The wisdom of expecting a return on an owner-occupied home

Are you making—or thinking of making—a primary home investment? In other words, do you hope owning a home that you plan to live will yield a return over time?

If so, there are plenty of experts around who will tell you that you’re wrong. They argue that homeownership doesn’t meet the threshold to be regarded as a true form of investment. And they muster some strong arguments. But are they right?

What we’re talking about here is seeing your own home (your principal residence) that way. Obviously, plenty of people are successful real estate investors. But they’re buying homes or land or buildings for development or renting out to others. Is it different when you’re an owner-occupier?

Ready to buy a home? Start here.Primary home investment? It depends on what you mean ...

This argument is a semantic one. In other words, it begins, “It depends what you mean by ...” In this case, “It depends what you mean by ‘investment’.”

Merriam-Webster’s defines that as “The outlay of money, usually for income or profit.” The Concise Oxford prefers, “A thing worth buying because it may be profitable or useful in the future.”

Looks like we need to explore the individual arguments in more depth to decide whether “primary home investment” is a misnomer.

Hmm. That was less helpful than you might have hoped. The first specifies “income or profit,” though it also contains the weasel word “usually.” The second allows for utility. And most of us find having somewhere to live useful. Looks like we need to explore the individual arguments in more depth to decide whether “primary home investment” is a misnomer.

Argument 1: “It’s not an investment just because it appreciates”

This argument relies on the premise that a true investment requires more than the prospect of an increase in value—it must also outpace inflation. You can define it that way if you want. Though it’s hard to think of many investments that are guaranteed to always beat the inflation rate.

Treasury Inflation-Protected Securities, (TIPS) will do that. But can you think of others that credibly guarantee to give you a better-than-inflation return? And that are literally “as safe as houses?”

Sometimes, home prices lag inflation

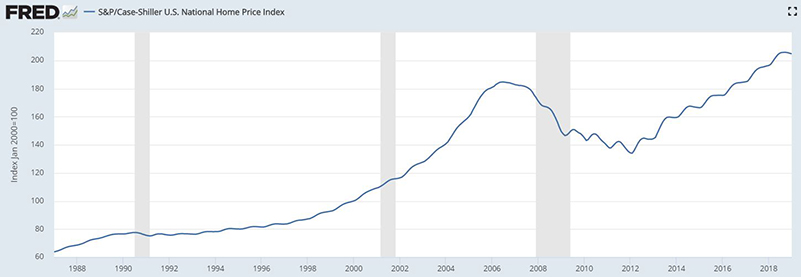

The financial crash of 2008 really messed with homeowners. Prices tumbled, leaving many with negative equity. You can see what happened in this graph:

S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPINSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPINSA, March 31, 2019.</font size>

The areas shaded gray represent times of recession. And you can see just how painful the crash was. But all markets falter sometimes. You could ask the people jumping off Wall Street ledges in October 1929. Or maybe not.

But home prices do outpace inflation—usually

CNBC analyzed home prices for the six decades between 1940 and 2000. The median home value at the beginning of that period was $2,938. By 2000, it was $119,600. “Yeah, yeah,” you say. “But what about inflation?” Using constant 2000 dollars (meaning you’re stripping out inflation), that median home value in 1940 would have been $30,600. And of course, the 2000 figure would still be $119,600.

Yes, homes got bigger and more sophisticated over that period. But the numbers are unarguable: over a long period, home values have historically outpaced inflation.

Argument 2: “A house has a more important primary purpose”

Because you need your home to live in, you can’t sell it whenever you want. This makes it different from shares, say, which you can buy when they’re at their cheapest and sell when their prices are highest.

That argument works especially well if your name is Warren Buffet. Most of us can’t tell when a particular share is under- or over-valued.

More importantly, it takes longer to sell a home. Worse, it involves a lot of expense and upheaval. So there’s no doubt a home is a less “liquid” (less easy to turn into cash) asset than many others.

