Impounds and escrows and trusts: oh my!

Paying your property taxes and hazard insurance through an impound account managed by your mortgage servicer is common. These accounts are sometimes called “escrow” or “trust” accounts.

Whether this arrangement is beneficial or harmful to you will largely depend on how good a money manager you are. Read on to discover whether you should love or hate your impounds. And whether you have any choice over whether you use an escrow account.

Verify your new rateWhat is an escrow or impound account?

Impound accounts lower risk for mortgage lenders, because they reduce the chance that your property will be confiscated for unpaid taxes, or that it will be destroyed and uninsured.

Impound accounts hold funds to pay your property taxes, homeowners insurance, and perhaps other accounts like flood insurance or HOA dues. Mortgage lenders set them up when you close your loan.

Why does my lender want so much money at closing?

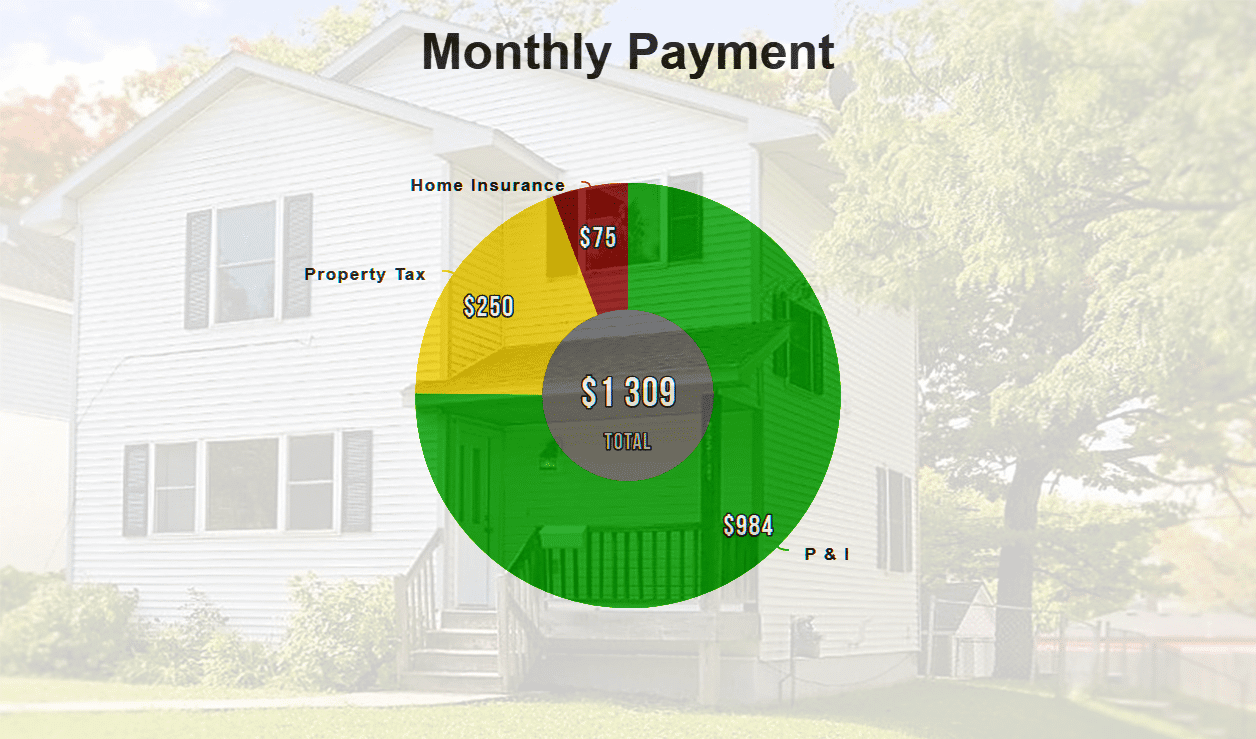

Lenders collect impounds each month, in addition to your loan principal and interest. When your property tax or other bills come due, the lender pays them on your behalf.

In other words, you’re spreading your tax and insurance payments equally over 12 months. That means your won’t have to come up with larger amounts every few months for taxes and annually for insurance.

What are the downsides?

If you’re a great money manager, you could be offended by the implication that you’re incapable of saving for big bills. It might feel as though you’re being patronized or even infantilized.

Do HOA dues make real estate unaffordable?

