Editor's note: This article was originally published on September 1, 2020, and updated on September 15

Fed policy to help keep mortgage rates low

On August 25, Federal Reserve Chair Jerome H. Powell made an important speech that should be good news for borrowers and mortgage rates.

The FOMC meeting on September 15-16 should help clarify how the Fed’s new vision will play out.

Below, we’ll explain what it likely means for mortgage borrowers: continued low interest rates for years to come.

Get today's rates. Start hereWill the Federal Reserve lower rates again?

The fed funds rate is already sitting near zero (technically, it’s at 0-0.25%). That’s about as low as the Fed can drop it without diving into negative interest rate territory.

In past statements, Fed chair Jerome Powell has made it clear the Fed doesn’t plan to broach negative rates in the foreseeable future.

So borrowers shouldn’t expect a drop in the fed funds rate — or rates directly tied to it, like credit cards, auto loans, and HELOCs.

But the good news is, we can likely expect rates to stay at their current low levels for quite a while. Here’s why.

New Fed policies mean continued low interest rates

In effect, the Fed has signaled that it won’t be tightening monetary policy for a long time, because economic recovery will be so uncertain post-COVID.

So interest rates are likely to stay low, probably for years.

And that should apply to mortgage rates, too.

As The New York Times put it in a recent article: “That could translate into long periods of cheap mortgages and business loans that foster strong demand and a solid job market.”

This does not mean rates are going to plummet; current home buyers and refinancers shouldn’t be affected too much.

But those looking to buy a house or refinance in the coming months and years should have low rates to look forward to.

Find and lock a low rateWhat the Federal Reserve (normally) does

For a very long time, the Fed has had two main policy goals:

- To keep the inflation rate at an average of 2% per year

- To keep employment high and unemployment low

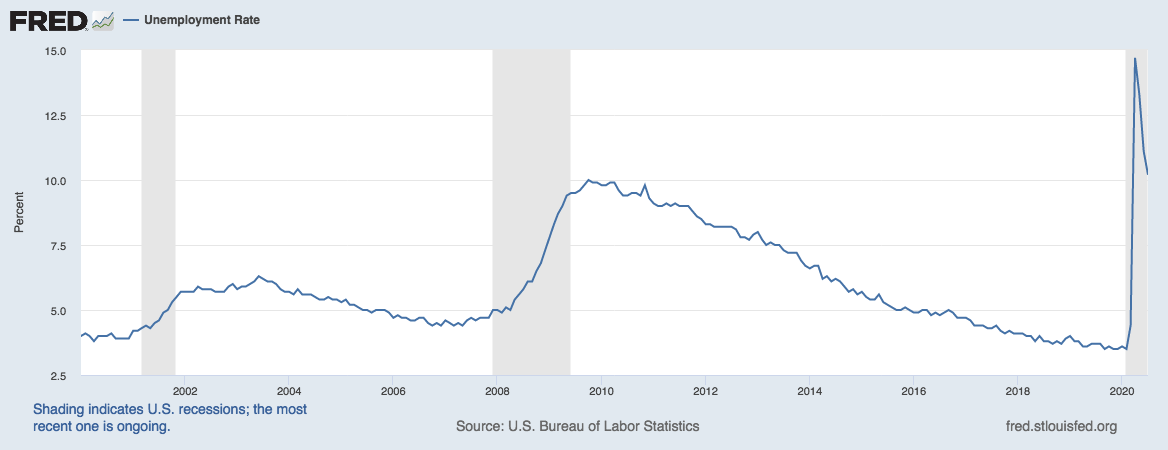

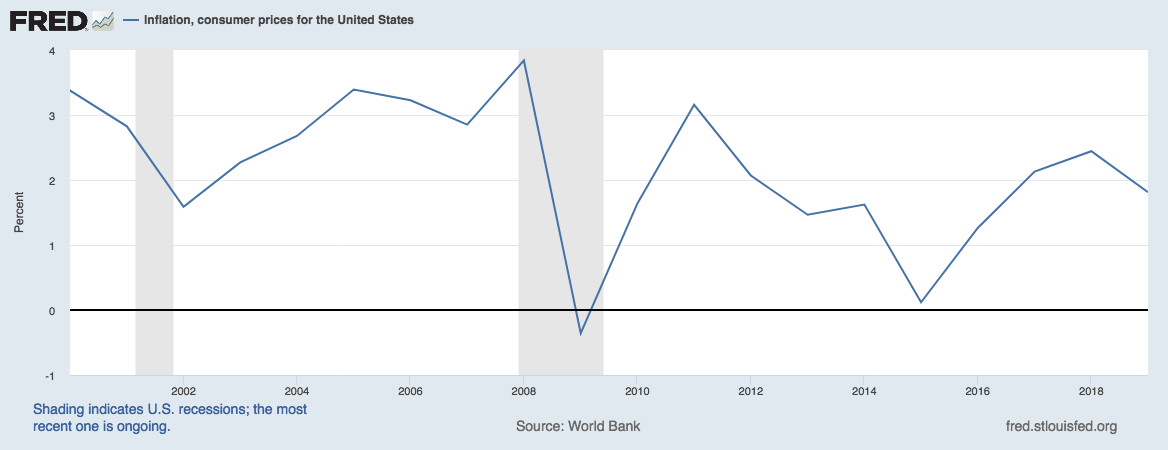

And you can see it’s generally done a pretty good job. The following graphs for the 21st century were retrieved from FRED, the Federal Reserve Bank of St. Louis:

Yes, there were a few spikes and troughs, most notably in response to recessions (the periods shaded in gray). But there’s been nothing out of control. Until 2020.

