, the most important thing is to shop around.

Shop around for the house, your real estate agent and, most importantly, your mortgage rate. Doing so can save you thousands (even tens of thousands) over the course of your loan.

Want to see what mortgage rates you qualify for? You can get started right here.

Time to make a move? Let us find the right mortgage for you