Home improvement: the pursuit of perfection

No property is perfect, and that alone explains why owners are constantly in the market for home repairs and upgrades.

The return on your investment depends on the improvements you choose, how much you pay for them, and, if you don’t pay in cash, the cost of financing.

Verify your new rateWhy the urge to update strikes

The top reasons for home repairs and upgrades are usually associated with three events in the ownership cycle.

First, we want to assure the home is in good condition when we buy.

Second, we want improvements which will help us sell the property when it’s time to move.

5 home improvements with the highest return on investment

Third, there are some improvements we want because they make us happy.

Home repairs and upgrades when we buy

Sometimes, it makes sense to buy a fixer-upper, knowing that you’ll have to make repairs or upgrades right away.

In a hot market with buyers lined up to make offers, sellers don’t have to improve their homes to sell them, so they most likely won’t.

For investors or first-timers, buying a fixer-upper can be a great way to add equity right off. And lenders are willing to help with programs like Fannie Mae HomeStyle and FHA’s 203(k) home loan.

Which is better? Fannie Mae Homestyle or FHA 203(k)?

Both mortgage programs allow you to finance proposed improvements as well as the property purchase.

Not all improvements add value

We all like to see a good return on our investments, but in many cases, home repairs and upgrades do not create additional value.

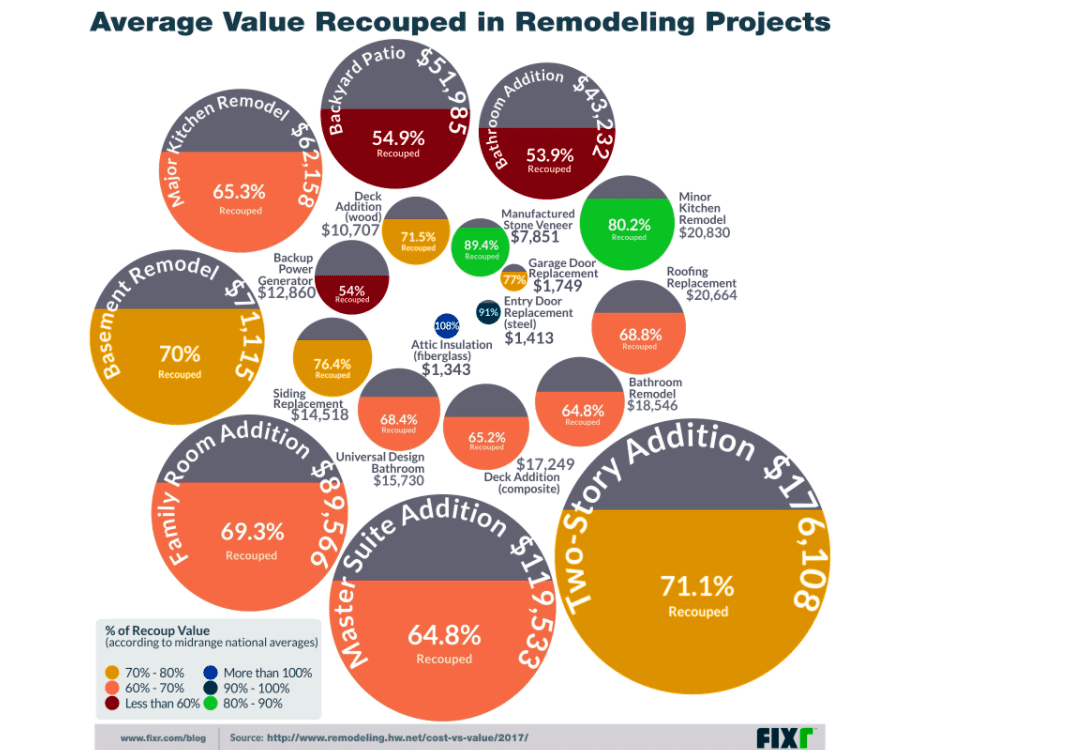

The well-regarded Cost vs. Value report published annually by Remodeling magazine examined 29 projects in 99 markets nationwide, and found that “loose-fill insulation in an attic is the only project that returns a higher value than its cost.”

If the financial return on home repairs and upgrades is not a sure winner, then why spend the money?

Deferred maintenance can cost you

Because not keeping a home updated and in good repair can cost you money. According to houselogic.com, failing to keep your home attractive and in good working order can easily knock 10 percent off your sales price.

So even if a repair adds only 50 cents of value for every dollar spent, you might also be saving additional dollars in existing home value.

