Do Lenders Allow You To Borrow Your Down Payment?

Is it okay to borrow your down payment? At first glance, the rules mostly say no. Except for a few programs, lenders prefer you to use your own resources. The risk of default goes down when homebuyers have “skin in the game,” and lenders know this.

But there can be ways around those rules. However, depending on the route you take, you may have to tread carefully.

Verify your low down payment loan eligibility

Enjoy the Seasoning

Suppose that just before you apply for a mortgage, you apply for a personal loan or cash advance on your credit cards. Your lender will assume it’s for your down payment.

But, just like wood, borrowed money seasons and changes its properties. It becomes indistinguishable from money that you saved.

And, after a short time, lenders become blind (for down payment purposes only) to differences between your personal loan and money you earned, inherited or were given.

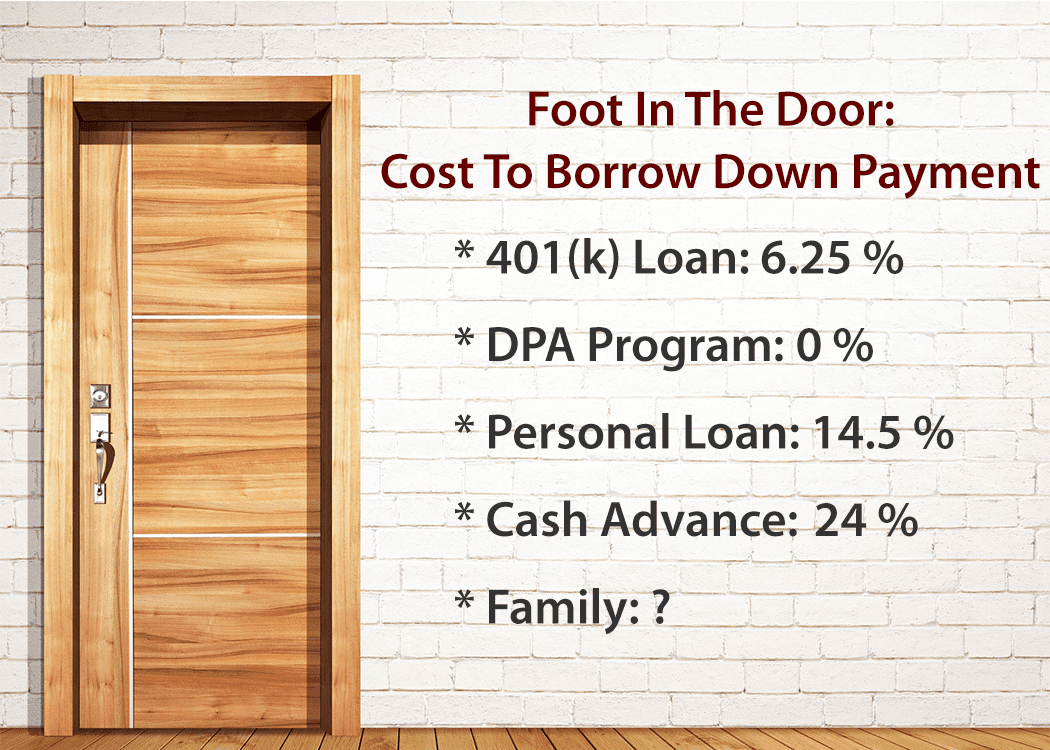

How To Borrow Down Payment Funds

For many lenders, it takes only 60 days for that blindness to set in. That means you’ll then be able to put your personal loan toward your down payment. No questions asked.

Take Your Time

However, not all lenders observe that 60-day cut off. Some want three or more months of bank statements. So it’s a good idea to land your personal loan several months before you make your mortgage application.

Lenders also look at your bank statements for large deposits, and they compare your average balance to your current balance. Leaving the money in there longer will reduce the chance of your average balance being a lot lower than your current balance.

Finally, getting your credit score into the best shape possible should be a big priority for you. Even a variation of a few points in your score can make an appreciable difference to the mortgage rate you’re offered. Use this time to improve it.

Protect Your Credit Score

Your personal loan application will hit your credit score. Not just once, but twice:

- Every time a lender makes a “hard inquiry” (one where it accesses your credit report to decide whether to lend to you), your score is dinged. (Different rules apply when you’re rate shopping for a mortgage.)

