Do you need a letter of explanation for a cash-out refinance?

A letter of explanation for a cash-out refinance isn’t always required by lenders. But it can help them to understand your needs and situation better.

In some cases, it can even make the difference between your application being rejected or accepted. So it might help to include a letter whether or not you’re asked.

Here’s how to write a top-notch letter of explanation for a cash-out refinance to help get your loan approved.

Verify your cash-out refinance eligibility. Start hereIn this article (Skip to...)

- What is a letter of explanation?

- When is a letter required?

- Template

- How to write your letter

- When to write one

- Why lenders want explanations

- Qualifying for a cash-out refi

What is a cash-out refinance letter of explanation?

A letter of explanation for a cash-out refinance does what its name implies. It explains to the lender why you want to take some cash out while you’re refinancing.

Verify your cash-out refinance eligibility. Start hereThere are many other types of letters of explanation that lenders might request. For example, they might ask that you explain a blemish on your credit report or why there’s a gap in your employment history.

But, with a cash-out refinance, the letter will usually explain your plans for the money you’re taking out. This helps your lenders understand why you want to cash out home equity. And it can be a contributing factor in your refinance approval.

When is a letter of explanation required?

Some lenders pretty much always ask for a letter of explanation on a cash-out refinance. Others will ask for a letter only if they’re on the fence about whether to approve your refi.

Verify your cash-out refinance eligibility. Start hereIn that case, the letter of explanation is your chance to tip the scales in your favor. So take it seriously.

Poor formatting, spelling, or grammar can reflect poorly on your application. So take your time, run spellchecks and ask someone you trust to proofread your letter for mistakes.

In addition, you can run a draft by your loan officer and make sure it’s what the lender wants to see before you submit the final version.

Cash-out refinance letter of explanation template

Below, we’ll explain exactly how to write a letter of explanation for your cash-out refinance and what to include.

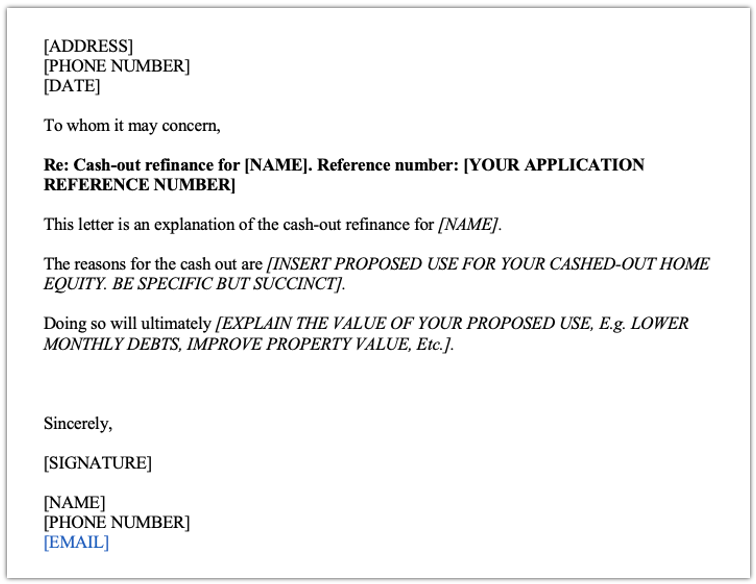

But first, here’s a sample letter of explanation to show you what yours should look like.

Verify your cash-out refinance eligibility. Start hereClick the image to open a PDF version of the cash-out refinance letter of explanation template.

What to include in your letter of explanation

Here’s a checklist of the contents you should include in your letter of explanation, from the top of the page to the bottom:

Verify your cash-out refinance eligibility. Start here- Lay out the letter as you would any other, with your full street address and phone number at the top

- Date the letter with the date on which you’re writing it

- Put in the recipient (the lender’s) name and full address

- Add a salutation — It doesn’t matter much how you greet your reader: “Dear underwriter,” “Dear Sir or Madam,” “To whom it may concern.” You choose

- Next comes a heading in bold: “Re: Cash-out refinance application for [your and any joint borrower’s full names]. Your ref: [the application reference number you’ve been given]“

- Now you’re ready to write your text. Begin by explaining the purpose of the letter. And, in the next paragraph, go on to provide the requested information. Be sure to answer the question posed. But keep it brief

- Insert a signoff line — Usually “Sincerely,”

- Leave a gap for your signature(s)

- Type below that gap your full name and that of any joint borrowers — with your email addresses and cellphone numbers underneath

Be sure that you and any joint borrower(s) sign in the gaps you left for those signatures.

And attach any supporting documents you think would be useful. Remember, it’s in your best interest to come across as scrupulously honest and transparent.

