Different loans, different costs

When looking for a mortgage, you’ll probably run across several terms that impact what you pay for your home loan. They are:

- Conventional mortgage

- Conforming mortgage

- Non-conforming mortgage

Differences cause the pricing for mortgages to vary and are important to know when you shop for a mortgage.

Verify your new rateWhat are conventional loans?

The term “conventional”, when applied to mortgage financing, is different from the way we normally use it — to mean something that is traditional or ordinary.

In mortgage lending, a conventional loan is privately funded, not government-backed. Very simple. Lenders often find government-backed loans more attractive than conventional loans, because potential losses are covered by a government-administered insurance program. Added safety means government loans often have lower rates than conventional mortgages.

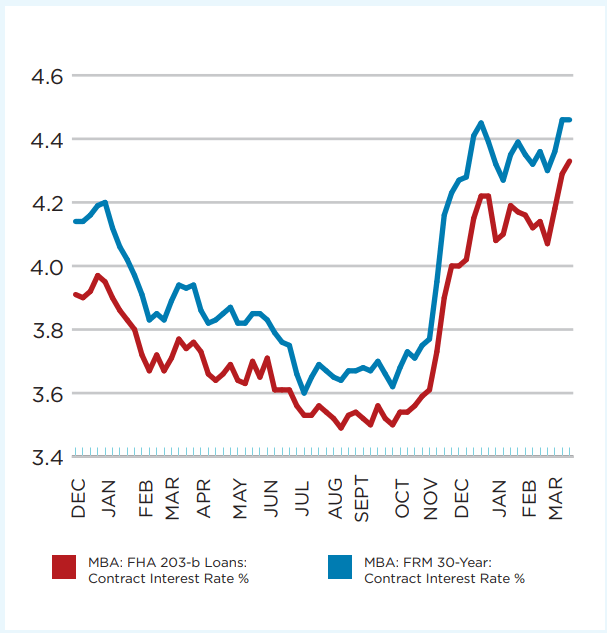

The image below shows the difference in interest rate between government (FHA) loans and conforming (Fannie Mae and Freddie Mac) home loans. Rates for government-guaranteed loans are lower, but they can be more expensive when you factor in their insurance costs and fees.

What is a conforming loan?

Conventional (non-government) loans can be divided into two types: conforming and non-conforming. Note that while all conforming loans are conventional, not all conventional loans are conforming. It is important to know also that the terms “conventional” and “conforming” are NOT interchangeable, even though some writers use them that way.

2018 conforming loan limits jump nearly $30,000

These differences between conforming and non-conforming loans reflect the lender’s ability to sell the loans to investors. The easier they are to sell, the less expensive they need to be.

The secondary market

Once a lender funds a conventional loan, it doesn’t necessarily keep it on its books. Lenders often sell mortgages on the secondary market and use the money they get to originate new loans.

Many lenders have a warehouse line of credit from a big bank. It is like a giant credit card they use to fund loans. Once loans are funded, the lenders bundle them up and sell them on the secondary market to Fannie Mae and/or Freddie Mac. To sell these loans in packages to investors, they must be as alike as possible, with a risk that can be measured.

Fannie Mae and Freddie Mac

Fannie Mae and Freddie Mac are the two mortgage giants called government-sponsored entities (GSEs). The purpose of these two GSEs is to provide a secondary market for home loans. They enable mortgage lenders to originate and fund loans over and over again.

Mortgage-backed securities and the secondary market: what REALLY determines your mortgage rate

Lenders sell the loans they fund to these two mortgage giants to pay off their warehouse line of credit. Fannie Mae and Freddie Mac WILL NOT purchase any loans that DO NOT CONFORM to their mortgage guidelines. Fannie and Freddie are bound legally to purchase loans that conform to their guidelines.

The Federal Housing Finance Agency (FHFA) is the government entity that sets conforming loan limits on conventional loans. It is similar to HUD where HUD sets loan limits for FHA Loans. Currently, the maximum conforming loan limits are capped at $453,100 in most parts of the country. “High-cost areas” have higher conforming loan limits. Many areas in California, Hawaii, Alaska, D.C. have conforming limit caps at $679,650.

