What is home equity?

Home equity is the portion of your home’s value that’s not ‘secured by any liens.’ In other words, it’s the portion you own free and clear because it’s not owed to a mortgage lender.

For example, if your home is worth $250,000 and you owe $100,000 on your mortgage, you have $150,000 of equity.

Home equity is a valuable asset by itself. But equity can also be tapped to help grow your wealth, if you know how to use it correctly. Here’s how it works.

Find out if you can cash-out your home equityIn this article (Skip to...)

- How to calculate home equity

- What’s the purpose of home equity?

- How do I access my equity?

- How much can I borrow?

- Should you borrow from your equity?

- What is negative equity?

- Home equity FAQ

How to calculate home equity

You need to know only two things to calculate your own equity:

- Your home’s current market value

- Your total outstanding mortgage balance (primary mortgage plus second mortgage, if you have one)

From here, the equation is simple:

Home Value – Total Mortgage Balance = Your Home Equity

Here’s a very basic example of the home equity calculation in practice:

- Home value: $200,000

- Mortgage loan balance: $100,000

- Home equity: $100,000 ($200,000 - $100,000)

Normally, homeowners build equity in two ways.

First, the mortgage balance falls a little each month as you pay down your debt. The lower your mortgage loan amount, the greater your equity.

Second, rising home prices typically push up the market value of the property. As your home’s value rises, it automatically increases your equity.

Finding your mortgage balance and home value

Finding the outstanding balance on your home loan is easy. You can probably log onto your mortgage account for an exact and up-to-date figure. Or you can check your most recent paper statement.

Determining your home’s current market value might be a little more difficult.

In most cases, this is not equal to the purchase price you paid when you bought the home, because real estate tends to increase in value over time.

You can get a rough idea of your home’s current value using online estimator services, such as Realtor.com, RE/MAX, and Zillow. Or perhaps you already know the prices that similar homes to yours have sold for in your neighborhood.

You might even be able to call a friendly local real estate agent for help if you have a friend or acquaintance in the business.

What’s the purpose of home equity?

Home equity is a valuable asset and a key benefit of homeownership. It’s one of the main ways individuals and families build wealth and financial security.

Keep in mind, equity is not liquid wealth. You typically have to take out a loan to access it (more details on that below).

But if you have enough equity, there are ways you can actively use it to your advantage.

Some of the biggest ways homeowners benefit from their equity include:

- The ability to borrow large sums of money from your equity at a very low interest rate, perhaps for emergencies or large expenses like home renovations

- Using equity as leverage to lower your mortgage costs. Homeowners who build up enough equity can get rid of private mortgage insurance (PMI) and sometimes refinance into a lower interest rate

- Increasing your profits when you sell the home. The more equity you have, the more money you’ll make when you eventually sell. This can be a key asset for homeowners moving to a new home or downsizing in retirement

Borrowing large sums from your equity

One of the key benefits of building home equity is that you’re creating a pool of wealth from which you can borrow.

When you borrow money from your equity, the loan is secured by your home (just like your original mortgage). That means home equity borrowing has far lower interest rates than other sources of money, like credit cards or personal loans.

For homeowners with enough equity built up, this is often the cheapest way to finance big expenses like:

- Home renovations, remodeling, or repairs

- Buying a second home or investment property

- Large, unexpected medical expenses

- Paying college tuition for yourself or a child

- Consolidating high-interest debts that are costing you a lot in interest

- Starting up a small business

- Creating an emergency fund

Of course, home equity borrowing isn’t a free ride. You’re still borrowing from a mortgage lender, even though it feels like you’re borrowing from yourself. That means you’ll pay interest on the loan. And ultimately, you’re increasing your debt and reducing your net worth.

So it’s best to do this only when necessary; for instance, if you have a huge and unexpected medical bill, or you’re starting a new, surefire company or you’ve built up a pile of expensive debts and need to consolidate them.

