Introduction to timing your entry into the housing market

The most successful investors know that timing their investments is crucial to making money. Ideally, you want to get into a market toward the end of a period when it’s been struggling, just before it takes off. And that applies to the housing market as much as any other.

If you recognize that as a smart strategy, you may be asking yourself if now would be a great time for you to buy a home. We see five signs that suggest it could well be.

Check your home loan options todayIn this article (Skip to...)

- Rising consumer confidence

- Favorable mortgage rates

- Increasing home values

- Personal financial readiness

- Availability of desired properties

Sign 1: Rising consumer confidence in the housing market

Each month, Fannie Mae publishes its Home Purchase Sentiment Index®. And, in its July 2024 report, published in August, it certainly wasn’t suggesting that now is a good time to buy a home.

Indeed, the percentage of respondents who said they thought it was a good time actually declined that month. But there are a couple of reasons to think their gloom is misplaced.

Check your home loan options todayFirst, the report says, “Thirty-nine percent of consumers expect mortgage rates to decrease over the next 12 months, while 26% expect them to increase.” Well, that’s very different from what experts are expecting.

We’ll cover that in more depth a little later in this article. But mortgage-rate watchers are essentially unanimous in expecting those rates to fall consistently.

And, secondly, consumers generally have growing confidence in their financial prospects. The consumer sentiment survey from the University of Michigan showed that, toward the end of August 2024, “Consumers’ short- and long-run economic outlook improved, with both figures reaching their most favorable levels since April 2024 and a particularly sizable 10% improvement for long-run expectations that was seen across age and income groups.”

When prospective home buyers feel financially secure and confident, and mortgage rates look set to continue to fall, those could well be signs that more and more buyers will be trying to dip their toes in the housing market. So, keep watching what’s happening to consumer confidence.

Remember, you stand to make more money by entering the housing market before everyone else does. If you follow the crowd instead of leading it, you might do fine. But you’re unlikely to maximize your gains.

Sign 2: Favorable mortgage rates

Mortgage rates have already fallen significantly. At the end of August 2023, those for 30-year fixed-rate loans stood at 7.18%, according to Freddie Mac. One year later, they were down to 6.35%. That’s a very worthwhile tumble.

Check your home loan options todaySam Khater, chief economist at Freddie Mac, wrote on Aug. 29, 2024, “Rates are expected to continue their decline and while potential homebuyers are watching closely, a rebound in purchase activity remains elusive until we see further declines.”

And the overwhelming majority of the forecasts we read agree that mortgage rates are likely to fall further during the last quarter of 2024 and throughout 2025. However, they’re not expected to decrease quickly.

For example, in its August 2024 forecast, the Mortgage Bankers Association (MBA) reckons they’ll likely be down at 5.9% during the last quarter of 2025. And it’s not expecting them to fall further the following year, holding a 5.9% average throughout 2026.

Meanwhile, in its forecast for the same month, Fannie Mae also thinks those rates will be averaging 5.9% in the last quarter of next year.

Of course, nobody can peer into the future with much certainty. But these are the forecasts from teams of economists who almost always focus on mortgage rates and the housing market. In other words, they’re the best we have to go on.

You can afford more with a lower mortgage rate

Don’t forget that the lower the mortgage rate, the higher the home price you can afford. Lenders are focused on your ability to comfortably afford your monthly payments.

And they can approve you for higher-value homes when rates are low because your monthly payments will be lower than with a higher rate.

What lower rates mean in dollars

It’s all very well talking about lower mortgage rates, but what does that mean to your household budget? You can use our mortgage calculator to find out, just as we did to model some examples.

We assumed we were buying a $250,000 home in Flordia and were making a down payment of $7,500, which is the minimum amount you’d need for a conventional loan with Fannie Mae or Freddie Mac branding.

We started by using the mortgage rate from the end of August 2023, 7.18%. Back then, monthly payments (principal and interest) would have been $1,643, meaning the total interest you paid over a 30-year term would be $348,900.

Then we made the same assumptions but used the rate a year on, in August 2024, when it was 6.35%. Now, those monthly payments were $1,509 and the 30-year interest cost $300,713. So, you’ve saved over $130 a month, and $48,000 over 30 years.

Finally, we ran the figures for a 5.9% mortgage rate, the one Fannie and the MBA are expecting during the last quarter of 2025. Monthly payments were down to $1,438 and the 30-year interest cost to $275,300.

So, should you wait to act until mortgage rates dip below 6%? Well, maybe. But, also in August 2024, the Realtor.com (National Association of Realtors®) economics team expected home prices to rise by 4.6% by the end of 2024.

And there’s the rub with delaying. The lower mortgage rates dip, the more first-time home buyers will be attracted to the housing market. And that extra demand is almost certain to push up home prices, perhaps significantly. Maybe now really is a good time to act.

