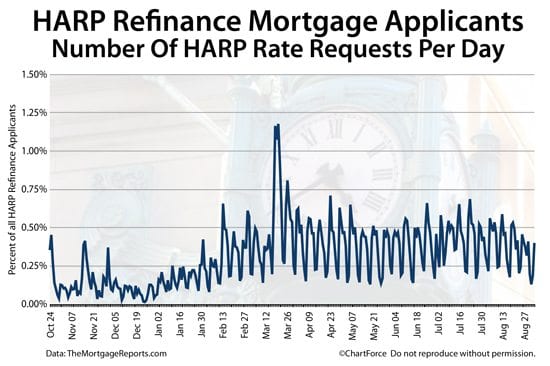

10 months since its introduction, HARP 2.0 remains in high demand among U.S. homeowners. Daily HARP refinance queries are elevated and so are the number of closed HARP transactions nationwide.

HARP is coming closer to fulfilling its promise to reach 7 million U.S. households.

Click here to get today's HARP mortgage rates

.

HARP : Mortgages For Underwater Homeowners

“HARP” is shorthand for Home Affordable Refinance Program, the government’s refinance plan for homeowners whose homes lost equity during last decade’s housing turndown. Under HARP, being underwater does not preclude your from refinancing.

In this way, HARP is similar to the which, also, ignores a home’s value.

HARP isn’t limited to underwater homeowners, however. It can also be used by homeowners who put 20% down at the time of purchase, but have since lost some (or all) of that home equity. Via HARP, homeowners whose 20% downpayment was “lost” can refinance without having mortgage insurance assessed.

This is an under-reported class of HARP homeowners despite that homeowners with between 80-105% loan-to-value account for nearly two-thirds of all HARP refinances.

Click here to get today's HARP mortgage rates

.

Demand For HARP Mortgages Steady

The Home Affordable Refinance Program was first launched in early-2009 but failed to gain traction. Underwriting guidelines were restrictively harsh and, because of how the program was structured, mortgage lenders assumed huge liability for each new HARP loan made.

In its first two years, the initial HARP rollout reached fewer than one million U.S. households — well short of the government’s expectation for the program. So, in October 2011, a reformulated “HARP 2.0” was released to allow for unlimited loan-to-value and for fewer lender liabilities.

The results have been immediate.

Through the first six months of 2012, HARP closings have climbed nearly 50% as compared to the two-plus year prior. Furthermore, surging HARP demand suggests that that the refinance program will continue to post blowout numbers through the program’s expiration December 31, 2015.

The overall pace of HARP applications is higher nationwide, with states including California, Florida and Arizona leading the way. It’s in these states in which HARP’s new unlimited LTV allowance is most needed.

Click here to get today's HARP mortgage rates

.

See Today’s HARP Mortgage Rates

With HARP 2.0, you’re not required to use your current mortgage lender. You can close a HARP refinance with any participating bank. So, if you’ve been thinking about HARP or planning for a refinance, make sure to get competing bids.

HARP mortgage rates are as low as “traditional” refinance rates, but mortgage rates can’t stay low forever.

Time to make a move? Let us find the right mortgage for you

.