By the way, federal regulator the Consumer Financial Protection Bureau warns against “borrowing against your home as part of an investment strategy.”

Canceling mortgage insurance

Many homeowners find private mortgage insurance (PMI) a real burden.

Paying PMI on a conventional loan — or mortgage insurance premiums (MIP) on an FHA loan — can easily add hundreds of dollars to your monthly mortgage payment.

The good news for homeowners with conventional loans is that they can stop paying PMI once their equity hits 20%. You simply call your mortgage loan servicer and ask to have it removed.

But that rule doesn’t apply to FHA loans.

What FHA homeowners can do once they have 20% equity is refinance to a conventional loan without PMI.

Their 20% equity counts as a 20% down payment, putting them over the threshold where mortgage insurance is no longer required.

Getting a lower mortgage rate when refinancing

When lenders look at any mortgage application, they focus on three main things:

- Your credit score

- Your debt-to-income ratio (DTI)

- Your loan-to-value ratio (LTV)

Lenders will adjust the mortgage rate you’re quoted to reflect how you measure up against those criteria.

The more home equity you have when you refinance, the lower your loan-to-value ratio. This is a good thing in lenders’ eyes because it decreases your risk as a borrower, and you’ll likely be offered a lower mortgage rate.

And, of course, if you managed to boost your credit score and pay down some of your debts in the meantime, that rate could be ultra-low.

Increased profits when you sell your home

Home equity can also act as a nest egg for your future life, helping you save money for when you move or retire.

When you sell your home, part of the proceeds are used to pay off your remaining mortgage balance. The less you owe on your mortgage, and the more equity you have when you sell, the more money you’ll get to keep from the sale.

These funds can be used to make a down payment on your next home, or in some cases even buy the property outright with cash.

For retirees downsizing to a smaller home or retirement community with lower housing costs, cashing-out home equity when they sell can also provide lump sum for living expenses.

How do I access my equity?

Home equity is not liquid wealth. Although it’s one of your assets, the money is tied up in your house. You can’t ‘spend’ your home’s value, per se.

To access your home’s equity and turn it into liquid cash, you either need to sell the home or take out a loan secured by its value.

Of course, you wouldn’t sell your home to access equity unless you were planning to move anyway. So most homeowners who want to cash-out their home equity while living in the house use one of these three methods:

- Cash-out refinance — You get a new mortgage with a larger loan amount to replace your existing mortgage, and you walk away with a check for the difference. Typically these have the highest closing costs but the lowest mortgage rates

- Home equity loan (HEL) — You borrow a lump sum as a second mortgage. You pay it back, usually at a fixed interest rate, over a set period of time. This is a second monthly payment on top of your primary mortgage payments

- Home equity line of credit (HELOC) — This is a bit like a credit card. You get a credit limit you can borrow against, pay back, and reborrow as often as you want within a certain time frame (the ‘draw period’). HELOCs typically have variable interest rates that are much, much lower than credit cards. But these loans are complicated so make sure you fully understand them before you commit

There are other ways in which you can tap your equity, too.

For example, you can borrow for home improvements using an FHA 203k home purchase loan or refinance. Or, if you are 62 years or older, you can explore reverse mortgages, which provide cash but roll up interest and loan costs so you pay nothing until you move or pass away.

It’s important to recognize that all of these loans — including HELs and HELOCs, which are ‘second mortgages’ — are secured loans. You’re using your home as collateral. So, if you fall too far behind on payments for any of them, you could face foreclosure.

Home equity loan, HELOC, or cash-out refinance: Which is right for you?

Choosing between a cash-out refinance, home equity loan, or home equity line of credit is something you want to get right. So be sure to read about them each in-depth. See:

- What are the benefits of a cash-out refinance?

- HELOC vs. home equity loan: Which is right for you?

