Understanding the prime rate

What is the prime rate? Yes, it’s an interest rate, but what’s special about it? How is it set? And how does it work?

We’ll get to those questions soon. But let’s start with one potentially surprising fact.

There’s no such thing as “the” prime rate. Banks and other lenders set or nominate their own, so there are likely dozens or perhaps hundreds.

We’ll keep using the “the,” but bear that in mind.

Check your home buying eligibility. Start hereIn this article (Skip to...)

- What is the prime rate?

- How is the prime rate determined?

- How does the prime rate work?

- What is the impact on borrowers?

- The bottom line

What is the prime rate?

The Federal Reserve has an answer to the question, what is the prime rate? It says, “The prime rate is an interest rate determined by individual banks. It is often used as a reference rate (also called the base rate) for many types of loans, including loans to small businesses and credit card loans.”

To call a prime rate a base rate is helpful. It’s the base for a bigger calculation.

Check your home buying eligibility. Start hereThe prime rate is a base rate

Suppose you were a huge — and hugely successful — global corporation, such as Coca-Cola or Microsoft. The likelihood of you repaying your loan is extremely high. So, your bank may well be willing to lend to you at its base or prime rate.

But you’re a consumer. And the lender can’t be sure it will get its money back from you. So, it adds to its base rate in accordance with the risks it thinks you pose.

Even those with a stellar credit score present quite a lot of risk. They might get hit by a truck or develop a serious, debilitating and expensive sickness.

So, the lender will quote you a rate considerably higher than its base rate. And the less creditworthy you are, the higher your interest rate will be above the prime rate.

What is the prime rate’s main driver of change?

Prime rates move from time to time. They may remain the same for years and then change several times over a few months as the economic outlook alters.

In 2020, they dipped as low as a 3.25% average. But by July 2023, they had soared to 8.5%, falling back to 7.5% by the end of 2024.

What is the prime rate’s main driver of change? It’s the knock-on effect of movements in the Fed’s federal funds rate. And we’re getting to that next.

How is the prime rate determined?

If the prime rate is the base rate on which your loan rate is calculated, the federal funds rate is the base rate on which your prime rate is calculated.

The federal funds rate is typically the biggest single component of a prime rate, and changes in the federal funds rate normally result in similar movements in prime rates. The rest of the prime rate mostly covers the lender’s overheads and profits.

Check your home buying eligibility. Start hereAt the end of 2024, the target range for the federal funds rate was 4.25% to 4.5%. At that time, the Fed had penciled in two cuts to that rate during 2025.

The average prime rate was 7.5% at that same time, according to The Wall Street Journal, which publishes the most widely used quote for average prime rates.

But your lenders’ prime rates may well be higher. The Journal cautions: “U.S. prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks. Other prime rates aren’t directly comparable; lending practices vary widely by location.”

Rather than setting their own prime rates, some lenders use the Journal’s average as the base in their loan agreements.

How the federal funds rate changes

The Fed says, “The federal funds rate is the interest rate charged by banks to borrow from each other overnight.” And the Fed sets that rate itself.

Roughly every six weeks, the Fed’s rate-setting body (the Federal Open Market Committee or FOMC) meets to review the federal funds rate and other aspects of monetary policy. The International Monetary Fund explains, “Central banks use monetary policy to manage economic fluctuations and achieve price stability, which means that inflation is low and stable.”

Our Fed, which is a central bank, has a range of tools to manage monetary policy. But the most powerful and prominent is its ability to change the federal funds rate at will.

Why does the prime rate change?

So, the main driver of changes to prime rates is movements in the federal fund rate. And the Fed moves its rate in response to the changing economic environment.

We have seen this clearly over recent years. The Covid pandemic and Russia’s invasion of Ukraine caused supply-chain bottlenecks, which pushed consumer prices quickly higher in the U.S. and around the world.

After a pause, the Fed responded by hiking the federal funds rate several times starting in 2022. The idea was that higher rates would deter American consumers and businesses from borrowing, which would reduce demand for goods and services, thus slowing price increases.

The inflation rate subsequently plummeted close to the Fed’s target of 2% a year. And, fearing high rates could slow the economy too much, the Fed began cutting the federal funds rate in August 2024.

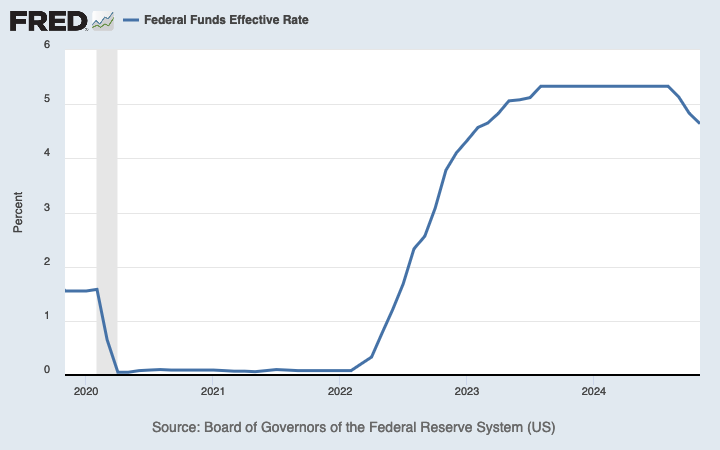

The following graph, from the Federal Reserve Bank of St. Louis, tracks how that rate has moved over the last five years:

How does the prime rate work?

