Second-rate second mortgage: What are your options?

There are many reasons a home buyer or homeowner might take on a not-great second mortgage, home equity loan (HEL) or home equity line of credit (HELOC). If you’ve got one, you might be experiencing borrower’s remorse. So what can you do about a bad second mortgage rate today?

Time to make a move? Let us find the right mortgage for youWrite this down

Before deciding where you want to go, you need to know where you are. So take a few minutes to think through your current situation — and how you got here. Your answers to the following questions will at least partly determine your future options.

How much equity do I have?

Your “equity” is simply the amount by which the fair market value of your home today exceeds the current balance(s) on your current mortgage(s). The sum couldn’t be simpler. It can be a dollar amount ($100,000 home value - $80,000 mortgage balance = $20,000 of home equity.)

But usually, you express home equity as a percentage. ($80,000 mortgage / $100,000 home value = .8, or 80 percent. And 100 percent - 80 percent of mortgage equals 20 percent of home equity.

And you can likely find your current balance on your lender’s website or through a quick conversation with one of its call center agents. Discovering the value of your home is usually a bit more complicated.

Of course, it’s easy if the identical home next door sold recently. But homes are rarely identical. And you’ll be lucky if one exactly the same as yours has been bought in the last few months. So read up on how to determine how much your home is worth.

Related: What’s my house worth? (4 ways to estimate your property value)

How much can I borrow?

You may remember LTVs from your first mortgage. The abbreviation stands for “loan-to-value” ratio. And it’s the amount you’re borrowing expressed as a percentage of your home’s value. So if you’re buying somewhere for $100,000 and need a loan of (or multiple mortgages totaling) $80,000, your LTV is 80 percent.

A “combined LTV” or “CLTV” will apply to any refinance of your mortgage and second mortgage(s). In other words, the lender will add up the amount you’re going to owe on all your mortgages. So if you have an $80,000 first mortgage and a $10,000 second mortgage, your CLTV is 90 percent ($90,000 in loans divided by $100,000 in property value).

Lenders can cap CLTVs where they want. But those ratios typically fall in the 80 percent to 90 percent range (higher for government-backed mortgages). Be aware that the higher your LTV, the higher your interest rate will probably be.

How much am I currently paying?

Dig out some paperwork or check online or with a call center to establish:

- Mortgage rate for the first mortgage

- Second mortgage interest rate

- First mortgage payoff (current balance plus accrued interest for the month)

- Second mortgage payoff

- Check for prepayment penalties for either loan

- Monthly principal and interest for both the first and second mortgage

You now have the information you need to make an informed decision on your best move. Though you’ll probably need the help of a refinance calculator to make much sense of the numbers.

What do I want to achieve?

Given that you clicked through on this article, you probably think your second mortgage rate is too high. So you want to reduce that. But what other goals might you have?

Depending on your circumstances, you may wish to achieve any number of goals, including:

- Have lower monthly payments on secured loans

- Reduce your first mortgage rate

- Reduce your second mortgage rate

- Have lower monthly payments on all your debts (by borrowing enough to pay down your credit card balances and other loans)

- Improve or add to your home

- Access a lump sum for a one-time purchase: medical expenses, a family wedding, college fees or other items

Your particular goal or goals will influence or determine the options open to you.

Refinance your first mortgage

This may be your smartest or dumbest move, depending on your circumstances. Much will depend on the mortgage rate you’re currently paying.

For example, suppose you bought or refinanced at the end of 2012 when mortgage rates hit a record low. You’d be nuts to mess with that and end up paying a significantly higher rate on all your secured borrowing.

But supposing you could get a lower rate now than you’re currently paying. Chances are, you could refinance your first and second mortgages into one big loan and get a double whammy: a lower combined rate and a single, lower monthly payment. However, such a move may count as a “cash-out refinance” and one of those typically comes with higher costs and more restrictions.

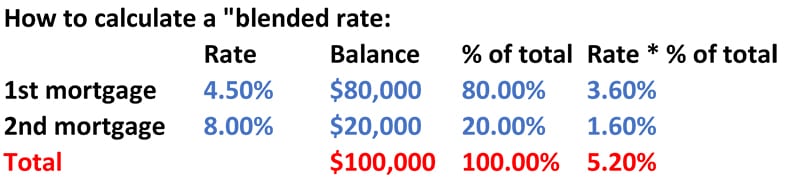

If you used your home equity loan to purchase your home or all the proceeds for qualifying home improvements, wrapping the loans into a new one won’t be considered a cash-out refinance. In that case, if the new mortgage rate is lower than your “blended rate” of your first and second mortgages, refinancing is probably a good decision.

In the example above, 5.2 percent is your blended rate. You find it by figuring out how much of your total balance your first mortgage comprises (in this case, by dividing the $80,000 first mortgage by the $100,000 in total mortgages) and multiply that number by your interest rate. So in the above example, multiplying the 4.5 percent rate by the 80 percent portion of the home loan total, you get 3.6 percent.

Repeat the exercise with the second mortgage, and the result is 1.6 percent. The sum is 5.20 percent. If you could combine your first and second mortgage and pa less than 5.2 percent, consider refinancing them together.

Restarting the clock

The downside of this option is that each refinance means resetting the clock on your mortgage. For example, imagine you’ve been paying down your 30-year loan for 10 years. Refinancing to a new 30-year loan means paying interest for 40 years instead of 30. Unless you can discipline yourself to pay extra each month.

If your goal is reducing your monthly costs right now,

Related: 4 cash-out refinance options that put your home equity to work

Mortgage insurance

If wrapping your first and second mortgage into a new loan would get you an LTV exceeding 80 percent, you’ll almost certainly have to pay mortgage insurance (MI) premiums. That’s a factor in your refinancing decision — it might be better to refinance one or both of the existing loans separately to avoid MI.

Refinance your HEL/HELOC to a better second mortgage rate

You can refinance your home equity loan or HELOC, just as you can any other loan. And your closing costs will likely be much lower — even zero for some HELCs.

This sort of refinancing is a no-brainer if you have a great deal on your existing main mortgage. The only barrier is that many lenders require you to have paid down at least 10 percent of your loan before they’ll entertain a refinance.

But where’s the tipping point at which it’s better to refinance just your home equity product to get a lower second mortgage rate rather than your first mortgage? Luckily, it’s more a question of math than judgment.

So you can run the figures through that refinance calculator and see which option best helps you achieve your goals. For example, if your overwhelming priority is to reduce your monthly outgoings, you can simply compare the new payment with your existing ones. Just don’t forget to take into account mortgage insurance and closing costs, though the latter can usually be rolled up within your new loan.

Get creative

The last thing most people want is to turn low-cost borrowing into a higher-cost loan. But there may be circumstances when you shouldn’t rule that out.

Suppose you’re just the wrong side of the 80 percent threshold for mortgage insurance. Then hitting your savings, borrowing with a personal loan, selling stuff you don’t need or getting a zero-interest credit card to buy your balance to under 80 percent might make sense.

Just one caveat: you need to be a good money manager to successfully juggle debts in this way. If you’re a bad one, playing clever can end in disaster.