- Cash-out refinance vs home equity loan

We don’t have space here to tell you all you need to know. But here are some of the most important characteristics of these loans:

- Cash-out refinances tend to have lower rates than HELs or HELOCs, but higher closing costs

- Home equity lines of credit (HELOCs) often have the lowest upfront fees of the three, and are the most flexible. But they’re also complex and have downsides that sometimes trip up unwary borrowers

- Home equity loans and HELOCs typically have a shorter repayment period than cash-out refinances, and you’ll have a smaller loan amount meaning you pay less interest

- You’ll likely pay less interest when you use any of these products to borrow a large amount than you would using a loan that is not secured by your home, such as a personal loan

- But personal loans have lower (or often zero) closing costs. So they may be better when you want to borrow smaller sums

- You need to shop around for the best deal with all these products. Offers vary widely and you could save thousands by seeking out the right lender for you

- Pay attention to the annual percentage rates (APRs) you’re quoted. These reflect the loan’s costs as well as its interest rate. So they’re often a better guide to value for money

There’s nothing especially scary about tapping your home equity. But it’s a serious business, so do your homework and be sure you’re making the right decision for your personal finances.

How much can you borrow from your home equity?

Don’t imagine you can withdraw all the equity you have in your home.

You may be able to find a lender that’s a little more flexible, but most want you to retain 20% of your property value as equity. That means you can usually borrow only 80% of the value of your home, including the amount you already owe on your existing mortgage.

Let’s look at the example we used earlier:

- Home value: $200,000

- You can borrow up to 80% of that: $160,000 ($200,000 x 80% = $160,000)

- Existing mortgage balance: $100,000

- Maximum amount of equity you can borrow: $60,000 ($160,000 - $100,000)

The maximum amount you can borrow compared to your home’s value is typically expressed as a maximum ‘loan-to-value ratio,’ or ‘LTV.’

In these terms, the maximum LTV on most cash-out refinance loans is 80%.

Lenders have this rule to lower the risk of borrowers defaulting. But it also adds to your wider financial health.

Should you use your home equity to borrow?

It’s up to you to decide what you borrow and spend from your home equity. But most financial advisers would warn against borrowing to extend an unsustainable lifestyle or to indulge personal whims.

For instance, using home equity to fund a vacation, wedding, or another one-time expense with no return on investment is generally regarded as a bad move.

It’s one thing to put your home on the line for a rare emergency that threatens your financial security, and quite another to do so for luxury purchases.

On the flip side, using your home equity to put your life back on track by consolidating expensive, out-of-control debts is often a very smart move — providing you’ve first consulted a certified financial counselor.

Many people also use home equity for renovations that increase the value of the home. This can benefit you in the long run by netting you a bigger profit when you eventually sell.

The main consideration to keep in mind when borrowing from home equity is that your house is used as collateral.

So if you can’t repay the loan — for instance, if you were to run up debts again and couldn’t afford monthly mortgage payments — you could face foreclosure.

This underscores the importance of tapping home equity only when necessary and using the money for purposes that improve your overall financial situation.

What is negative equity?

Most homeowners will see their equity increase over time and they pay down their mortgages and home prices increase.

Sometimes, though, home prices fall, either nationwide or in a local property market. If home prices drop sharply enough, a homeowner can end up owing more on their mortgage than the home is worth.

When that happens, a loan is said to be in “negative equity” or to be “underwater.”

For example, say you bought a home for $350,000 and your current mortgage balance is $300,000. If that home’s value falls to $275,000, you now owe $25,000 more than the home is worth.

