Interest rates and different states

It may surprise you to learn that mortgage rates in the US can vary quite a lot between states. A 2014 survey, for example, found a .71 percent difference between average rates in Rhode Island, the cheapest state, and those in Nebraska, the most expensive state. So your mortgage rate will depend quite a bit on where you live.

Verify your new rateYour mortgage rate and risk factors

What causes such high rate differences among states? Primarily, differences in risk:

- Mortgage default risk — what percentage of borrowers fail to repay their loans?

- Early repayment risk — how many borrowers refinance or sell before the lender can make a profit?

- How do state laws impact the lender’s ability to foreclose?

Mortgage default risk

The economies of individual states can be as different as the economies of different countries. And this can really impact lender costs. When the local economy is weak, more homeowners default on their mortgages. In that case, lenders and investors require higher mortgage rates to compensate them for taking that risk.

Fast-falling foreclosure rates are pushing up your home value

On the flip side, states with low unemployment and healthy real estate markets are considered safer by lenders and investors. Their mortgage rates tend to be lower.

Early payoff risk

Another risk the lender takes is that of an early refinance or sale, paying off the mortgage before the lender can profit from it. This is referred to as “refinancing risk” or “reinvestment risk.” It incorporates local real estate market strength, mortgage rates, the availability of credit and other factors.

3 reasons to pay off your mortgage early (and 2 not to)

You can probably see how increasing property values might trigger an interest in refinancing as people drop mortgage insurance, combine their first and second mortgages, or cash out some home equity. Increasing prices can also cause more homeowners to sell.