Now, look at the unprecedented spike in unemployment at the far right of the top graph. It shot up to 14.7% earlier this year.

Yes, unemployment is coming down. But the unemployment rate in July 2020 was still 10.2%, which translates into more than 16 million people without jobs.

And we’re far from a guaranteed recovery after COVID — or even a guarantee that the pandemic could be close to its end.

With such a sharp change in the economy, and so much uncertainty about how long it will continue, the Federal Reserve has had to tweak its policies in order to meet those pillars of 2% inflation and high employment.

How Federal Reserve policy changed in response to COVID

Clearly, some special action was needed to address unemployment.

So Powell and his colleagues on the Fed’s top policy committee (the Federal Open Market Committee or FOMC) came up with a fresh approach outlined in their new “Statement on Longer-Run Goals and Monetary Policy Strategy".

Essentially, that involved rebalancing the Fed’s priorities.

Inflation policy

Instead of regarding employment and inflation as equally important, it would for now work to stimulate job creation even if that meant giving inflation a slightly freer rein.

In his speech, Powell said:

“In seeking to achieve inflation that averages 2 percent over time, we are not tying ourselves to a particular mathematical formula that defines the average. Thus, our approach could be viewed as a flexible form of average inflation targeting.”

Employment policy

And the Fed made a second change. Powell went on to say “the Committee did not set a numerical objective for maximum employment.”

So the Federal Reserve can continue to support employment growth, even when employment levels are high (and conversely, unemployment levels low).

In other words, it expects to be implementing economic stimulus policies for a long time to come.

Powell put it thus: “employment can run at or above real-time estimates of its maximum level without causing concern, unless accompanied by signs of unwanted increases in inflation.”

Impact on interest rates

To the average ear, the Fed’s new policies might sound too nuanced to have much of an effect.

As former Federal Reserve chair Janet Yellen said on Aug. 27:

“It seems like a pretty subtle shift to most normal human beings. But most of the Fed’s history has revolved around keeping inflation under control.”

New policies mean the Federal Reserve’s target interest rate could stay the same or move lower even as the economy begins to improve.

“This really does reflect a decisive recognition that we’re in a very different environment,” Yellen says.

Markets and investors were quick to pick up on the meaning behind Powell’s statement. They recognized it as a very significant change.

That’s because it means the fed funds rate (the target interest rate) will likely stay the same (near zero) even if inflation rises over the 2% mark or the employment market runs hot.

But the Fed doesn’t set mortgage rates, right?

Every time the Federal Reserve announces a change in its interest rates, loan officers and mortgage brokers are bombarded with calls from borrowers asking what that means for their mortgage rates.

The standard reply is, “Nothing. The Fed doesn’t determine mortgage rates.”

And they’re quite right. Changes to the Fed Funds rate directly affect a whole lot of loan products, but not mortgages (except for existing adjustable-rate mortgages (ARMs)).

How mortgage rates are determined

Mortgage rates are determined by supply and demand in a ‘secondary market,’ where mortgage-backed securities (bundles of mortgage interest) are traded. And, normally, the Fed gets no say in that market.

The Fed has had a bigger impact on mortgage rates recently, because it’s been buying mortgage-backed securities itself. But that’s a temporary intervention and a distraction from normal principles.

However, Federal Reserve policy changes do affect the overall mood of the market. And that can have an indirect effect on mortgage rates.

What the Fed’s change means for mortgage rates

Within a couple of days of Powell’s speech, at least one lender was advertising, “Fed stimulus cuts mortgage rates — Fed stimulus pushes mortgage rates to insane lows.”

It’s not clear whether that referred directly to the latest announcement, or to the organization’s earlier actions.

But it reflects a general feeling that the latest news out of the Fed is good for mortgage and refinance rates.

Those in the process of buying or refinancing should not wait to lock a rate. Mortgage rates are already near record lows and not expected to drop much further.

However, it does not mean that those who are in the process of buying or refinancing should wait for rates to fall before they lock.

Average mortgage rates have only inched down since Powell’s speech. And they’re already near record lows — so borrowers shouldn’t expect drastically lower rates thanks to the Fed’s action.

Rather, Powell’s announcement should be seen as good news for those who want to buy or refinance in the future, because rates are likely to stay at or near their current levels for quite some time.

Long-term dangers

And there are those who fear the long-term consequences for mortgage rates.

Writing for Mortgage News Daily, industry guru Matthew Graham warns of the dangers of the Fed taking its eye off the inflation ball: “High inflation is bad for low rates. It also connotes a higher comparative level of economic activity and employment. Those things are also not good for rates.”

And he’s right. The last thing investors want is to be stuck with a load of fixed-rate, low-yield, mortgage-backed securities during a time of high inflation. They inevitably lose money.

Lower mortgage rates still the likely outcome

But, for now, those investors have a lot more to be worried about than possible future inflation. And few expect either inflation or employment to reach worrying levels for years.

So it looks likely that the consensus view that Powell’s speech will be good for mortgage rates will hold true for the time being. Let’s hope that time ends up being several years.

Your next steps

If you’re already in the process of buying or refinancing, the Fed’s recent announcement shouldn’t affect you too much.

Rates are already ultra-low and not likely to plummet based on Powell’s statement. So there’s no real reason to wait on locking.

But if you’re planning to buy a home or refinance somewhere down the line, take heart. It seems like newsworthy rates aren’t going away any time soon.

Time to make a move? Let us find the right mortgage for you