Forced sale

There’s another factor here. Because your principal residence is also your shelter, you may find yourself having to move when market conditions are less than favorable. Suppose your employer posts you elsewhere or you suddenly need a bigger place for family reasons. You might have to sell when home prices are low.

That’s a good point. But it’s one that applies to all sorts of investments. A period of sickness or unemployment might see you liquidating your stock portfolio to keep the lights on and food on the table. And not necessarily at a time when stock prices are high. External factors can affect your sale of all types of assets.

But does that stop your house being an investment? Does it make “primary home investment” oxymoronic?

Argument 3: “A house can’t be an investment if you plan never to sell it”

Suppose you end up living in your home all your life. Or perhaps you move sometimes but always plow back all the profit you made on your last home into the next one. By the time you die, you won’t have seen a penny back on all your costs of homeownership. So you can’t count a home as an investment.

This seems the weakest of all the arguments. Suppose you die with a $500,000 stock portfolio. Does that mean stocks aren’t investments?

To your estate, your home, once sold, will be money, just like your stocks. And your kids will be equally delighted to squander both.

Argument 4: “Thinking of your home as an investment can lead to equity stripping”

“Equity stripping” is when you release some of the value you’ve built up in your home so you can spend it. You can do that through a home equity loan, a home equity line of credit (HELOC) or a cash-out refinance.

And it comes with real dangers. Imagine you undertook one of those in 2006 when it seemed inconceivable that home prices would ever dip. Then they did exactly that.

There’s a good chance you’d have ended up with negative equity (your home was underwater) or very little equity. And that might have stopped you refinancing to a lower mortgage rate or even selling at all.

So you need to weigh risks and use sound judgment when deciding to strip equity. But does your ability to choose to do so necessarily stop your home being an investment? After all, you can choose to borrow against your 401(k). Does that mean 401(k)s aren’t investments?

Argument 4: “The ‘carrying costs’ of a house are too high for it to be considered an investment”

“Carrying costs” are the amount you pay to keep an investment on the road. For example, if you borrow to buy stocks, the interest you pay on your margin account is a carrying cost.

When you own a home, the carrying costs are eye-wateringly high. You’re not just paying back the principal and interest on your mortgage every month. You have to pay to maintain the property and to stay current with real-estate taxes and homeowners’ insurance. You might also face homeowners’ association (HOA) fees and private mortgage insurance.

Early in 2019, The Mortgage Reports compared the costs of buying against renting. It used national averages and conservative assumptions to attempt a side-by-side assessment. And all those additional costs made a big difference to homeownership, especially in the early years. It concluded that, over 30 years:

... buying will have cost you $1,161,502 (not allowing for equity gains), compared with renting a comparable house, which would cost you $1,189,976. That’s less than $30,000 in savings. And, over 30 years, such sums are neither here nor there.

Except, after 30 years of buying, the homeowner has an asset worth over $1 million, while the renter has … nothing. And, of course, the renter has to keep paying after the 30 years are up, while the buyer has finished with her biggest cost of homeownership. Meanwhile, her property may continue to appreciate in value.

Read: The cost of homeownership vs. renting over 3, 5 and 10 years

Does that sound like an investment to you?

Argument 5: “Your house won’t generate cash flow”

This is a good point. Unless you rent out your house (in which case it will no longer be a primary home investment), you likely won’t see any cash flow. Well, lots of cash flowing out but, absent boarders, none coming in.

The argument here is that, with an investment, you usually expect some sort of cash flow on the asset while you’re waiting for it to increase in value. Well, maybe.

But plenty of collectors of art, classic cars, antiques, fine wines and other commodities would claim that they’re making sound, high-performing investments. And they see no cash flow until they sell. They often also have high carrying costs for storage and insurance.

Should you “invest” in a primary home?

So what do you think? Do those who argue that a primary home investment is not an investment at all have a point? Or do their arguments (unlike your home) have no foundation?

If you’ve decided that a home to live in is a good idea (whether or not an actual investment), check your eligibility to buy a home and current mortgage rates.

Time to make a move? Let us find the right mortgage for you