Foreclosure laws

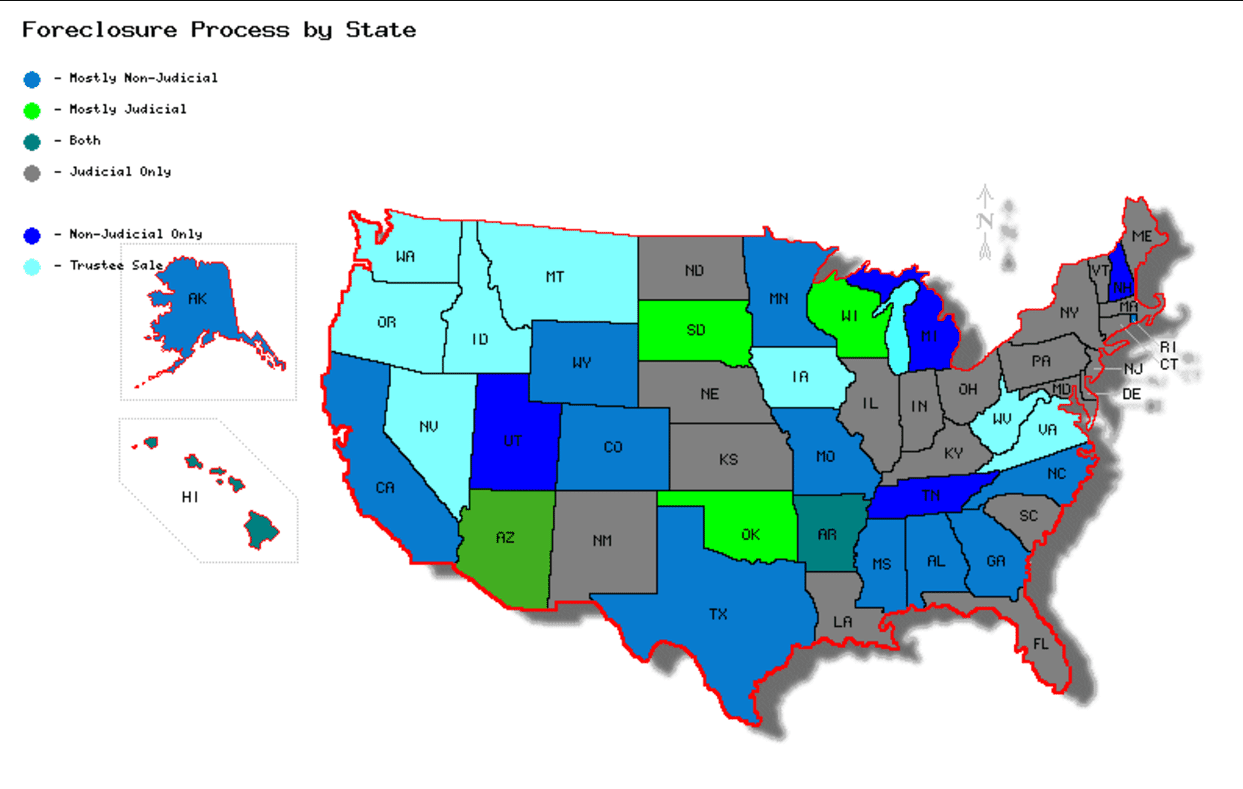

States vary in the way they treat mortgage debt and the ability of lenders to recover what’s owed. For one, states can allow judicial foreclosure, non-judicial foreclosure, or trustee sales when homeowners default on their mortgages. Non-judicial foreclosure doesn’t require lenders to take you to court to foreclose, so it’s cheaper for lenders and costs less. The map below shows how states handle foreclosure, according to RealtyTrac.

Mortgages can be either recourse loans or non-recourse loans. “Recourse” is the ability of the lender to recover money owed by the borrower in the event of foreclosure.

For example:

- Borrower owes $400,000 and defaults on the mortgage

- Late fees and collection costs add up to $40,000, for a total of $440,000

- The home fetches $360,000 in a foreclosure sale ($80,000 short of the balance and fees owed)

- The lender sues the borrower for the remaining $80,000 and wins. This is called a deficiency judgment and the lender has the right to enforce it.

"Boomerang" buyers can get mortgages after foreclosure

In a non-recourse state, the proceedings go differently:

- Borrower owes a total of $440,000

- The home fetches $360,000 in a foreclosure sale

- The lender writes off the remaining $80,000

Some states have different rules depending on whether the home is a primary residence or not, or whether the loan is a purchase mortgage or home equity loan. Non-recourse states include:

- Alaska

- Arizona

- California

- Connecticut

- Idaho

- Minnesota

- North Carolina

- North Dakota

- Texas

- Utah

- Washington

Researchers have claimed that borrowers pay almost a quarter percent more because a lender cannot seek a deficiency judgment. The table below shows which states allow each kind of foreclosure and under what circumstances.

Competition

Local mortgage rates can depend on the number of lenders in the area and the ease of comparing mortgage quotes. Studies have shown that the amount of local competition influences mortgage rates, even though today, it’s not hard to get mortgage quotes online.

Do some states cost borrowers more than others?

Rates also depend on supply and demand. If your state’s economy is struggling and the unemployment rate is high, consumers are less likely to purchase property. This forces lenders to cut profit margins and lower your mortgage rate to keep business coming.

Conversely, if there is strong local job growth and a healthy economy, buyer demand will increase, allowing rates to do the same.

Costs

Some states just cost more to do business in. If you ever bought a $9 gallon of milk in Hawaii, you know this.

Some states drive competition out by requiring mortgage lenders have a brick-and-mortar office in the state in order to finance local properties.

Getting sellers to pay your closing costs

Rents, property taxes, legal fees and licensing costs also come into play. An office in San Francisco is going to require more overhead than one in Des Moines. All these extra costs are passed on to the consumer.

Loan size

In areas where loan amounts are very large, your mortgage rate tends to be higher. That’s because jumbo and super-jumbo home loans are less easy for lenders to sell. Larger amounts can also be risky because when they go bad, there’s more money involved.

"Expensive" homes now easier to finance

In states where loan amounts tend to be small, rates are also higher. That’s because there are finite costs associated with every loan, regardless of its size. If it costs a lender $1,000 to process a loan, that can be pretty much swallowed up in a $400,000 home loan. But it’s huge when you’re looking at a $40,000 mortgage.

What are today’s mortgage rates?

If you live in an area with little competition for mortgage business, you don’t have to accept what local providers are willing to offer. It’s easy to get mortgage quotes online.

You may not be able to change your state to a cheaper one, but by comparing mortgage quotes from several competing lenders, you can negotiate a better deal.

Time to make a move? Let us find the right mortgage for you