To make loans alike, Fannie and Freddie have established guidelines for credit rating, debt-to-income ratios, loan sizes and other factors. Loans must “conform” to these guidelines to be considered “conforming.”

What is a non-conforming loan?

Home loans that do not conform to Fannie Mae and/or Freddie Mac Guidelines are non-conforming loans. Non-conforming loans often have higher mortgage interest rates and higher fees than conforming loans. The best way to understand non-conforming loans is to do a comparison to conforming loans.

Non-conforming loans can include mortgage underwritten to strict guidelines and sold to groups of investors (but not through Fannie Mae or Freddie Mac), loans with creative guidelines that are held and serviced by the lender (these loans are often called “portfolio” loans and the lenders are “portfolio” lenders), and non-prime mortgages,

Because their guidelines run from very restrictive to very lenient, interest rates for non-conforming mortgages vary widely, and shopping aggressively for these home loans can really pay off.

Why you might choose a non-conforming loan over a conforming mortgage

Common sense says why even bother with non-conforming loans versus conforming loans if they are more expensive. Many folks are under the belief that non-conforming loans are for borrowers with bad credit. This is not always the case.

In many cases, the only thing that makes a loan non-conforming is its size. In fact, these “jumbo” home loans may have better interest rates sometimes than those of conforming mortgages.

So you might choose a non-conforming loan just to get a more expensive house. But these loans can allow you to finance by verifying your income differently or bypassing waiting periods following a serious event like a bankruptcy or foreclosure.

Non-QM loans

The government divides mortgages into “qualified” or QM loans and non-QM mortgages. QM loans are safe, plain vanilla products that protect the lender from lawsuits and buybacks if the borrower fails to repay. Non-QM loans are riskier for lenders, so their rates and costs are usually higher.

Flamethrowers and high-risk loans: Just because you can, doesn't mean you should

Non-QM loans allow quirky properties

Non-qualifying mortgages can be useful when trying to buy a property not allowed by Fannie Mae or Freddie Mac.

- Non-warrantable condos: units that don’t meet conforming guidelines, such as the number of units occupied by renters, are non-warrantable

- Condotels: condominium units that are within a hotel complex

Non-QM loans at USA Mortgage:

- 10 percent to 20 percent down payment

- The amount of down payment depends on credit score

- With non-QM loans to qualify for 10 percent down payment, 680 credit score

- 660 credit score requires 15 percent down payment

- 640 credit score requires 20 percent down payment

No waiting period after housing event:

- Foreclosure

- Deed in lieu of foreclosure

- Short sale

Debt to income ratio

Here are the debt-to-income (DTI) requirements for non-QM loans at USA Mortgage. Your DTI is your monthly account payments, including housing, credit cards, auto loans, student loans etc., but not living expenses like food and utilities, divided by your gross (before tax) monthly income.

Simple mortgage definitions: debt-to-income (DTI)

Programs allow:

- 43 percent DTI but higher numbers may be negotiable

- Up to 50 percent DTI with compensating factors

- Bank Statement loan program for self-employed borrowers

- 24 months bank statement deposits

- Can be business or personal accounts

For the bank statement program, we average 100 percent of bank deposits over the 24 months to derive monthly income on personal bank accounts. With business accounts, we average 50 percent of bank deposits over 24 months to derive monthly income on business bank statements.

For these loans, we require 10 to 20 percent down, and you need a 720 FICO score for 10 percent down payment.

Jumbo mortgages

Mortgages that do not conform to Fannie Mae and/or Freddie Mac mortgage guidelines are non-conforming loans. Jumbo loans are non-conforming because they exceed conforming loan limits.

Is a jumbo mortgage better than a non-conforming loan?

Mortgage rates on non-conforming loans are higher than government and conventional loans. Minimum down payment requirements are 5 percent to 20 percent. The higher a borrower’s credit scores, the lower the down payment requirements. With less than 20 percent down, you have mortgage insurance.

Buying a home

With housing prices escalating and no sign of a housing correction, home buyers who do not qualify for conforming loans now can take advantage of non-conforming loans to purchase a home.

Time to make a move? Let us find the right mortgage for you