How to write a cash-out refinance letter of explanation

You can think of your letter as a marketing opportunity. You’re trying to get the reader to “buy” your reasons for borrowing. And your reader is a mortgage underwriter — the person who approves or declines applications based on their assessment of your borrowing risk.

As with all good marketing communications, you want to try to put yourself in the readers’ shoes. And then tell them what they want to hear.

So, for example, you might say you want to invest in your home by remodeling your kitchen. You’ve had three quotes for the renovation costs and are attaching your preferred one. If there’s a difference between that sum and the one you’ve applied to borrow, explain that.

If you’re borrowing too little, say where the rest of the money will come from. Or, if you’re borrowing more than the quote, say where the balance will go. Perhaps you want to add it to your rainy-day emergency fund.

It’s probably unwise to say that you’re using the money for a one-time luxury, like paying for a vacation or expensive car. But consolidating other high-interest debts is fine.

Finally, you mustn’t lie. Because your letter forms part of your application. And prosecutors can make a federal case out of mortgage fraud.

When to write a letter of explanation for your cash-out refinance

You’ll always have to provide a letter of explanation for a cash-out refinance if your lender requests one. Your only alternative is to cancel the application and walk away.

Verify your cash-out refinance eligibility. Start hereChances are, you’ll get such a request if the mortgage underwriter sees your application as borderline and needs some reassurance about what you’ll do with the money. But, for some lenders, these requests are automatic for all applications.

Should you write a lettter of explanation even if the lender doesn’t ask for it?

You might want to include a cash-out letter of explanation even if you haven’t been asked for one. This could give your application a little extra boost, provided the reasons for your cash out are financially prudent.

Don’t volunteer one if you’re planning a vacation or other luxury purchase with your cash-out funds.

Or, if your plans make it less likely that you’ll be able to keep up with the payments on your refinanced mortgage. For example, “I’m planning to quit my steady job and need the money for my startup business venture” will set off alarm bells.

However, if you have a good story to tell that shows you’re a responsible borrower with sound plans for your cash, then why not help your lender to understand that?

Why do underwriters ask for letters of explanation?

Don’t panic when you’re asked for a letter of explanation for a cash-out refinance. Sometimes, it’s an automatic part of a lender’s process. But, even when it isn’t, you should see it as an opportunity to strengthen your application.

Verify your cash-out refinance eligibility. Start hereKeep in mind, an underwriter would have already rejected your application if they had serious doubts. They just want some reassurance that you’re a responsible borrower with thought-through plans.

For example, underwriters might make a request for a letter of explanation if your debt-to-income ratio (DTI) is higher than they’d like.

But, if you write to confirm that some or all the cash you’re taking out will pay down some or all of your existing debts, you should improve your chances greatly. Because that would significantly reduce your DTI.

But that’s just an example. Try to understand the reason behind a request for a letter of explanation that you receive. And do your best to address it as directly as possible.

Indeed, if you have a good relationship with your loan officer, you might find them a source of useful background information. Make it clear that you’re not asking for inside help, just a steer that might help you to clear up anything that’s bothering the underwriter.

Do I qualify for a cash-out refinance?

The criteria lenders apply when deciding who qualifies for a cash-out refinance vary by lender and loan program.

Verify your cash-out refinance eligibility. Start hereAll lenders regard cash-out refinances as a little riskier than non-cash-out ones. So you should expect to pay a slightly higher mortgage rate: often 0.125% to 0.5% higher.

Overall, lenders will offer the best deals to those whom they regard as the least risky borrowers.

Underwriters look at your:

- Credit history and credit score — A minimum FICO score of 620 or higher is usually required. The higher your score, the better. This shows you’re not just able but also willing to make your payments on time

- Home equity — Most lenders require you to retain 20% of the value of your home as equity after a cash-out refinance. The more you retain, the better

- Income and debts — The more disposable income you have left at the end of each month, the more lenders will like you. A low debt-to-income ratio goes a long way on your refinance application

- Employment history — Your ability to hold down a steady job in the past is a good indicator of your ability to consistently make monthly payments in the future

For more information about these loans, read: How a cash-out refinance works: Rules and requirements. In particular, that explains the amount of cash you can get using a cash-out refi.

Find your best cash-out refinance rate

Many variables determine whether you’re approved for a cash-out refinance and the rate you’ll pay. Those include the state of the mortgage market and the economy, the lender you choose, and your own personal finances.

As with all mortgages, you’ll find the best possible deal on a cash-out refinance by getting multiple quotes (“Loan Estimates”) from multiple lenders. Compare those and choose the one with the lowest overall cost of borrowing.

Shopping around will not only lower your rate, but also maximize the value of your cash-back when you refinance.

Time to make a move? Let us find the right mortgage for you