Mortgages are actually pretty simple

If you know about mortgages, it’s easier to choose the right loan and get it for less. But you don’t need to be an expert to get a good one if you follow a couple of simple steps.

Time to make a move? Let us find the right mortgage for youScope out your options

Right at the start, when you begin saving for a down payment, you need to find out how much you can afford to borrow. This is something you really need to know about mortgages. Dream too big, and you could end up “house poor,” able to afford your mortgage but little else.

Dream too small, and you end up having to move and start over because the home fails to meet your needs.

Remember! Mortgage rates, home prices and lending criteria (the rules you must meet to qualify for a loan) change all the time. So you’re only getting a ballpark idea of what you’ll be able to afford.

Mortgage calculators are your friends

Luckily, there are online tools to help you get a real feel for the possibilities ahead. The Mortgage Reports offers a range of mortgage calculators to help you choose a home price and down payment.

The affordability calculator lets you set different parameters, including the home price, your income, and the payment you want to come up with an affordable loan amount. Then, set your savings goals:

Mortgage Down Payment Calculator

Don’t forget, many mortgages need only a 3.0 percent or 3.5 percent down payment and some require nothing at all. And you may be eligible for help from one of the thousands of down payment assistance programs that operate across the country.

Complete guide to down payment assistance in the USA

Choose the type of mortgage you want

There’s no such thing as the “best” mortgage: Only the one that suits you best. That will depend on your personal circumstances.

Do you need a low down payment? If so, you’ll probably want one backed by the Federal Housing Administration (an FHA mortgage), Freddie Mac or Fannie Mae. They come with mortgage insurance, which increases your monthly payment. But you won’t have to save 20 percent that way.

You don’t need a 20 percent down payment to buy a home

Do you qualify for a mortgage with zero down payment? Eligible veterans and servicemembers can get great VA loans. The United States Department of Agriculture has a no-down-payment option for anyone who qualifies and who buys in certain rural (and some suburban) areas using USDA loans.

How to buy a house with no money down in 2018

Are you cash-rich but income poor? Then you’ll want the lowest monthly payment possible. And a 20 percent or higher down payment will help you get that, not least because you’ll pay no mortgage insurance premiums. You can buy discount points that drive your mortgage rate even lower.

Down payment options” from zero to 20 percent or more

You may even be better off with an adjustable rate mortgage (ARM). These almost always come with much lower initial rates than their fixed-rate cousins, and these rates can be fixed for three-to-ten years.

Explaining mortgage discount points in plain English

Once the fixed period ends, your mortgage rate floats with other interest rates. So they are not without risk. However, if you sell or refinance before that period expires, you can save a lot of money.

ARM mortgage in 2018: no longer the wallflowers

Find a lender

You may not need to know in detail about mortgages in general but you really need to know about the individual ones you pick from. So be ready to a little comparing.

Get competitive quotes

The Internet has made it quick and easy to get and compare competitive offers. And that’s very important.

Analysts have found that mortgage rates between lenders can vary by .375 percent to .625 percent on a given day. On a $200,000 loan over 30 years, paying 4.5 percent instead of 4 percent would cost you more than $20,000!

Compare offers

You can request quotes in a matter of minutes, but the ones you get won’t be set in stone. They’re a way for you to sift lenders and find some that are attuned to your needs.

You then need to come up with a short list of likely candidates and ask each to provide you with a loan estimate. These are much more serious documents. True, they can still be changed before closing, but only for an acceptable reason.