- Opening a new account reduces the average age of all your accounts. And that too damages your score.

Shop For A Mortgage Without Lowering Your Credit Score

Time Heals

Providing you make prompt payments on your new account, your score should bounce back within a few weeks.

What Is A "Good" Credit Score, And How Do You Make It Even Better?

So give your score breathing space. Some suggest you don’t open or close any accounts during the six months before you make a mortgage application.

Watch Your Debt-to-Income Ratio

Lenders may soon become blind to your personal loan when assessing your down payment sources. But they’ll see it when evaluating your ability to afford your new mortgage.

Central to that evaluation is your “debt-to-income ratio” (DTI). This is the proportion of your monthly income that goes out in regular monthly debt payments.

Your Debt-To-Income Ratio Can Tell You How Much Home To Buy

When you apply for your mortgage, by law you must disclose your personal loan balance and payment. And it’s likely to show up on your credit report anyway.

When Lenders Don’t Care If You’ve Borrowed

There is an exception to lender rules about borrowed mortgage down payments: when you borrow from yourself.

Most lenders (though fewer financial advisers) don’t mind you raiding your retirement accounts for your down payment. In fact, they often won’t count your payments back into your funds as part of your DTI.

You Don’t Need 20 Percent Down To Buy A Home

But borrowing from these funds is a big step. So check with your tax accountant before doing so to make sure you recognize all the pros and cons, including any tax implications.

Your 401(k)

Different 401(k) programs have different rules. So talk with the people who manage yours to explore your options.

Loans may or may not be available. You also need to know what will happen if you switch employers and leave the program before the loan’s fully repaid.

Read This Before Borrowing From Your 401(k) To Buy A Home

But, whatever your program’s rules, you won’t be able to borrow more than half your current balance, up to a maximum of $50,000. That’s the law.

However, there’s a legal exception if your balance is $20,000 or less: You can borrow the whole amount up to $10,000, subject to your program’s rules.

Your IRA

The rules for individual retirement accounts (IRAs) are stricter, certainly if you want to avoid standard penalties. They include:

- You can’t withdraw more than $10,000.

- You’re buying a home.

- You haven’t owned a home (or had any “ownership interest” in one) for the previous two years.

- You can borrow in this way only once in your entire life.

- You must use the funds within 120 days of their arrival.

- You may still have to pay income tax on the sum you withdraw.

How To Buy A House With No Money Down In 2017

You really need professional advice to make sure you comply with these and other rules. Or at least research your plans through the IRS website or call center.

Gifts from Family and Friends

You can use gifts from close family to fund all or part of your down payment. However, these will have to be fully documented, including a letter from each donor confirming the money is not a loan.

How To Give And Receive A Cash Down Payment Gift For A Home

Grants and Loans

Don’t forget to explore all your options for funding your down payment before borrowing. Some employers offer exceptionally cheap loans just for that purpose. And a few even provide grants, which don’t have to be repaid.

The Lowdown On Down Payment Grants

And the same applies to government and charitable programs. This is called DPA, or down payment assistance. Studies have shown that many who qualify for such programs have no idea that they even exist.

Loans from Family and Friends

Meanwhile, there’s sometimes nothing to stop you borrowing your down payment from family and friends.

While such a loan won’t normally show up on your credit report, you should disclose the debt so your lender can factor it into your DTI ratio.

The Family Mortgage: Borrowing From Loved Ones Instead Of A Bank

It’s worth noting that lying on a mortgage application comes with maximum penalties of 30 years in federal prison and $1 million in fines.

Avoid Down Payments Altogether

Before getting too hung up on your down payment, make sure you need one. A surprising number of borrowers can put down small sums or even nothing.

Getting Sellers To Pay Your Closing Costs

With seller concessions, you can reduce what you need for closing costs as well.

What Are Today’s Mortgage Rates?

Today’s mortgage rates are especially attractive after recent dips. But most experts predict rates and housing prices to trend higher. If borrowing a down payment can get you into a home before this happens, it’s probably a good decision.

To get the best mortgage rates, compare quotes from several lenders and choose the one with the best terms.

Time to make a move? Let us find the right mortgage for you