Interest rate environment to enter uncharted territory

Mortgage rates have been dropping fiercely, so many rate shoppers assume they can’t go any lower.

They would be wrong.

Quite frankly, the U.S. economy is in uncharted territory, the conditions of which could spell the lowest mortgage rates ever.

Recently, mortgage rate expert Barry Habib predicted mortgage rates would fall to “the lowest they’ve ever been.” At the time, it seemed merely a click-bait claim.

Now, it appears strangely prescient.

The spread between two key interest rates inverted Wednesday, August 14, 2019. Here’s why that seemingly insignificant phenomenon could lead to ultra-low mortgage rates, perhaps the lowest ever recorded.

Get started here to check today's mortgage rates.What’s the big deal about a ‘yield curve inversion’?

In short, a yield curve inversion is a big deal because it’s awfully good at predicting oncoming recessions.

In fact, it’s accurately predicted the last seven of them.

And with recessions typically come very low interest rates (more on that later).

A yield curve inversion has accurately predicted the last seven recessions.

In a normal world, a 10-year U.S. Treasury bond will pay investors more than the 2-year.

That makes sense. In exchange for holding your money longer, you get paid a bigger “yield,” or interest rate, on that bond.

A yield curve inversion is when short-term bonds pay more than long term ones. In this case, the 2-year note pays more than the 10-year. This has happened prior to every recession in recent memory.

But, why would a short-term bond pay more? Well, markets believe that the government will soon intervene and bring long-term rates down via stimulus. No one wants to commit to a 10-year bond when things are so uncertain.

And this brief but significant inversion happened on August 14, and it could usher in a new era for mortgage rates.

Why rates could drop much lower after the yield curve inversion

As mentioned above, the U.S. economy is entering uncharted territory.

Never before have rates already been so low when recession fears hit.

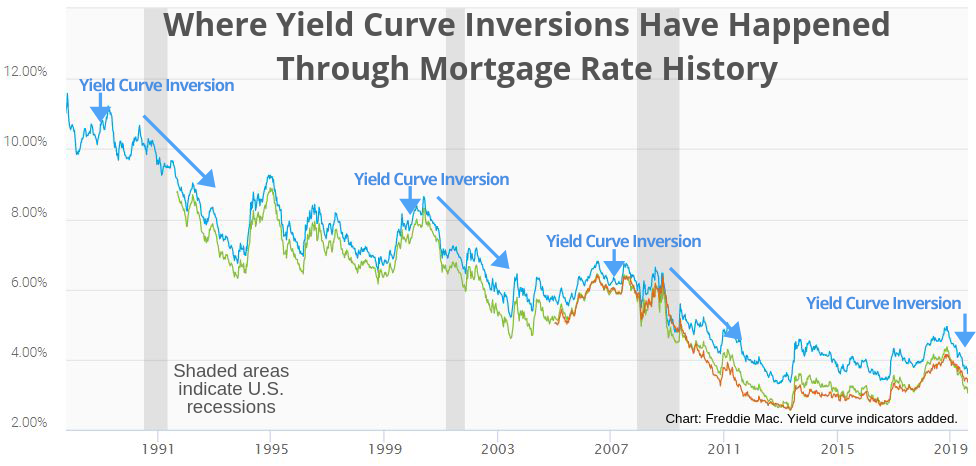

Take a look at the chart below. Every time a yield curve inversion happens, rates drop in coming years. But it seems rates have nowhere to go. Or do they?

Back in 2006, with a deeply inverted yield curve, 30-year mortgage rates were above 6%, according to Freddie Mac. At the time those were the lowest pre-recession mortgage rates since Freddie Mac had been tracking data.

Now, we’re seeing another inversion, but rates are at an almost unbelievably low level of 3.6%, again using Freddie’s data.

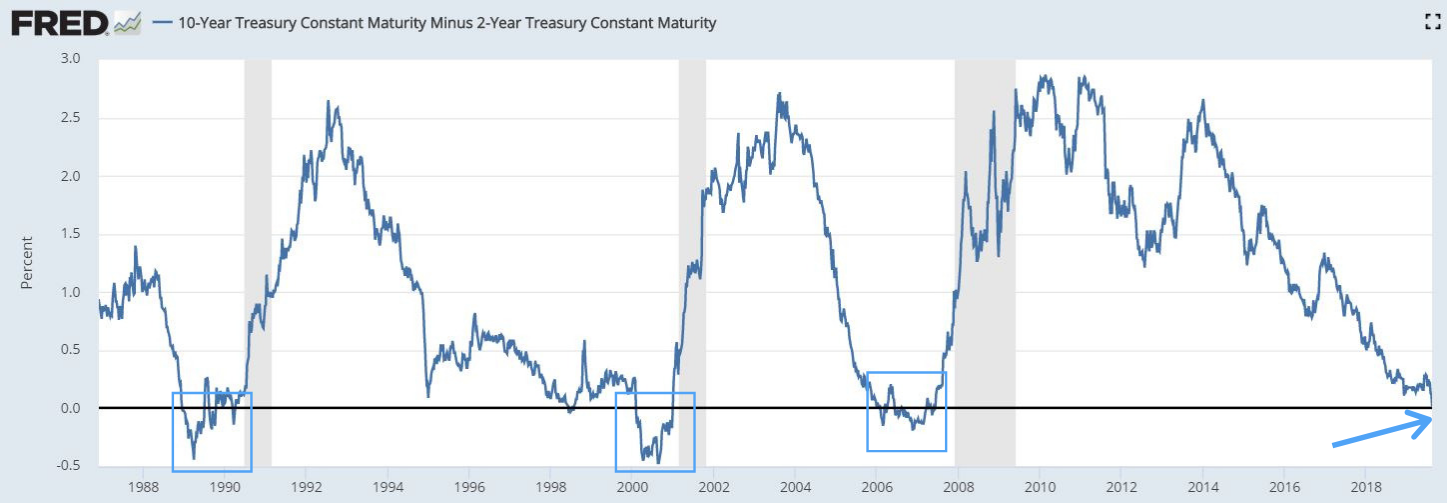

The following chart shows yield curve inversions since 1987. Anywhere the 2-year / 10-year spread drops below zero (indicated with boxes and an arrow below), a recession eventually follows (shaded areas).

So what happens to mortgage rates after a yield curve inversion? In 2009 and onward, we saw mortgage rates march downward, ending at about one-half their pre-recession levels, at just 3.32% in December 2012.

But where do mortgage rates go now that they are already at an ultra-low 3.6%? If rates follow the same pattern this time, and get cut in half again, we’re looking at a 1.8% 30-year fixed loan.

If rates get cut in half again, we’re looking at a 1.8% 30-year fixed loan.

A sub-2% mortgage rate seems unlikely to today’s world. But keep in mind that a Danish bank is already offering negative mortgage rates, and $15 trillion in government bonds worldwide are already “paying” negative yields.

The U.S. might not be far behind that trend. According to Bloomberg, former Fed chief Alan Greenspan says, “There is no barrier for U.S. Treasury yields going below zero.”

U.S. Treasuries don’t dictate mortgage rates, but mortgage rates often follow the same trends. If Treasuries go negative, we could realistically see 2% rates, or even lower.

Only one thing seems certain after the inverted yield curve: we haven’t seen the end of ultra-low mortgage rates.

Unsure about this prediction? Then capture an already-history rate now

No one knows what will happen to mortgage rates. The inverted yield curve could just be a false alarm. After all, each history doesn’t always repeat itself.

If you’re in the no-recession camp, you could capitalize on rates that are already lower than anyone thought they would be by now.

Start at the link below.

Time to make a move? Let us find the right mortgage for you