Loan estimates

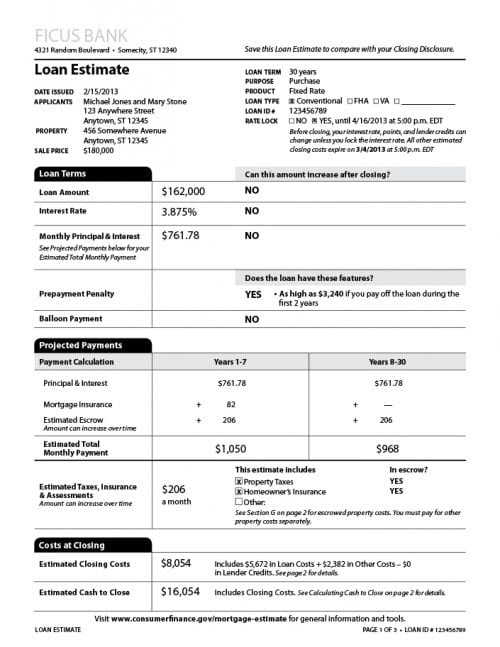

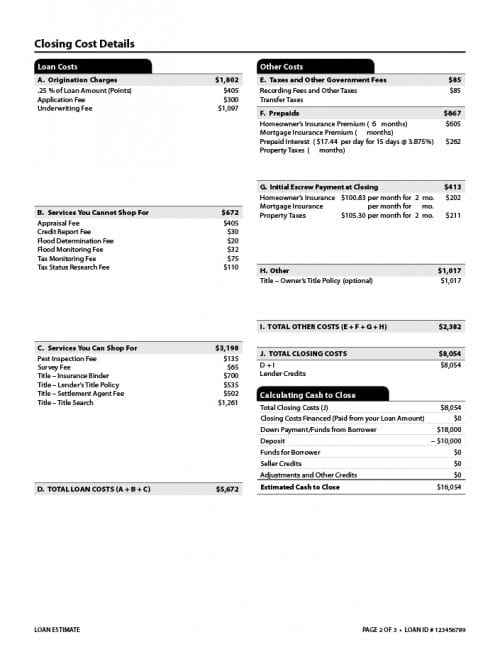

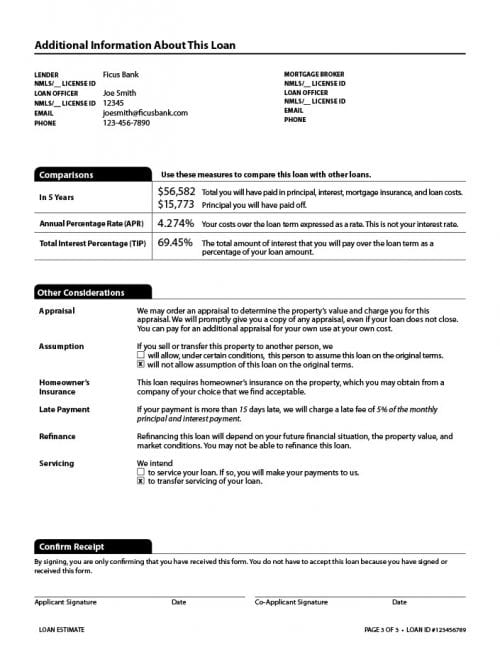

Loan estimates are formal documents that set out in detail the terms of the mortgage being offered. They have a standardized layout, meaning it’s easy to do side-by-side comparisons.

Here, courtesy of federal regulator the Consumer Financial Protection Bureau is a sample that shows what to expect:

It really is important at this stage to make a proper comparison. You could save (or lose) tens of thousands of dollars by skimping on this process.

Get prequalified or pre-approved

Your credibility as a homebuyer will take a big boost if you get prequalified or preapproved. By doing so, you’ll get a letter from your lender saying either you’re probably good to go (prequalified) or definitely good to go (preapproved).

Your real estate agent and the home seller will take you much more seriously if you have a letter from a lender saying that. Indeed, you might well be able to get a better purchase deal with the added leverage one gives you.

Prequalification vs. preapproval

A prequalification isn’t as powerful as a preapproval. The former means your lender has run some numbers, based on information you’ve provided, and come up with an estimate of how much you may be eligible to borrow. That’s good enough for many.

But a pre-approval means you applied for a mortgage and can close on your loan as long as the property meets the lender’s guidelines. That makes you close to a cash buyer.

Float or lock your rate?

Once you’re preapproved, found a home and opened escrow, you’ll probably be given a fixed period during which you’ll be free to float or lock your mortgage rate.

In other words, if you think mortgage rates are likely to fall during that time, you can let the rate you’re going to pay float down with them. But, if you think they’re going to rise, you can lock at any time.

Nobody knows for sure what’s going to happen to mortgage rates in the future. Some experts devote a lot of time to analyzing trends. They generally tend to be right about what’s going to happen more often than most homebuyers.

Mortgage rates today plus lock recommendations

The Mortgage Reports website has such an expert and publishes every business day a recommendation of whether you should float or lock.

Closing

At least three days before closing, your lender must send you a closing disclosure, which is the final version of your loan estimate. You need to check that very carefully because it gives you your last chance to correct any errors without holding up your transaction.

How to make the most of your closing disclosure

“Closing” means taking legal ownership of your new home. You sign various documents, pay your closing costs, and receive funds from your lender.

Mortgage closing: what happens at your signing

It’s when you may discover that the amount you know about mortgages is way more than you thought.

[cta-linkl]