Q and A: reader question about shopping for a mortgage

At The Mortgage Reports, we get questions from site visitors all the time, and we generally answer them directly. But this one concerned an aspect we had not yet addressed: How can you shop for a mortgage when lenders won’t give you a loan estimate?

Verify your new rateLoan estimates are not always easy to get

This reader says, “I’ve been reading the Mortgage Reports for a while now, as well as having looked at many other articles about homebuying, and there is a question I have that I have not yet seen a clear answer to anywhere.

“I was hoping by the subject line of this article you wrote “How to shop for lower mortgage rates" that this article would answer it, but it didn’t. So I was wondering if you might write an article that answers my question. I’m sure it is a question many people have. Here it is.”

Verify your new ratePre-approvals and loan estimates when you shop for a mortgage

“When house buying, it is always recommended that you go through the process of getting pre-approved for a mortgage before starting your house hunting, so that you will be able to make a fast, solid offer on a house once you find a house you like.

Mortgage disclosures: Do you have to read EVERYTHING?

“You recommend in your article to compare lenders for the best rate using the Loan Estimate form. But in order to compare lenders using a Loan Estimate Form, you have to have a specific house address and a price to tell the lenders in order to get that Loan Estimate form. Which obviously you don’t have yet if you are getting pre-approved.

“So how do you compare lenders to choose who you will use and go through the lengthy process with of providing bank statements and documented income for pre-approval, before you have an address of a house you want to buy?

“Every lender I’ve spoken with says they need a specific address and price before they can make a Loan Estimate form. I understand why it is recommended to get pre-approval, and why you want to compare lenders with the Loan Estimate form, but in practice, how do you do both when each requires being at a different point in the house buying process?”

Expert’s answer

Mortgage law has changed a lot in the last few years. What it says is that lenders don’t have to provide a Loan Estimate (LE) disclosure unless a borrower makes an application. And without an application, lenders prefer not to provide the LE, which is a binding commitment and can cost them money if not completed precisely.

Avoidable junk fees and bogus loan costs

If they don’t have all the information they need, it increases the chance of mistakes on the LE. So, lenders prefer to supply “worksheets” or “scenarios,” when they give you a mortgage quote. These don’t come with all the consumer protections of a Loan Estimate.

For preliminary shopping, a worksheet is okay. But once you have a property address, request Loan Estimates from a number of lenders and get a Loan Estimate from each of them before locking in and committing to a lender.

You might be in a hurry when your offer is accepted. But this little bit of extra time will not delay your closing and may give you a much better rate.

How to shop for a mortgage before you have a property address

The bankers in the trenches said that applicants who want LEs should find a property address in the general area or same zip code as property they’re interested in and use that when they apply.

You can always change the property address when you find a home.

Don’t accept your lender’s first quote

If you want an LE, plan to provide the other five elements as well — your name, income, social security number, loan amount and property value. With custom mortgage quotes, you have to provide information in order to get information.

Will it mess up your credit score, to have all those lenders pulling your report? Not really, as long as you get it done within a limited time — two to four weeks, depending on the version of FICO your lender uses.

When lenders must by law issue a Loan Estimate

Loan Estimate 1026.2(a)(3): (i) Application means the submission of a consumer’s financial information for the purposes of obtaining an extension of credit.

(ii) For transactions subject to § 1026.19(e), (f), or (g) of this part, an application consists of the submission of the consumer’s name, the consumer’s income, the consumer’s social security number to obtain a credit report, the property address, an estimate of the value of the property, and the mortgage loan amount you want.

6 online tools every mortgage consumer should use

Many, many borrowers get loan pre-approval without a property address. This is called a “tbd” application, for “to be determined.” And if borrowers make an application and authorize a credit report, they usually get disclosures even without an address. But lenders don’t have to provide these until you have an address.

If you look at lender forums like the one at Bankers Online, you’ll see that lenders themselves are confused about this issue. A couple of them said that their company does not issue LEs for mortgage pre-qualifications, period.

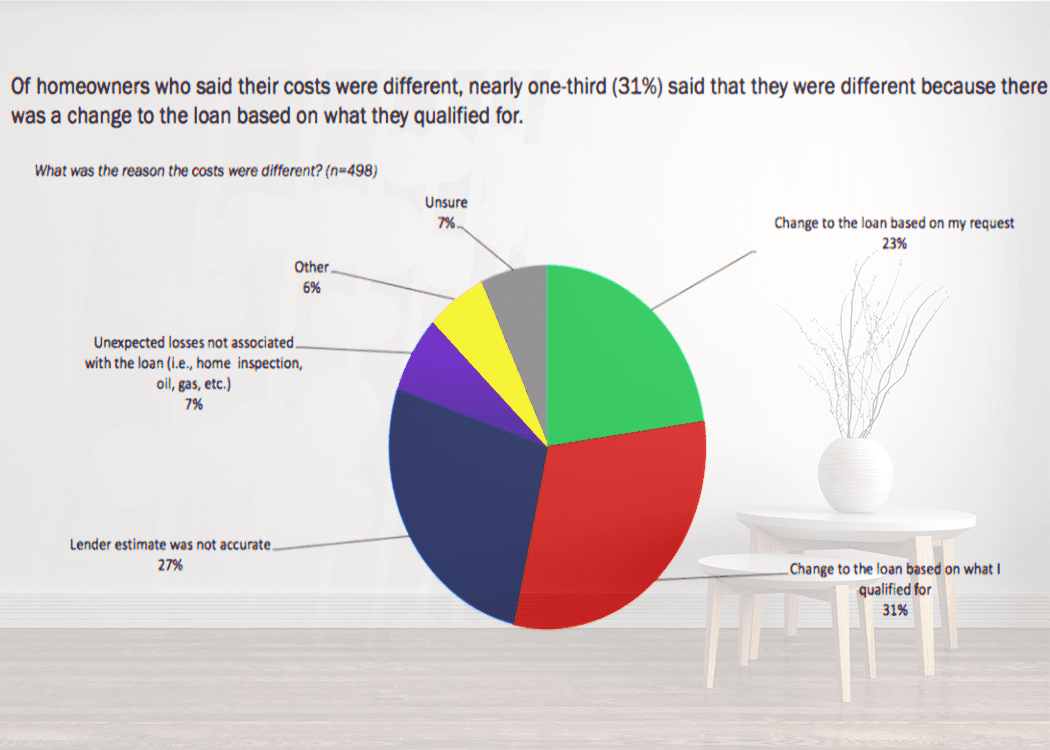

Survey: LEs are not accurate

A ClosingCorp survey indicated that the Loan Estimate is not accurate about half of the time. Many times, that’s the result of borrower-initiated changes. However, about a third of the time, the LE changed because the applicants qualified for a different program or loan amount. So the lender has to issue a new LE when the loan experiences a “material change.”

In fact, 58 percent of homebuyers received a revised estimate because of changes to:

- Closing costs (12 percent)

- Insurance costs (6 percent)

- Taxes (5 percent)

- Title (4 percent)

- Mortgage/monthly costs (4 percent)

- Escrow (4 percent)

- Appraisal fees (3 percent)

- Utilities (3 percent)

- Brokers fees (3 percent)

What are today’s mortgage rates?

Current mortgage rates have recently fallen. They are enticingly low for homebuyers.To shop for a mortgage, provide the six pieces of information that will force lenders to give you an LE. Then compare rates and terms.

Keep in mind, however, that a Loan Estimate is not binding when anything significant changes — like your selection of loan, your income, loan amount or property address. So it’s a good idea to come back here and pull a set of new quotes before locking in your interest rate.

Time to make a move? Let us find the right mortgage for you