What is the prime rate’s effect on your loan rates?

Well, each time a lender changes its prime rate, your variable interest rates are likely to move. So, the rate on your existing fixed-rate mortgage won’t budge, but most of your other borrowing costs (including adjustable-rate mortgages) will.

Check your home buying eligibility. Start hereIf you’re a first-time home buyer, the rate on the mortgage you’re going to need may or may not change when the prime rate does. These aren’t mostly determined by lenders but by movements in yields on mortgage-backed securities, a type of bond. And they tend to move ahead of Fed rate changes, based on what markets expect to happen.

Variable-rate borrowing types typically include credit card balances, personal loans, home equity lines of credit (HELOCs), and adjustable-rate mortgages. Some student loans have variable rates, too.

When prime rates fall, you should pay less for these types of borrowing. But, when those rates rise, you’ll likely pay more.

What is the prime rate? It’s sometimes your best friend and other times your worst enemy.

What is the prime rate’s impact on borrowers?

We’ve established that hikes in the prime rate drive up borrowing costs while cuts reduce them. And those movements are mostly caused by changes in the federal funds rate.

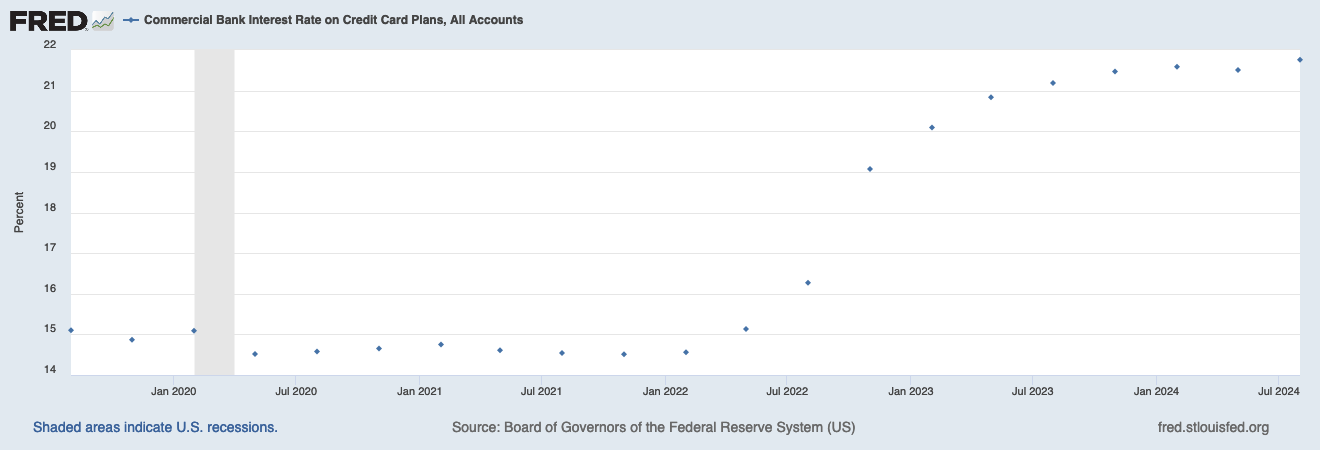

Time to make a move? Let us find the right mortgage for youTo see just how closely those changes are reflected in the real world. Check out the following graph, again from the Federal Reserve Bank of St. Louis.

It shows movements in average credit card rates over the last five years. Compare it to the last graph (above), which showed changes to the federal funds rate over the same period, and you can see just how close the relationship is. You’d likely see something similar for adjustable-rate mortgages and other variable-rate loans.

So, do you just have to live with this volatility? Mostly, yes.

Risks whatever you do

But there are things you can do to moderate your risks when interest rates are rising. To start with, you can cut back on your borrowing so your budget won’t be swamped if rates increase.

And you can opt for fixed-rate loans rather than variable-rate ones. Mortgages are the obvious ones here. But you could also opt for a home equity loan (mostly fixed-rate) rather than a HELOC (mostly variable-rate).

Indeed, some personal loans, student loans and auto loans can come with fixed rates. However, with all loans, initially, you pay a higher rate for fixed- rather than variable-rate borrowing. That’s because you’re shifting the risk of higher rates onto the lender’s shoulders.

You’ll be glad you did if prime rates shoot higher. But you could regret it if those rates tumble. You’ll end up paying more than less cautious folk.

At the time this was written, the Fed was planning on two more cuts to the federal funds rate in 2025, which should reduce borrowing costs on variable-rate loans.

But the Fed has changed its plans several times recently. And the new administration has brought much uncertainty to the economy. Some economists are convinced that his policies will be a huge success while others think they could prove disastrous. Only time will tell.

The bottom line

The prime rate has a powerful impact on household budgets — for better or worse. There are ways you can reduce your exposure to the risk of rising rates. But these come with their own risks if those rates fall.

Now that you know more about the prime rate, the federal funds rate, and the Fed’s role in borrowing costs, you can watch out for news about all three. Having some idea of what’s coming could save you a packet.