But the biggest inconvenience for many is the amount required to front-load the account. That’s several months of taxes and at least 12 months of homeowners insurance, added to the closing costs, when homebuyers may be feeling particularly strapped.

And you’ll be asking yourself an important question: What happens to the interest earned on the escrow account’s balance?

What happens to the interest?

If you own a modest home in an area with low property taxes, you may not care much about that interest. With yields on savings currently so low, it could add up to pocket change.

All about escrow accounts for mortgages

But if you own a valuable home in an area with high property taxes and insurance premiums, the sums in your escrow account could be substantial. And the interest could be sufficient for you to miss it.

Generally, your lender gets to keep your interest. However, some states do require lenders to turn it over to you:

- Alaska

- California

- Connecticut

- Iowa

- Maine

- Maryland

- Massachusetts

- Minnesota

- New Hampshire

- New York

- Oregon

- Rhode Island

- Utah

- Vermont

- Wisconsin

But, even in those states, there may be legal exceptions. For example, in California, lenders are allowed to require impounds if your loan is “higher-priced,” with a rate that exceeds market rates by 1.5 percent. Probably because these loans are riskier.

Can you get your impound account waived?

With some types of mortgage, there’s no escaping these escrows. They’re compulsory for government-backed loans like FHA, VA and USDA mortgages.

4 ways to keep your closing costs low

If you don’t have one of those mortgages, lenders may let you pay your own property taxes and hazard insurance. This is more likely if:

- Your loan-to-value ratio is 80 percent or lower

- Your FICO scores are high (often 740 is the cut-off)

- You are willing to pay for the privilege (.125 to .250 percent fees often apply)

If you are a highly-qualified borrower who feels strongly about waiving impounds, it’s worth asking about fees when you shop for a home loan. You may be able to negotiate that concession upfront when the lender is competing for your business.

Can you dump your existing impound account?

Providing you don’t have an FHA, VA or USDA loan, you can ask your lender to cancel your escrow account once your LTV dips below 80 percent. That’s only a rough guide, because each company can set its own threshold.

Getting sellers to pay your closing costs

Whatever sort of loan you have, the lender can refuse your request, and insist that your escrow account remain operational. Or, it may allow you to casncel your impounds but charge you a fee for doing so.

Should you avoid impound accounts?

Should you avoid an escrow account when you negotiate a new mortgage? Or dump an existing one, once you’re able? It depends why you want to.

If you are worried about your lost interest, resent being treated like a financial child and have zero money worries, it may be a legitimate choice. But be ready for an additional administrative burden.

Guide to FHA home loans: down payment and closing costs

You’ll not only have to take on budgeting for and paying those bills, but you’ll also likely have to prove to your lender you’ve done so. And you may have to pay an escrow waiver fee on closing or cancellation.

Many people enjoy being free of administrative burdens, and are glad to have their escrows. If you’re not one of those people, the time to deal with them is when shopping for your home loan.

What happens if the lender messes up?

Sometimes, lenders or loan servicers collect your impounds but fail to pay your taxes or insurance. This may be more likely if your loan is sold to another lender and the impound account doesn’t transfer seamlessly.

What should you do if your mortgage is sold?

The lender must make the insurance and tax payments on time as long as your mortgage payment is not more than 30 days past due. If there aren’t enough funds in your escrow account to cover the payments, that’s not your problem. The lender’s job is to manage your escrows, and by law, it must advance funds to pay your accounts.

If the insurance or property tax has not been paid on time, notify your lender in writing. It must confirm receipt of the notice of error within five business days, correct the error within 30 business days and eat the cost of any late charges or penalties.

What happens if you mess up?

If you choose to avoid escrow accounts, what happens if you get into arrears with your taxes or insurance? Typically, your lender will step in, pay the outstanding amount and add it to your mortgage balance.

Mortgage escrow and PITI explained in plain English

But it’s also likely to declare you in breach of your waiver, and impose a new escrow account on you. If your arrears are for insurance, it can also require a “force-placed” policy, which is usually much more expensive than alternatives you find yourself.

What are today’s mortgage rates?

Today’s mortgage rates are still extremely low by historical standards. However, if avoiding impounds is important to you, you’ll want to ask about them when you’re comparing mortgage offers. Otherwise, you could find that your deal is not as good once you add the impound waiver fee.

Time to make a move? Let us find the right mortgage for you