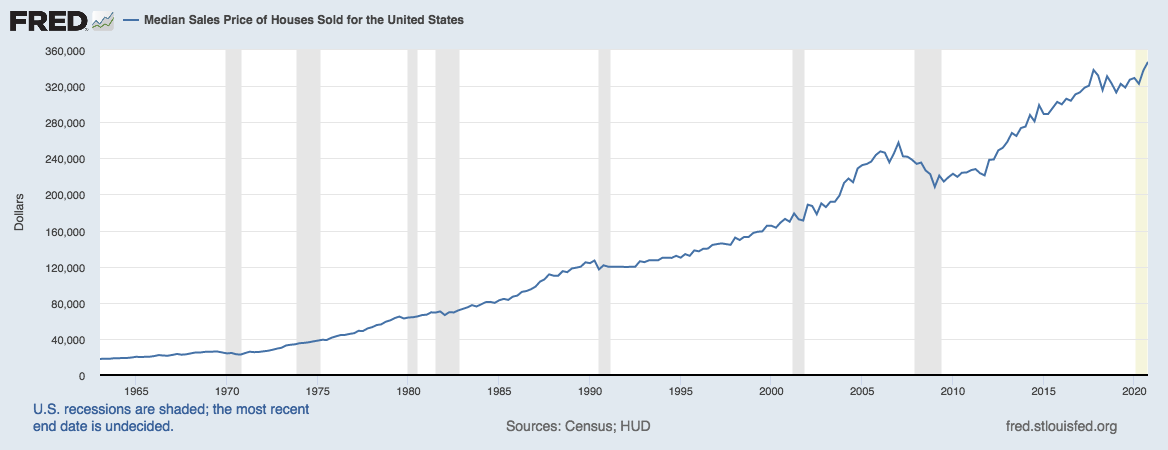

Those can be difficult times for homeowners. But, luckily, they’re relatively rare and usually brief. Here’s a graph showing home price trends since 1960:

Source: FRED, Federal Reserve Bank of St. Louis

If you find yourself in negative equity, there are a number of relief programs that can help you refinance into a more affordable mortgage and get your finances back on track.

You can read more about mortgage relief refinance programs here.

Home equity FAQ

Your home equity is the portion of your home's value that you don't owe to a mortgage lender. You'll build equity as you pay down your mortgage and as your home's value increases. If you have enough equity, you may be able to borrow from it at a low interest rate.

When you withdraw equity from your house, you increase the amount of debt that's secured by your home. You may face higher monthly mortgage payments or an additional monthly payment on a 'second mortgage.' But you'll get a lump sum or a line of credit you can spend in any way you want.

The more home equity you have, the better. Equity increases your overall net worth and lets you use your home as a financial safety net. Having 20% equity is a key benchmark because it often lets you cancel private mortgage insurance (PMI) or refinance into a lower interest rate. You typically need significantly more than 20% if you want to cash-out home equity.

There are three main ways to 'lose' equity: 1) You borrow more against the home (e.g. using a cash-out refinance or second mortgage); 2) You fall behind with mortgage payments; 3) Your home's value decreases.

You bet! You have 100% equity. If you sell, you'll get to keep all the proceeds (minus closing costs). You can also borrow against this equity, but that creates a new 'lien' which means your home could still be foreclosed if you don't repay the loan.

Most lenders want you to retain 20% of your home's value as equity. So you can usually take out 80% of your home's current market value. But that's the maximum for all your secured borrowing, so it includes your existing mortgage(s).

There's no rule for this. Some homeowners sell with little or no equity. But, if you have enough equity to make a 20% down payment on your new home, you should be able to avoid mortgage insurance.

Most people can get a good idea of their home's value with some online research and maybe a call to a real estate agent friend. Deduct your current mortgage balance from that value, and that's your equity. You might also be able to get an estimate by contacting your mortgage loan servicer (the company you make payments to).

That depends on your needs. For some, it's a cash-out refinance. For others, it's a home equity loan or HELOC. Make sure you pick the right one by reading the information above and clicking the links to access more details.

Do you qualify to cash out your equity?

Home equity can be a great way to finance home improvements, debt consolidation, and other large expenses. And today’s low rates make home equity borrowing more affordable.

But you need to be eligible to take out a new loan against your home’s value. Typically, you need significantly more than 20% equity and good credit to cash-out.

A mortgage lender can tell you whether you qualify to cash out home equity, and how much you can borrow. You can check your eligibility right here.

Time to make a move? Let us find the right mortgage for you