In this article:

Refinancing your mortgage can reduce your monthly costs in several ways.

- Lower your payment by restarting the term of your home loan. If you have been paying down your mortgage for five years, stretching out the remaining balance over a new 30-year term can lower your payment

- Drop your interest rate by shopping for a lower one (perhaps by choosing an adjustable-rate loan). This can also reduce your monthly payment

- Reduce the amount of interest you pay by refinancing to a 15-year mortgage. Your payment will likely increase, but 15-year interest rates are lower, and you pay much less interest overall

When to refinance

Sometimes a refinance is driven by a need for cash. You can refinance to turn some of your home equity into cash for just about any reason. But that is not what we’re talking about here.

This is about improving your financial position with a “rate and term” loan that just replaces your old mortgage with a better one, or a “limited cash-out” refinance that allows you to include the closing costs in your new loan.

Related: 4 Cash-Out Refinance Options That Put Your Home Equity To Work

When instant cash is not the point

This article is for those who are considering strengthening their financial position by getting a better mortgage deal for the long term. That might involve reducing the total interest you pay, the sum you pay each month to keep up your mortgage or the length of your repayment.

Each of those three options has its own pros and cons. For example, shortening your loan’s term will probably save you the most money in the long run. But you’ll need good cash flow to afford the higher monthly payments that come with shorter loans. So that’s not for everyone. Read on to explore each option more fully.

Timing

Picking when to refinance and the route to take needn’t be that hard. You can use this refinance calculator to model your different options.

If one model makes financial sense, you can go with it. If more than one is attractive, you can choose the option that makes you more or most comfortable.

Recognizing priorities

That choice will depend on your financial health and goals. If you’re struggling to make your monthly mortgage payments, your overwhelming priority will be to reduce those payments so you can keep your housing show on the road. You can worry about longer-term issues when times are easier.

Related: 5/1 ARM or 15-year fixed? What's better n 2018?

Suppose, however, you’re in a sweet spot and can afford to take a more strategic view of your financial future. You may well decide to refinance to a shorter loan (a 15-year or even 10-year mortgage) because, in the long run, that should slash your overall cost of borrowing.

Closing costs and ways to avoid them

If one single element is likely to undermine the viability of a refinance, it’s likely to be closing costs. These typically come in at anything between 2 percent and 5 percent of a home’s value.

True, you can often add the costs into your refinance balance, but then you are paying costs and interest on costs.

Related: Guide to mortgage closing costs: Average mortgage costs and how to keep yours low

And high costs are not necessarily a bad thing, as long as they get you big savings. If you save $2,000 per year in interest, you’ll make up for $2,000 in closing costs in one year.

But saving $20 per month would mean that you break even in eight years. Not such a good deal.

No-closing-costs deals

What do lunches and mortgage refinances have in common? You can’t get a free one of either.

However, that doesn’t mean you have to put down any cash on closing. As already mentioned, many lenders are happy to add your closing costs to your new loan balance. Others will pay your costs for you — in exchange for a slightly higher mortgage rate. Either way, you’re almost bound to end up covering them yourself.

Related: 6 ways mortgage shoppers are lowering closing costs

That doesn’t mean you can’t get good deals on costs. That’s why you shop, compare loan programs and lenders. And that’s easy to do online.

Cutting your monthly mortgage payment

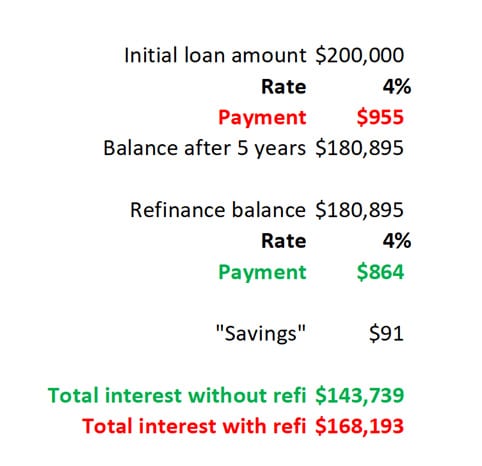

Providing you’ve had your mortgage for several years, it’s generally easy to cut your monthly payment, even if you don’t get a lower rate. An example might be helpful. In this case, the refinance rate is exactly the same as the old rate. Obviously, you won’t pay less interest this way. But your payment drops anyway.

Because, if you refinance to a new 30-year loan, you can spread the payments over the next three decades.

Downsides

That has a glaring downside. Today, you are due to be clear of your mortgage in the late 2030s. After refinancing, you’ll be facing payments until the late 2040s.

More importantly, you’ll be “resetting the clock” on your mortgage. In other words, you’ll be financing your home over 35 years (5 so far and 30 to come) instead of 30 years. And the longer you borrow money for, the more it’s going to cost you.

Still, if times are tough and you’re barely able to keep up payments, this may be your smartest — or only — move.

Cutting your mortgage rate

Deciding when to refinance is easier if you’re going to get a lower mortgage rate. Who doesn’t want to pay less for the same thing?

It’s not as easy to get a lower rate now as it was in recent years. That’s because mortgage rates are inching up. However, if you haven’t refinanced in quite a while, you might still be able to get a better deal.

Downsides

The same downsides apply when you’re getting a lower rate as do when you aren’t. You’re likely to be resetting your mortgage clock and that means:

- You’ll have to wait longer to be free of your mortgage

- Your borrowing costs will be higher because you’re spreading your payments over a longer period

Of course, you don’t have to do either of those. When you can afford to, choose a loan with a shorter term, or make additional payments toward reducing the principal when you can afford to. Your lender can tell you what payment would allow you to pay off your loan on time and actually save on the total interest paid.

Cutting your mortgage term

Here’s when to refinance with zero guilt. That’s because you’re resetting your mortgage clock in the right way. Instead of extending the time you’re in debt, you’re shortening it.

And that means you’ll:

- Be free of your mortgage earlier than planned

- Pay less interest overall because you won’t be borrowing for as long

If you can afford this option, it may be a great choice.

Downsides

You’re going to have to make a higher mortgage payment every month. That’s just basic math: If you pay back the same sum in fewer installments, each installment must be bigger.

That means only those with sufficient spare cash at the end of each month can consider this choice. And it’s important you’re reasonably certain that income is secure. You won’t be able to unilaterally decide to reduce your payments on a 10-year or 15-year mortgage, any more than you can with a 30-year one.

Oh, and before you commit, make sure there are no prepayment penalties on your existing loan. Lenders will often waive those if you’re refinancing to the same term, but some may impose them if you’re about to become a less profitable customer.

Opportunity costs

You should see cutting your loan term as an investment decision. In other words, you should compare the benefits it delivers with those that might come with other sorts of investments.

However, don’t be too distracted by flashy returns elsewhere. Alternative investments probably won’t deliver the same peace of mind and basic security that a paid-down mortgage does. Whenever you’re investing, you should be looking to balance your portfolio in a way that suits your personal appetite for risk.

Deciding if and when to refinance

There are downsides to each type of refinance. But there are upsides, too.

These are big transactions and it’s natural to be apprehensive. However, providing you run the numbers first and understand the pros and cons of each of your choices, you should be set to make an intelligent and informed decision.

Time to make a move? Let us find the right mortgage for you