Why not reach out to a mortgage lender to get a good idea of the rate you currently qualify for?

Sign 3: Increasing home values

Rising home values can indeed indicate a healthy market with good investment potential. But investors always like to buy just before prices in any market take off.

And, for the housing market, we may be there now. Don’t forget the National Association of Realtors® economics team’s forecast that home prices could rise by 4.6% by the end of 2024.

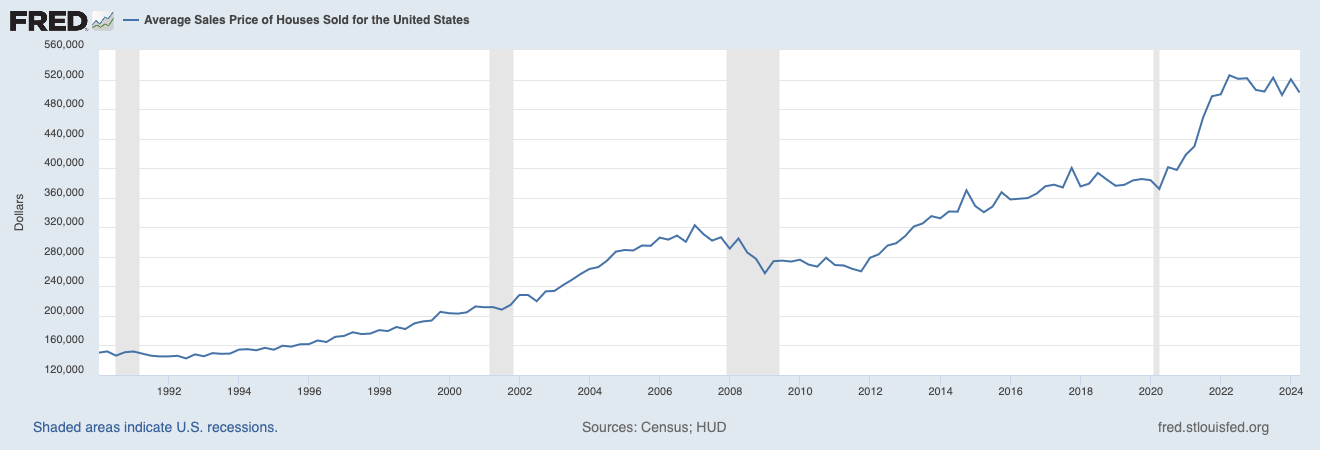

Check your home loan options todayHowever, we can’t claim that those prices have risen much recently. If you look at the graph, you’ll see them peaking in the second quarter of 2022 and zigzagging along a plateau since.

We believe there’s a good chance home prices might rise, roughly in line with Realtor.com’s expectations. If we are both right, buying now should show a fast and handsome return on investment, especially as lower mortgage rates breathe new life into the housing market and push prices even higher.

Sign 4: Personal financial readiness

This isn’t really a sign of shifts in the housing market. It’s more about whether you’re in good shape to become a home buyer.

We mentioned earlier that mortgage lenders focus on your ability to comfortably afford your new mortgage’s monthly payments. But there’s more to getting approved for a mortgage than that.

Check your home loan options todayLenders also want to be sure that you:

- Are a responsible borrower (credit score and credit report)

- Haven’t piled up too big an existing debt burden (debt-to-income ratio or DTI)

- Have a consistent source of income (employment record or years of accounts and IRS filings)

So, if you’re thinking of making a mortgage application soon, you should work to boost your credit score and pay down debts, especially any card balances. Why not ask a lender now to look over your finances and make suggestions for how you might get them application-ready?

Sign 5: Availability of desired properties

There’s no point in your entering the housing market if there’s nothing you like where you want to buy. So, go ahead and take a look at what homes are available in your target area or neighborhood. Some places have more available homes than others.

Time to make a move? Let us find the right mortgage for youJust don’t despair if there’s currently little interest. Things might soon get better.

Many homeowners have felt trapped in their homes and unable to sell. That’s because they currently have a mortgage rate in the 2.8%-5% range and simply couldn’t stomach moving to a different home with a 7%+ or even 8%+ rate.

But, as mortgage rates drop further, more and more of them will likely be tempted to grit their teeth and list their existing homes. So, you may soon have a wider choice.

Housing market: The bottom line

The housing market isn’t yet in perfect condition. But there are signs that it may soon be. And being ahead of the curve could help you maximize the return you make on your investment.

We covered four of those signs:

- Growing consumer confidence

- Falling mortgage rates

- Rising home prices expected soon

- Improving availability of desirable homes likely

The fifth sign, your personal readiness, is down to you. But, if your personal finances are in good shape, you may decide that now really could be a very good time to get into the housing market.