The refinance calculator can help answer the eternal question: “With rates dropping, is now the time to refinance?”

The ability to refinance is one of the great options available to mortgage borrowers.

Almost all loans now give borrowers the right to prepay their mortgage without penalty. This means you can lower your monthly mortgage costs in the right situation.

Ah, but how do you know when it’s the right time to refinance? To find out let’s work with a calculator. As you’ll see, there’s both useful information as well as additional questions you need to ask.

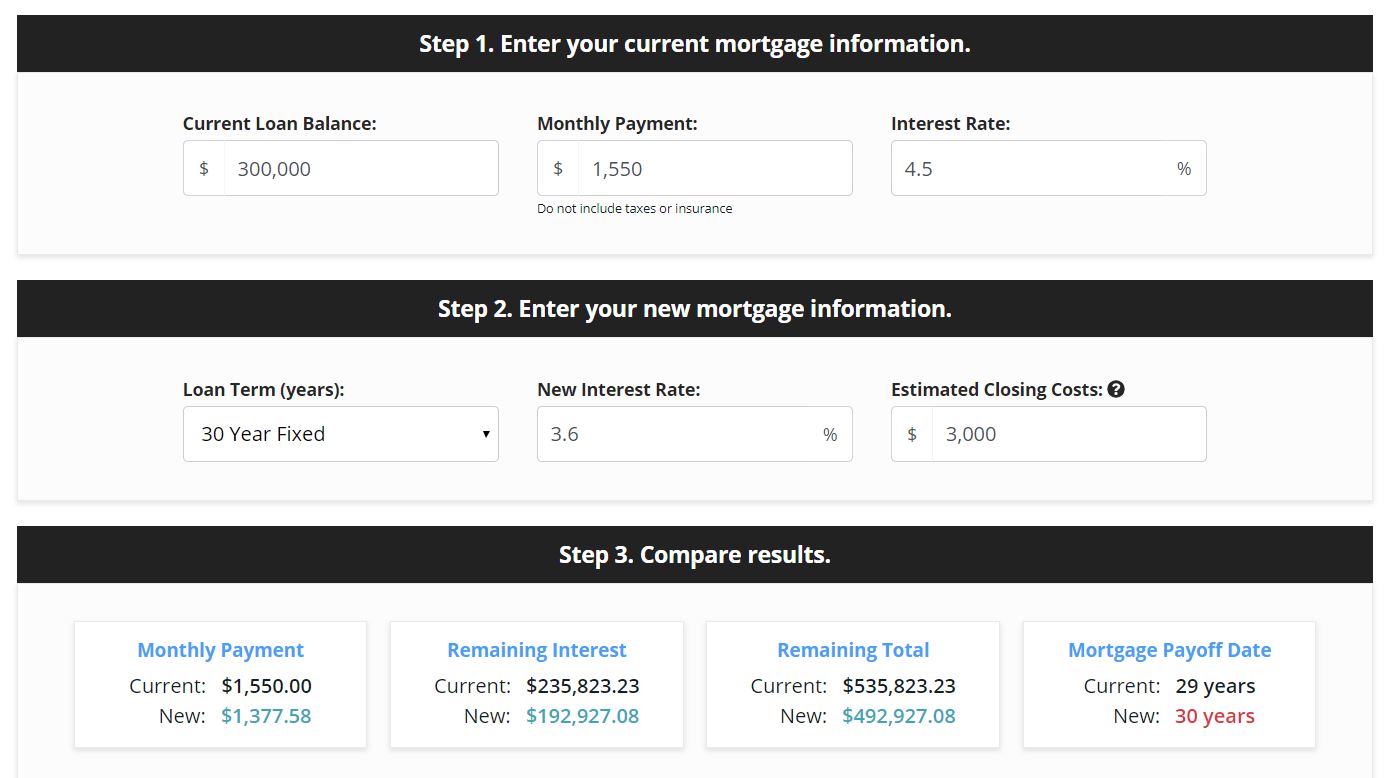

Step 1: Enter current financing data into refinance calculator

We first need to input our current mortgage balance into this online refinance calculator, then, interest rate and the monthly payment for principal and interest. For a rate-and-term refinance we’ll borrow an amount equal to the current loan balance and not the original – and larger – debt.

Step 2: Enter the new loan characteristics

In this section, we need to add three pieces of information.

- How long is our new mortgage? We can replace a 30-year mortgage with a new 30-year mortgage. That will give us the lowest monthly cost. Since mortgages today almost universally allow prepayments (partial or total payoff) without penalty, you might want to stick with a 30-year replacement mortgage. If you want, you can then make additional monthly payments as your finances allow. Prepayments can speed the debt reduction process.

- The new mortgage rate. Can we really get the 3.6% mortgage rate we’ve been reading about? Part of the answer depends on our credit standing. If you have an 800 credit score than 3.6% may be realistic. If your credit score is 690 you probably want to enter a higher interest rate.

- Closing costs. The online refinance calculator allows us to enter estimated closing costs. The calculator assumes we are tacking the loan fees onto the new loan amount. With $4,000 in estimated closing costs, for example, the monthly payment rises.

It is possible to refinance with lower closing costs. For example, you might want to consider a no-closing-cost refinance. In this situation, the lender pays some or all of the settlement charges in exchange for a higher interest rate. However, keep your eyes on the prize. Make sure the refinance still provides value even if you get a slightly above-market rate.

Step three: Examine the results

Once our new and old information has been entered, the refinance calculator will return four results.

Monthly payments. The program will show the difference between our current monthly payment and the new one. Since the refinance calculator is so easy to work try it with both a figure for expenses and without. Without expenses, you can see the direct impact of a lower rate.

Remaining Interest. Here the program is explaining the cost of interest over the remaining life of the current mortgage and the new mortgage. This is useful information in the sense that it gives us the savings that can arise from refinancing.

In practice, very few mortgages are held the full term (i.e. 30 years). The real importance of the remaining interest measure is that it means with a good refinance we’ll owe a lot less to the lender when we sell or refinance in the future.

Remaining total. In this area, we can see the total remaining costs if we keep our current financing or replace it with a new loan. We’ll be ahead by over $40,000 over the long term with refinancing in this example. Again, while this is a useful measure, in virtually all cases the loan will be paid off long before 30 years so our actual savings may not be quite as much.

Payoff date. This area shows us how much longer the new and old financing will be outstanding.

How long will you keep the new loan?

The refinance calculator gives us good numbers to better understand the potential savings that might come from refinancing. However, borrowers also need to consider a factor which the calculator cannot measure.

If the calculator shows you can save $100 a month that’s great. But can you take advantage of such savings? If you expect to move in 18 months and the cost to refinance is $3,000 you won’t have enough time to get your money back.

If you save $100 per month but expect to move in 18 months, and closing costs are $3,000, you won’t have enough time to get your money back.

A good general measure is to expect to recover closing costs within 36 months through monthly savings. If that doesn’t seem possible then you have to carefully consider the value of refinancing.

Material benefit & the refinance calculator

When refinancing borrowers should look for at least one of four benefits before refinancing.

- A lower monthly payment.

- A lower interest rate.

- More security, such as a conversion from ARM financing to a fixed-rate loan.

- A shorter loan term.

If you see one of these benefits then refinancing is something to consider. For more information, use the refinance calculator to see how you might save. There’s no obligation and you don’t have to provide your name or email.

Start your refinance if the numbers tell you to

If the refinance pencils out, start your process now. Rates are low but they may not stay that way.

Start your refinance below and capture today’s historicl low rates.