In addition, you should understand that real estate improvements can be valued in different ways.

If you want to sell a home more quickly. for example, fixing up and repairing it can make sense. Every month the house remains on the market comes at a cost, and “wallflower” properties tend to attract low-ball offers or be ignored after a while.

In an era when many purchase offers are contingent on a satisfactory home inspection, repairs and improvements done before the sale can help avoid a lot of hassle and costs in the selling process.

Finally, improvements improve the appearance, comfort, efficiency or security of your property. If you plan to occupy it for some time, you want to be comfortable.

And if a new coat of paint or some landscaping simply makes owners happy, what’s a better value than that?

Paying for home repairs and upgrades

Many improvements are small enough that they can be done over time as do-it-yourself projects. Others involve big dollars upfront. Different loans are best for different projects, and the cost of your financing impacts the return on your remodeling investment.

There are several basic approaches to take.

Second mortgage

A fixed second mortgage (aka, a home equity loan) allows you to convert existing home equity into cash for home improvements. It usually comes with a fixed interest rate, equal monthly payments, and delivers a lump sum when you close.

Cash-out refinance vs. home equity loan: which is the better deal?

How much can you borrow? In many cases, up to 80 or even 90 percent of your home’s value.

Suppose your property is worth $300,000, and you still owe $150,000. Your current loan-to-value ratio is 50 percent ($150k / $300k).

If your lender approves a second mortgage up to 80 percent, you could borrow up to $90,000. ($300,000 x 80% = $240,000. $240,000 less $150,000 = $90,000).

The second mortgage is great for budgeting because its payment doesn’t change. It is appropriate for projects that require a large upfront payment.

However, you pay interest on the entire amount from Day 1, so it’s not always the most economical loan. It also costs more to set up than programs like the HELOC.

HELOC

For DIYers, projects that involve many stages over a longer time period, or smaller loans, a home equity line of credit (HELOC) might be the best choice.

Lenders like HELOCs and they can be very cheap to get. With a HELOC, you essentially have a huge credit card secured by the property. You can borrow from the line just as you would from a credit card, and you can also pay back at any time.

HELOC vs fixed home equity loan

However, unlike a credit card, a HELOC has two phases — a drawing period, in which you use your credit and your minimum payment is interest-only, and a repayment period, in which you must pay back the remaining balance.

A 15-year loan might have a draw period of five years, followed by a 10-year repayment period. This can be a problem if you’re used to paying interest-only on $20,000 ($83 a month at 5 percent), and then your payment increases to $212 during repayment.

HELOC rates are variable, but some lenders offer an option to convert your loan to a fixed-rate account once the drawing period ends and the repayment period begins.

You can take money out during the draw period, but not during the repayment phase. If you owe $25,000 at 4 percent, and have 10 years to repay, the monthly principal and interest is $253.

FHA Title 1

Second, look into the FHA Title 1 program. It allows you to borrow up to $25,000 over 20 years. At 4 percent interest the monthly cost for principal and interest would be $151.50.

If you borrow less than $7,500, you don’t need to secure it with a lien against your home. It is actually a personal loan.

Cash-out refinancing

if you can improve o the terms of your first mortgage, it might make sense to replace it with a larger loan, and use the excess cash for your home improvement.

For instance, take that $150,000 debt and replace it with a 30-year, $200,000 mortgage, giving you $50,000 in cash. This loan is most attractive if you want to take a lot of cash out.

4 kinds of cash-out refinancing to put money in your pocket

However, it is the most expensive loan to set up, because lenders charge more for cash-out refinancing, and because your total loan amount (replacing your mortgage plus the cost of home improvements) is larger.

Bridge loans

If you’re just fixing up your home to sell it fast, look into a bridge loan. This is a short-term loan you pay off from the proceeds when you sell your home.

Bridge loans: financing your housing transition

Because it is a very short loan – maybe a month or two in some cases — expect to pay more points and / or fees. The lender won’t make enough in interest to offset the costs of originating it without these extra charges.

What are today’s mortgage rates?

Current mortgage rates and costs differ between lenders and programs. HELOCs usually offer the cheapest setup costs, but rates are variable and can increase.

Home equity loans have higher rates and costs, but they are fixed — something to consider if you expect to be making the payment for a long time.

Cash-out refinancing has the highest cost — but if you can get a better mortgage and you need a lot of cash, it can be best, because it comes with lower interest rates.

Whatever loan you choose, get your best deal (and highest return on investment) by comparing offers from several competing lenders.

Time to make a move? Let us find the right mortgage for you